Bankruptcies start 2023 on the rise

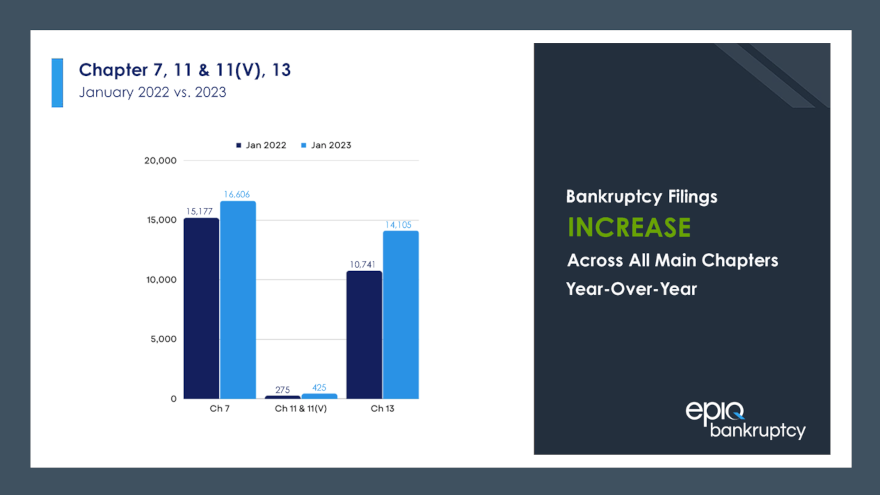

Chart courtesy of Epiq Bankruptcy.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Bankruptcy new filings were up year-over-year across Chapter 7, 11, 13, and 15 in January, according to data provided by Epiq Bankruptcy.

However, one expert said long-term trends remain “inconclusive.”

Total U.S. bankruptcy filings in January came in at 31,087, representing a 19% lift from the 26,215 total filings registered in January 2022.

Epiq tabulated the 29,545 overall individual filings were 20% higher in January than the 24,703 individual filings recorded last year.

While still below pre-pandemic levels, Epiq noticed individual Chapter 13 filings continued to increase in January, as the 13,702 reported filings were a 32% jump over the January 2022 total of 10,346.

Analysts went on to mention total commercial filings rose 12% to 1,694 in January over the 1,508 total filings reported in January 2022. Commercial Chapter 11 filings increased 70 percent to 257 filings up from 151 filings recorded one year ago. All subchapter V small business filings increased 49 percent to 137 in January 2023 from the 92 filings registered the previous year.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“While month-over-month and year-over-year new filings were up for most chapters, we continue to see a delta between more cases closing in a month than are being opened, making it inconclusive whether we've reached a turning point from historic lows in bankruptcy filings,” said Gregg Morin, vice president business development and revenue for Epiq Bankruptcy.

“In January 2023, 8,786 more total cases closed than opened. The two biggest deltas were Chapter 7s where 4,419 more cases closed than opened and Chapter 13s where 4,315 more cases closed than opened,” Morin continued in a news release.

Compared to December, every new filing except Chapter 12 increased.

Epiq determined January’s total filings represented a 5% increase when compared to the 29,640 total filings recorded in December.

Total individual filings for January marked a 6% rise from the December 27,911 total, however total commercial filings did decrease 2% from 1,729 in December.

Individual Chapter 7 increased 2% from 15,471 and individual Chapter 13 increased 10% over December’s 12,393.

“While still below pre-pandemic totals, bankruptcy filings continue to increase amid growing debt loads due to inflationary pressures and reduced availability of low-cost financing,” American Bankruptcy Institute executive director Amy Quackenboss said in the news release.

“Struggling households and businesses on shaky economic footing can look to bankruptcy to provide a solid path toward a financial fresh start,” Quackenboss added.

ABI partners with Epiq Bankruptcy to provide the most current bankruptcy filing data for analysts, researchers and members of the news media.