Upstart set to acquire Prodigy to reinforce auto platform

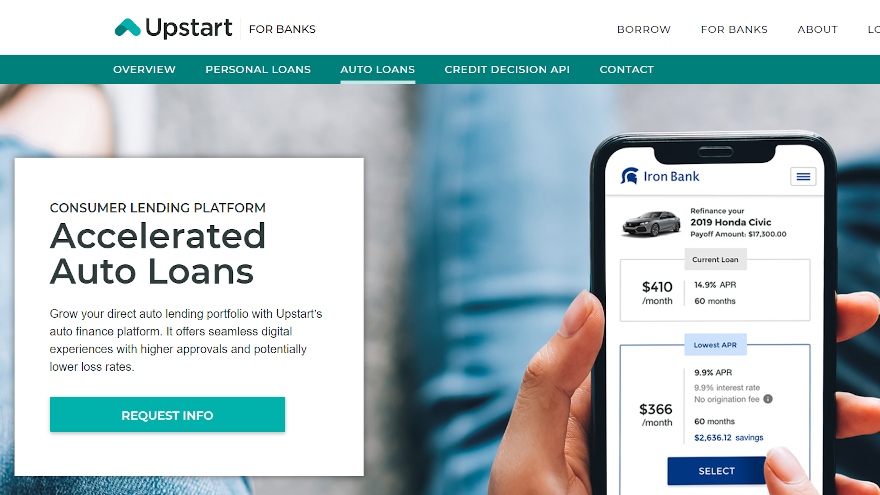

Screenshot courtesy of Upstart.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

SAN MATEO, Calif. –

In June, Upstart Holdings broadened its offering by entering into the auto-financing market.

Last week, the platform fueled by artificial intelligence (AI) revealed an upcoming acquisition to strengthen its position in the auto sphere.

Upstart announced it has entered into a definitive agreement to acquire Prodigy Software, Inc., a provider of cloud-based automotive retail software.

According to a news release the transaction is expected to close in the second quarter and is subject to customary closing conditions.

In September, the first AI-enabled contract was originated on Upstart’s platform. In this initial phase, Upstart is enabling consumers to refinance “expensive and mispriced” contracts, saving consumers an average of $72 per month.

Following the initial launch, Upstart continues to roll this program out in states across the country.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

With the acquisition of Prodigy, Upstart said it will accelerate its efforts to offer AI-enabled auto financing through thousands of dealers nationwide where the majority of financing is originated.

Executives described Prodigy as an end-to-end sales software that can bridge the gap between how dealerships operate and the new way that people are shopping for vehicles. More than $2 billion in vehicle sales have been powered by Prodigy at franchised dealers from top brands such as Toyota, Honda and Ford.

“While Amazon and Shopify have modernized the online shopping experience, the auto industry has been left behind. Upstart is on a path to reduce the cost of auto financing, and we can accelerate this opportunity with a modern multi-channel purchase experience,” Upstart co-founder and chief executive officer Dave Girouard said in the news release.

“Auto retail is among the largest buy-now-pay-later opportunities, and together with Prodigy, we aim to help dealers create a seamless and inclusive experience worthy of 2021,”

Since 2014, more than $9 billion in personal loans have been originated by Upstart’s bank partners. Incorporating more than 1,000 variables and trained on more than 10.5 million repayment events, Upstart’s AI-powered lending model can provide banks with up to 75% fewer defaults at the same approval rate.

And now with Prodigy’s technology set to be part of the equation, Upstart is looking to gain more momentum in auto financing, too.

“Our mission has always been to build the world’s best car buying experience, and for the majority of buyers today, that experience includes financing their vehicle. Prodigy CEO Michia Rohrssen said.

“Upstart’s demonstrably better lending technology will enable us to deliver more affordable and transparent auto loans to millions of consumers through our dealer network,” Rohrssen went on to say.