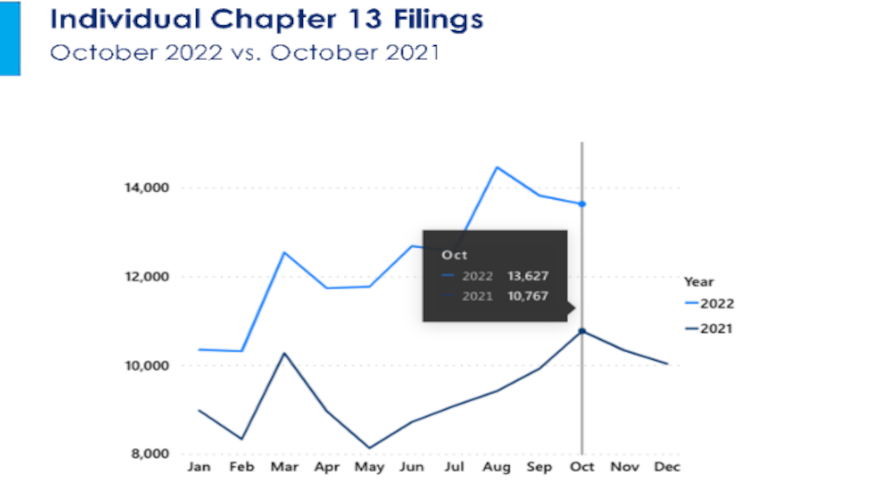

Individual Chapter 13 bankruptcies make notable jump in October

Chart courtesy of Epiq Bankruptcy.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Your buy-here, pay-here operation might see an uptick in individuals who need a transportation solution after having just filed for Chapter 13 bankruptcy.

According to data provided by Epiq Bankruptcy, individual Chapter 13 filings increased 27% year-over-year in October with cases totaling 13,627. That’s up from the 10,767 filings in October of last year.

Epiq also reported that total bankruptcy filings in the United States increased 4% to 32,695 in October over the 31,493 total filings in the same month a year ago.

Analysts determined overall individual filings increased 4% in October, as the 30,809 filings were up over the 29,695 individual filings registered in October 2021.

Epiq also pointed out the 1,886 total commercial filings in October represented a 5% increase from 1,798 commercial filings in October of last year. Commercial Chapter 11 cases ticked up 2% in October to 304 filings from 297 filings the previous year.

“With inflation increasing the costs of goods and services, and with interest rates rising, families and businesses have been presented with tough financial decisions,” American Bankruptcy Institute executive director Amy Quackenboss said in a news release from Epiq. “Though filing rates are still below their pre-pandemic totals, struggling households and businesses are still turning to bankruptcy for relief from mounting economic challenges.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Looking at the data on a sequential basis, however, a slightly different story appears. Epiq said all filing chapters in October registered a decrease compared to September’s figures.

October’s total bankruptcy filings represented a 2% decrease when compared to the 33,194 total filings recorded the previous month.

Total individual filings for October marked a 1% dip from September individual filing total of 31,179.

Individual Chapter 13 filings also registered a 1% decrease from September’s individual Chapter 13 total of 13,814.

“While comparing month-over-month or year-over-year filings is one way to determine what's trending in the bankruptcy market, the delta between new filings and closed cases is another valuable capacity metric,” Epiq Bankruptcy vice president of business development and revenue Gregg Morin said.

Epiq said that not since 2010 have there been more new filings in a year than cases that were closed and it’s trending that way again in 2022, as there have been 61,857 more cases closed than were opened through October 2022 compared to the same period in 2021.

For the past four months, Epiq added that the difference has steadily decreased, from 7,627 in July, to 6,516 in August, 5,291 in September, and 3,252 in October.

ABI has partnered with Epiq Bankruptcy to provide the most current bankruptcy filing data for analysts, researchers, and members of the news media. Epiq Bankruptcy is a leading provider of data, technology, and services for companies operating in the business of bankruptcy.

Its new Bankruptcy Analytics subscription service provides on-demand access to bankruptcy data that’s updated daily.

Learn more at https://bankruptcy.epiqglobal.com/analytics.