Survey shows how dealers disagree about solving digital retailing

Graphic courtesy of eLEND Solutions.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Dealerships agree that there are problems with the digital retailing of used and new vehicles.

How to smooth out those issues is where stores are not yet in agreement.

A new dealer survey from eLEND Solutions confirmed that dealerships are experiencing a significant disconnect between the online and in-store process; one that they agree must be solved to shorten transaction times and improve the customer experience.

But, while the majority indicate that digital retailing offers a solution by speeding up steps in the traditional sales process, the survey results showed that dealers remain reluctant to fully embrace digital retailing.

The snapshot survey was fielded by eLEND Solutions among dealers in February to find out why time spent by customers with the auto dealership has only decreased by five minutes in the past five years, as reported by Cox Automotive.

Pete MacInnis, the chief executive officer and founder of eLEND Solutions, pointed out the survey results surfaced even as adoption of digital retailing buying experiences has increased as a result of the pandemic.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“We were stunned at this small reduction in the amount of time spent in the dealership over the past years,” MacInnis said in a news release. “As our survey indicates, the disconnect between the online and instore process, and the lack of more holistic digital retailing adoption — especially when it comes to digital finance — is hampering process efficiency.

“This continues to stand in the way of auto dealers and consumers realizing DR’s true benefits,” he continued.

MacInnis noted that, in the survey, the vast majority of dealers agreed that unrealistic initial finance terms presented online can slow the process down, but that if more realistic payment terms were initially presented online, 60 minutes-plus could be knocked off the transaction time.

MacInnis said this metric is significant given that 53% of dealers think that less than 20% of the sales process should be devoted to negotiations and final terms of finance.

However, when it comes to a capability that could help solve the issue of unrealistic terms — customer information such as driver license verification, credit application data, credit data and supporting documents being submitted online — the survey showed that more than half of participating dealers think that 80% of that information should only be submitted in-store.

Similarly, eLEND Solutions discovered that one in two dealers think that 80% of traditional in-store processes should remain exclusively in-store versus online. Less than one in three think that 40% or more of traditional in-store processes should be enabled online via digital retailing.

“Car buyers who engage digitally are more satisfied with the overall purchase experience and the time spent transacting, yet dealers remain ‘disconnected’ about digital retailing disconnects,” MacInnis said.

“Until auto dealers have access to, and the will to fully embrace, tools and processes that are able to solve information disconnects from online to instore, it is unlikely that the time spent in the dealership is going to improve any time soon,” he went on to say.

Other key survey takeaways include:

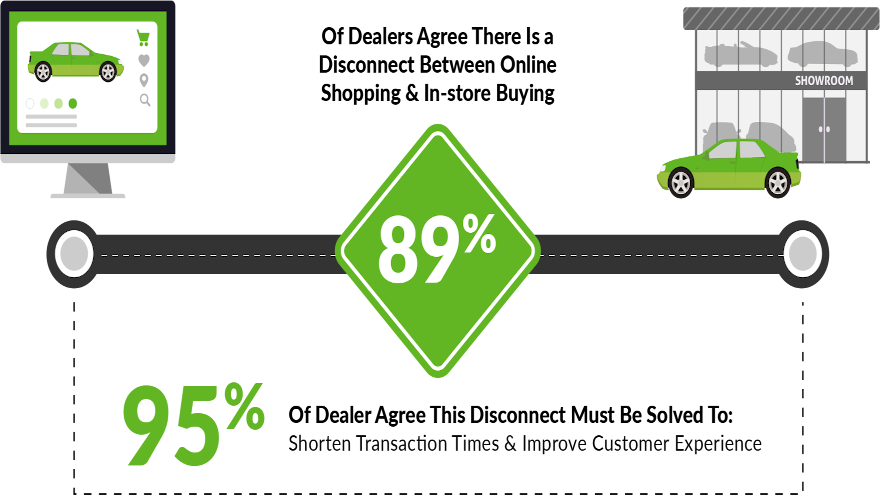

• 89% of dealers agree that there is disconnect between online shopping and instore buying

• 95% of dealers agree that this disconnect must be solved to shorten transaction times and improve customer experience

• 95% of dealers believe that digital retailing eliminates/speeds up many of the steps in traditional sales process

• 64% believe 20% or less of the traditional in-store sales processes are now handled through online digital retailing in dealerships who are using DR, with only 25% saying over 40%

• 50% of all surveyed dealers think that 80% of traditional in-store processes should remain exclusively in-store. Less than 1 in 3 think at least 40% of traditional in-store processes should be enabled online via DR.

• 54% think that that 80% or more of all required customer information/supporting documentation should only be submitted in-store; only 29% say that over 40% should be able to be submitted online

• 96% believe that unqualified or unrealistic payment terms presented to consumers online negatively impact the efficiency and timeline, i.e. time spent on the transaction, of the car buying process

• Majority agree that transaction times can be dramatically accelerated if realistic terms are presented

• 95% say that at least 30 minutes could be knocked off transaction times, with 58% saying an hour or more could be saved.

• 53% of dealers think that less than 20% of the sales process should be devoted to negotiations and final terms of finance.

MacInnis offered more insight about this survey during an episode of the Auto Remarketing Podcast recorded during NADA Show 2022. The episode is available below.