Same day dollar limit increase pushes ACH activity higher in Q1

Graphics courtesy of NACHA.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Money moving electronically continues to be on an upward trajectory.

According to a news release distributed by NACHA on Monday, the ACH Network experienced overall growth in the first quarter of 2022, even as recent forms of pandemic-related government assistance have ended.

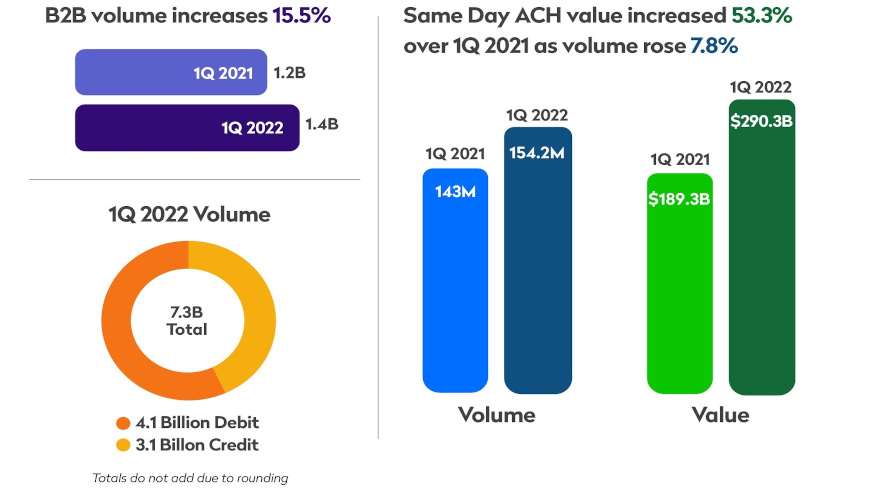

Officials said growth in the first quarter was fueled by business-to-business (B2B) payments and the increase to the same day ACH dollar limit.

B2B payments increased by 15.5% from the first quarter of 2021, with more than 1.4 billion ACH B2B payments made. That also is a 35.5% increase from the first quarter of 2020, when COVID-19 initially closed many workplaces.

“Many businesses and organizations have come to realize that ACH payments are not just the new normal, but the best way of doing business, given their reliability and convenience,” NACHA president and chief executive officer Jane Larimer said.

The same day ACH per payment limit increased to $1 million on March 18, contributing to a 53.3% increase in same day ACH dollar value over a year earlier, to $290.3 billion, along with a 7.8% volume increase to 154.2 million payments.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“The payments community has welcomed the new $1 million limit and put it to immediate use,” Larimer said. “The ACH Operators and financial institutions have worked hard to make same day ACH the successful modern payment option that it is.”

Overall volume on the ACH Network totaled 7.3 billion payments, up 2.2% from a year earlier, and moving $18.5 trillion, a 7.1% increase.

Larimer pointed out this growth occurred even in the absence of the pandemic-related assistance payments that existed in 2021, when economic impact payments were being made and expanded unemployment benefits were available.

“Adding 154 million payments in a single quarter, with additional value of $1.2 trillion, speaks to the strength of the ACH Network, as it meets the needs of consumers, businesses and governments to make and receive payments,” Larimer said.