Bankruptcies turn upward in February

Charts courtesy of Epiq.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Despite February being the shortest month on the calendar, Epiq and the American Bankruptcy Institute (ABI) spotted a sequential rise in total filings during the month.

According to bankruptcy filing statistics from its new bankruptcy analytics platform, Epiq reported February new filings totaled 26,985 across all chapters, marking a 3.2% rise from January which had 26,155 new filings.

Epiq said total commercial filings across all chapters came in at 1,420, down 5.4% versus January, which had 1,501 new filings.

Overall, analysts said the total number of open bankruptcy cases in the U.S. fell month-over-month by 1.1%, down to 714,866 at the end of February compared to 723,725 open cases at the end of January.

Epiq delved deeper into the data to note that Chapter 7 individual bankruptcies totaled 15,196 new filings in February, up 1.1% over January, which had 14,295 new filings. So far in 2022, Epiq said Chapter 7 individual bankruptcy filings are down 29.9% with 29,491 cases compared to the first two months in 2021, which had 42,079 new filings.

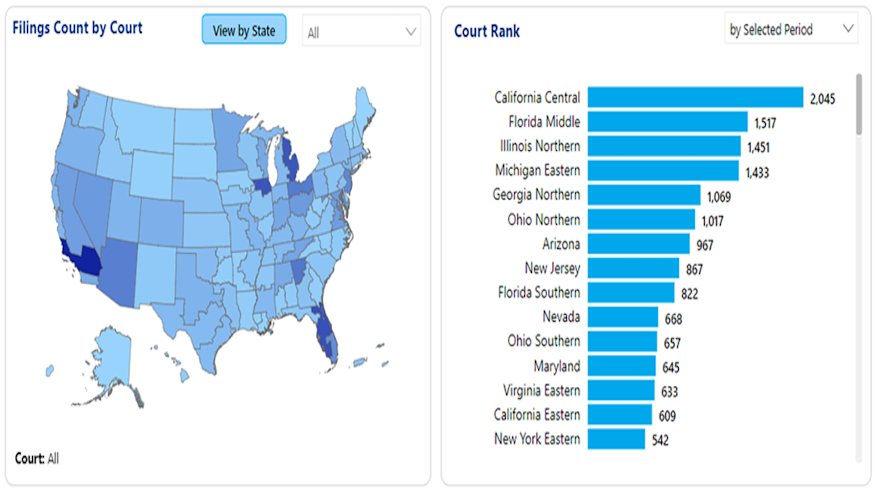

In February 2022, the top five states with new Chapter 7 filings included:

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

— California: 1,744

— Florida: 1,248

— Illinois: 887

— Michigan: 811

— Ohio 793

Epiq went on to mention Chapter 13 individual bankruptcies constituted 10,306 new filings in February, which was flat versus January which had 10,345.

In February 2022, analysts said the Southeast continued to lead new Chapter 13 filings with Georgia (1,040), Alabama (791), Tennessee (712) and Florida (701) leading the way as the largest states with filing activity.

Analysts added Chapter 11 commercial filings, including Sub Chapter V, had a total of 203 new filings in February, down 10.8% from January which had 225. Of these February filings, 93 were Sub Chapter V, which was up 16.5% from the 80 cases during the prior month.

Chris Kruse, senior vice president of Epiq Bankruptcy Technology, explained these small business filings are a key metric to watch as the pandemic continues and government aid ceases.

“Although February 2022 new bankruptcy filings continue to be well below pre-pandemic levels, Chapter 7s are up and Chapter 13 individual filings remained flat month-over-month, even with February having three less days than January,” Kruse said in a news release. “We are watching these trends closely.”

ABI discussed commercial bankruptcies, too, in its latest filing update that cited other Epiq data.

Since the Small Business Reorganization Act of 2019 (SBRA) became effective on Feb. 19, 2020, to provide Main Street business debtors with a more streamlined path for restructuring their debts, ABI said more than 3,000 debtors have elected to file under subchapter V of Chapter 11.

In response to the economic distress caused by the COVID-19 coronavirus pandemic, the “Coronavirus Aid, Relief, and Economic Security Act” (CARES Act; P.L. 116-136) was enacted on March 27, 2020, increasing the debt eligibility limit for small businesses looking to file under the SBRA’s subchapter V from $2,725,625 to $7.5 million.

Congress extended the limit last year with the enactment of the “COVID-19 Bankruptcy Relief Extension Act of 2021,” but the threshold is set return to $2,725,625 on March 27 without further congressional action.

“With government stabilization programs and lender deferments tapering off, consumers and businesses are navigating an economic landscape that includes rising inflation, worker shortages and growing supply chain challenges,” ABI executive director Amy Quackenboss said in another news release.

“Congressional consideration of extending or permanently making the expanded eligibility limit of small businesses electing to file for subchapter V under Chapter 11 before it expires on March 27 would provide a reliable path for small businesses to successfully restructure, reduce liquidations and save jobs,” Quackenboss continued.

Turning back to overall bankruptcy data, ABI said the average nationwide per capita bankruptcy filing rate (total filings per 1,000 population) was 1.03 for February, a decrease from the 1.25 rate registered in January.

The average daily filing total in February was 1,420, a 14% decrease from the 1,643 total daily filings registered in February of last year.

States with the highest per capita filing rates (total filings per 1,000 population) in February included:

1. Alabama (2.94)

2. Tennessee (2.35)

3. Georgia (2.17)

4. Mississippi (1.99)

5. Nevada (1.83)