TransUnion study: Credit score not translating into strong consumer performance

Chart courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Experts said credit scores are generally higher nowadays, but outstanding portfolios aren’t necessarily reflecting a financial health often seen with contracts connected to higher points on the credit spectrum.

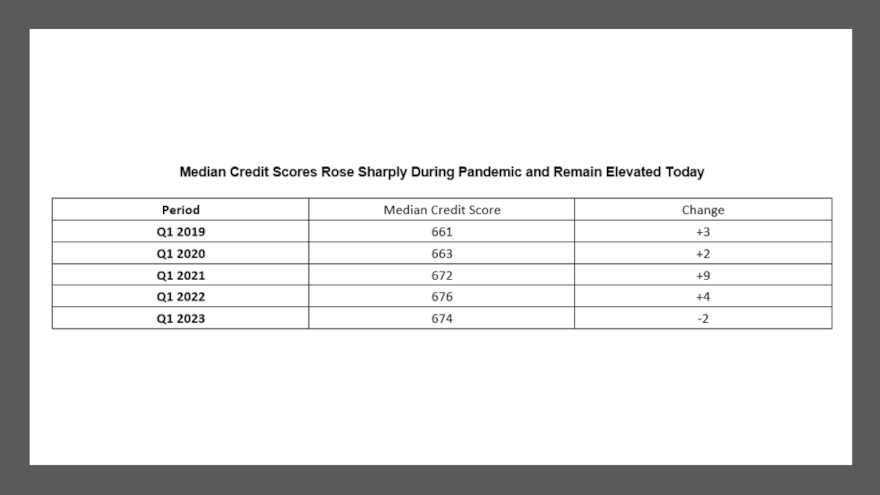

A new TransUnion study determined that median credit scores — aided by government assistance programs, lower credit usage and loan payment forbearance offerings — increased markedly during the early stages of the COVID-19 pandemic.

Now, more than three years since the pandemic started, TransUnion indicated some consumers who migrated to higher credit score ranges are becoming delinquent on their credit obligations at higher rates than historically observed for those risk tiers.

Among the factors that led to a rise in credit scores in recent years, experts said two have stood out, including:

—Lower credit balances and utilization, driven by less spending and excess liquidity from government assistance

—Lower delinquencies, driven by payment forbearance programs and also excess liquidity that enabled consumers to stay current

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

With many activities and travel plans shut down over the course of the pandemic, particularly in its early phases, TransUnion explained many consumers used those savings, plus additional funds provided by the federal government in the form of pandemic relief, to pay down credit balances.

Experts said this behavior ultimately led to lower balances on which consumers were more easily able to remain current and consequently lower rates of delinquency, which helped drive an increase in credit scores and more access to credit.

Against this backdrop of higher credit scores, TransUnion recapped consumer demand for credit rebounded starting in mid-2021, as many government assistance programs ended and inflation began to rise.

“Demand was especially strong for credit cards and personal loans, products that provide immediate liquidity to consumers,” TransUnion said in a news release, mentioning that credit card originations in 2022 increased 58.8% as compared to 2020, while unsecured personal loan originations were up 54.3% over that same period.

The study also revealed that many borrowers previously in riskier credit tiers who recently migrated to a higher credit risk range were more likely to fall back into some of the credit behaviors that they had displayed previously.

For some consumers, TransUnion said this trend led to delinquency rates not in line with those of consumers aligned in prior years with that higher credit score, but instead, similar to consumers who typically had scores that were, in fact, lower.

For example, TransUnion reported the delinquency rate of the sub-segment of new unsecured personal loan borrowers in Q3 2021 who had recently migrated to a higher credit score more closely resembled that of borrowers with credit scores 25 points lower prior to the pandemic (Q3 2017 & Q3 2018).

That same trend held true for credit card trade lines (25 points), while for auto finance, performance of recent migrators resembled that of borrowers with credit scores 10 points lower, according to the TransUnion study titled, “Score Migration Impact to the Credit Ecosystem.”

“Credit scores continue to perform extremely well at their intended role of rank ordering borrower risk. That said, the temporary benefits brought on by pandemic-era government relief programs, and resulting consumer credit behaviors during that time, led to a rise in scores for many consumers, particularly those who previously had lower scores due to delinquent accounts and/or high credit utilization,” said Michele Raneri, vice president and head of U.S. research and consulting at TransUnion.

“Lenders would be well-advised to take a more holistic look at score migrators using data-driven insights into additional trended credit behaviors to better determine which ones are likely to remain in their elevated positions as well as those who may perform more in line with their prior score levels,” Raneri continued

“It’s important to understand that our research indicates that credit scores remain fundamentally sound. Many borrowers who have seen their credit scores rise are, in fact, performing as they should be,” Raneri went on to say.

“However, our study findings underscore the need for lenders to consider doing a deeper dive on credit score migrators beyond their initial rank-ordering – especially in the short-term as the pandemic’s impact is still being felt,” she added.