TransUnion: Nearly 1 in 7 new digital accounts suspected to be fraudulent

Chart courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Here’s a startling but perhaps not surprising statistic. Nearly one in seven newly created accounts is suspected to be digital fraud.

That’s the top finding from TransUnion’s 2024 State of Omnichannel Fraud Report, which is based on proprietary insights from TransUnion’s global intelligence network.

Largely driven by bad actors using fabricated or stolen identities, experts suspect that this finding may represent a shift in tactics by fraudsters hoping to engage earlier in the transactional process.

The study showed that 13.5% of transactions associated with online account creation were suspected to be digital fraud globally in 2023.

TransUnion indicated examples of the types of transactions that take place during the account creation process include account signup, registration and loan origination.

Among the industries that saw the highest percentage of digital account creation transactions suspected to be digital fraud globally in 2023 were retail (44.7%), travel and leisure (36.0%) and video gaming (31.5%).

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Similarly, in the U.S., the study determined the highest percentage of digital fraud in the online customer journey occurred at account creation, at 4.8%, varying widely by industry.

“This early phase new account digital fraud may represent a paradigm shift of sorts among fraudsters,” said Steve Yin, senior vice president and global head of fraud solutions at TransUnion.

“In lieu of using traditional tactics to gain access to and ultimately compromise existing accounts, they are increasingly choosing to create new accounts that they can control themselves,” Yin continued in a news release. “These fraudsters leverage synthetic identities assembled in large part through the use of credentials gathered as a result of one or multiple data breaches.”

The study also examined the volume and severity of data breaches over the course of 2023 and compared them to previous years.

TransUnion determined that the number of data breaches in the U.S. increased by 157% from 2020 to 2023 and 15% year-over-year in 2023 to a level never previously seen.

In addition, experts said the average breach risk severity — the ability of a breach to enable identity fraud as measured by TransUnion — increased 11% year-over-year to 4.1 in 2023. That’s the highest reading ever measured by TransUnion.

“This rise may have played a key role in this explosion in suspected fraudulent accounts and the record-high lender exposure associated with synthetic identities in 2023,” experts said.

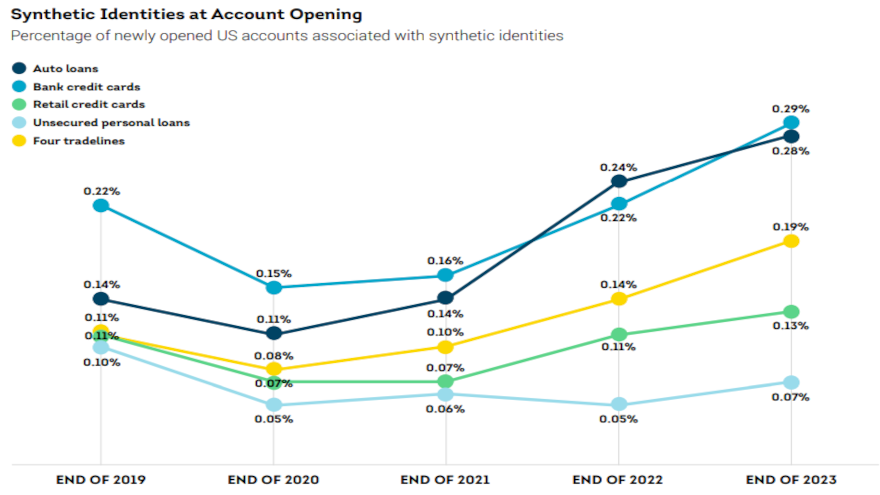

Furthermore, the study found lender exposure to these suspected synthetic identities for U.S. auto financing, bank credit cards, retail credit cards, and unsecured personal loans had soared by 63%, from $1.9 billion since the end of 2020 to $3.1 billion as of the end of 2023.

This trend aligned with TransUnion’s digital fraud findings, which determined synthetic identity fraud was the fastest-growing type of digital fraud globally from 2022 to 2023.

Experts added Lender exposure is defined as the total credit amount synthetic identities have access to for U.S. auto financing, bank credit cards, retail credit cards and unsecured personal loans.

The complete report can be found via this website.