Upstart continues solution development to leverage AI for auto financing

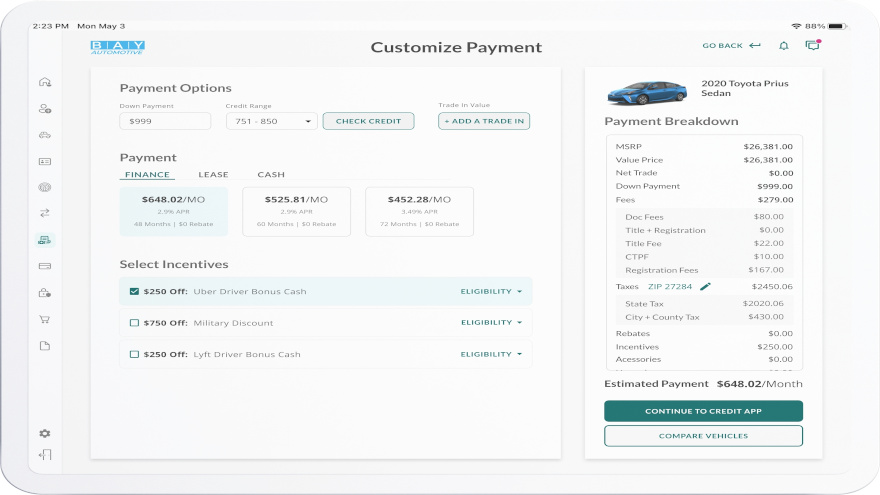

Image courtesy of Upstart.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

SAN MATEO, Calif. –

Upstart ventured into auto financing last summer and then acquired Prodigy in April to enhance its platform fueled by artificial intelligence.

Then last week, the company announced the availability of Upstart Auto Retail software, which includes AI-enabled financing.

Upstart explained the cloud-based solution can offer a “superior” vehicle-buying experience for both consumers and dealerships because this new software will provide access to Upstart-powered auto financing for the first time.

Upstart Auto Retail is the evolution of Prodigy Software, which was acquired by Upstart in April. So far this year, Upstart said in a news release, the number of dealerships signed up to use its software has nearly tripled.

One of those users is Del Grande Dealer Group (DGDG), one of the largest family-owned dealer groups in the San Francisco Bay Area. According to that news release, DGDG has used Upstart’s tools for more than a year.

“The auto selling solution we’ve been using from Upstart has empowered our salespeople to make the buying process more transparent and helped sell more vehicles at a higher profit,” DGDG vice president of finance Tony Corini said. “Now by adding Upstart-powered financing, we look forward to approving more borrowers and continuing to develop our No Brainer checkout experience.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

With the addition of Upstart-powered financing, Upstart said more dealerships will be able to instantly offer affordable financing to more of their customers.

While Upstart said it is currently rolling out AI-powered financing to a limited number of dealers, the company pointed out that it will be available early next year to all dealers using the platform.

“Buying a car is an iconic and memorable experience for most Americans, but the financing step is where things often unravel,” Upstart chief executive officer and co-founder Dave Girouard said. “Upstart Auto Retail will provide millions of consumers with a car buying experience worthy of 2021, including that all-important financing step.”