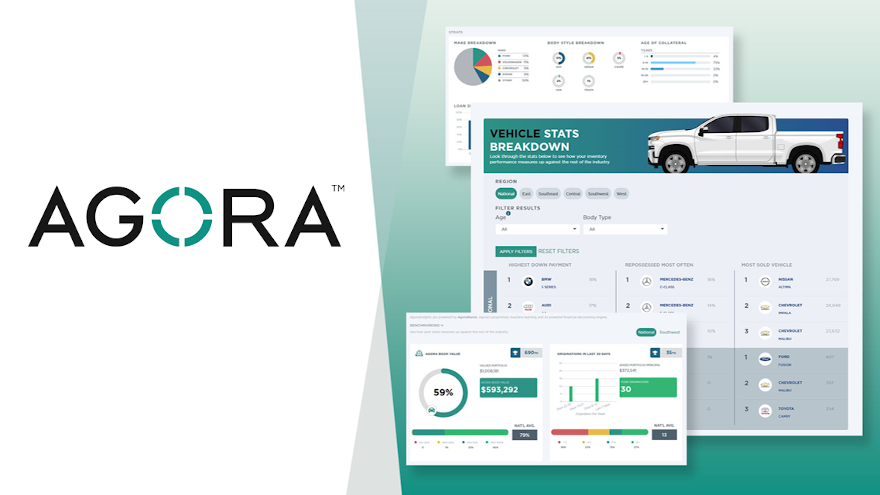

3 enhancements to AgoraInsights

Images courtesy of the company.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

ARLINGTON, Texas –

Agora Data added more technological horsepower to its platform aimed to help buy-here, pay-here dealerships gain more financial information and resources to growth their businesses.

On Tuesday, the company highlighted the three enhancements it made to AgoraInsights. They include reporting functionality, historical trends and real-time data.

Agora Data explained the added features provide a vital resource for an underbanked and underserved industry by making data-driven analytics easily accessible, and free of charge to all members.

Agora Data seeks to enable dealers and small to mid-sized finance companies to have better analytics into their portfolio’s performance and value, and as a result, make more effective business decisions.

The company also noted that these AgoraInsights enhancements, based on input obtained from Agora customers and industry experts, fulfill an important need for more knowledge to plan strategically and proactively.

Agora pointed out that the dashboards are designed to be easy to use and display both high-level as well as detailed information with impactful graphics including make and body style, most sold vehicle, age of collateral, repossessed most often, highest down payment, valuation, delinquency and more.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

In addition to the enhanced reporting capabilities, dealers can compare their portfolio’s performance with national and regional trends.

“It is our goal to continuously improve, create, and organize data-driven information so our customers are on the forefront of industry trends and can better understand the key drivers that impact their portfolio’s performance,” Agora Data senior vice president of product Zach Maynard said in a news release.

“Agora makes available to customers the ability to utilize data-rich reporting to determine the cars that perform well, or poorly, in their region and use the information to ultimately better manage their business,” Maynard continued.

Agora Data chief executive officer Steve Burke added these perspectives.

“Data science provides the backbone for all our industry-changing solutions. We’ve back-tested and trained our models with over $15 billion of loan data creating predictability and accuracy using artificial intelligence and machine learning,” Burke said.

“Reimagining auto finance with industry-changing solutions is helping dealers establish best practices and gain the freedom and resources to build wealth,” he went on to say.

For more information about AgoraInsights, go to https://agoradata.com/agorainsights/.

Dealers and finance companies wanting to connect and gain more knowledge about their portfolios are invited to join Agora at https://app.agoradata.com/signup.