Top 3 trends highlighted in Experian’s annual Identity and Fraud Report

Charts courtesy of Experian.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

If any trends are on a steady, upward trajectory nowadays, it seems like fraud complexity and frequency are two of them.

Experian recently released its 2024 U.S. Identity and Fraud Report revealing that generative AI (Gen AI), deepfakes and cybercrime are critical threats putting intensifying pressures on businesses.

Experts highlighted the ninth annual Experian Identity and Fraud Report provides valuable insights into emerging fraud trends such as these, as well as shifting consumer expectations.

According to the Federal Trade Commission, consumers reported losing more than $10 billion to fraud in 2023 alone, representing a 14% increase over the previous year and the highest dollar amount ever reported.

Experian’s research showed more than half of consumers say they’re somewhat or very concerned about conducting activities online. Identity theft (84%) and stolen credit card information (80%) are their top online security concerns, a jump of more than 20% from the previous year.

Additionally, Experian said online privacy (67%), phishing emails or phone scams (65%), and false information or fake news and ads (49%) round out the top five online security concerns for U.S. consumers.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

While consumers want the convenience and accessibility of digital transactions, Experian pointed out that they don’t want to compromise on security.

As such, consumers’ expectation that businesses will react to their fraud concerns has remained high at 82%.

People understand the connection between identity verification and a positive customer experience with 63% saying it’s extremely or very important for businesses to be able to recognize them online, according to Experian research.

Experts noted the ability to repeatedly identify consumers can translate to trust.

The report mentioned 81% of consumers say they’re more trusting of businesses that can accomplish easy and accurate identification.

The report also indicated that financial services companies were the most trusted, with retail banks, P2P lending and buy-now, pay-later financing all listed as top trusted organizations by U.S. consumers.

From a business perspective, Experian determined this year’s data found that companies reported high engagement and investment in Gen AI, Gen AI security solutions and AI models that improve customer decisions.

With that said, Experian mentioned businesses recognize the challenges of Gen AI with 70% of businesses saying that AI fraud is expected to be the second greatest challenge for their business.

In fact, Tier 1 businesses listed Gen AI fraud as their top stress point.

Despite those concerns, Experian acknowledged funding for Gen AI fraud detection and prevention is lacking.

When asked about the most important potential investment areas for 2024, businesses ranked detecting and preventing Gen AI fraud and deepfakes as the 12th most important investment area behind prevention for legacy fraud types like identity theft and first-party fraud.

“As the widespread use of Gen AI continues to accelerate, businesses will need to be prepared to address this evolving fraud,” Experian said in a news release.

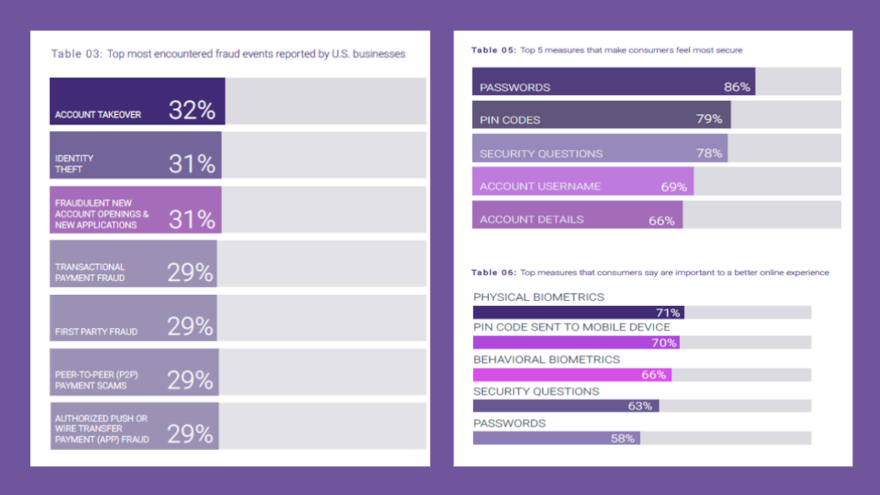

Elsewhere, the research indicated consumers want more behavioral and physical analytics verification.

Currently, multifactor authentication (48%) and the use of passwords (45%) are the most used fraud prevention methods.

Among the methods used most recently, Experian said physical analytics (71%), PINs sent to a mobile device (70%) and behavioral analytics (66%) evoke the highest sense of security for consumers, with security questions (63%) and passwords (58%) rounding out the top five.

Interestingly, experts explained that while consumers have greater trust in physical biometrics and behavioral analytics, less than 30% of businesses are using these solutions — showing companies could consider investments in physical and behavioral analytics to verify identities and combat fraud.

“With digital transactions increasing every day and new technology changing the fraud landscape, our latest report underscores the need for businesses to review their current strategies and invest in the right tools to address the evolving complexity of fraud schemes of the future,” said Kathleen Peters, chief innovation officer for Experian in North America.

“Companies need to take a multilayered approach to fraud prevention that leverages the right data, analytics and technology in an orchestrated way to combat fraud and build trust and positive experiences with legitimate customers,” Peters continued in the news release.

Experian’s 2024 Identity and Fraud Report is based on two major surveys conducted in the U.S. in March.

The first asked more than 2,000 U.S. consumers about their online interactions and expectations regarding security and customer experience.

The second survey asked more than 200 businesses in the U.S. about their strategies for effective fraud management, customer identification and authentication, including investments related to security and customer experience. Companies ranged in size from $10–$49 million to above $1 billion in revenue.

Industries that completed the survey include retail banks, fintech, consumer technology and electronics, payment system providers, and many other companies from a range of verticals.

To read Experian’s 2024 Identity and Fraud Report, visit this website.

Experian’s identity verification and fraud prevention solutions helped clients avoid an estimated $15 billion in fraud losses globally last year.

To learn more about Experian’s fraud prevention solutions, visit https://www.experian.com/business/solutions/fraud-management.