Individual Chapter 13 bankruptcy filings make ‘substantial’ jump in 2022

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

If they haven’t already, buy-here, pay-here dealerships might be seeing more applicants arriving with an active bankruptcy on their credit file.

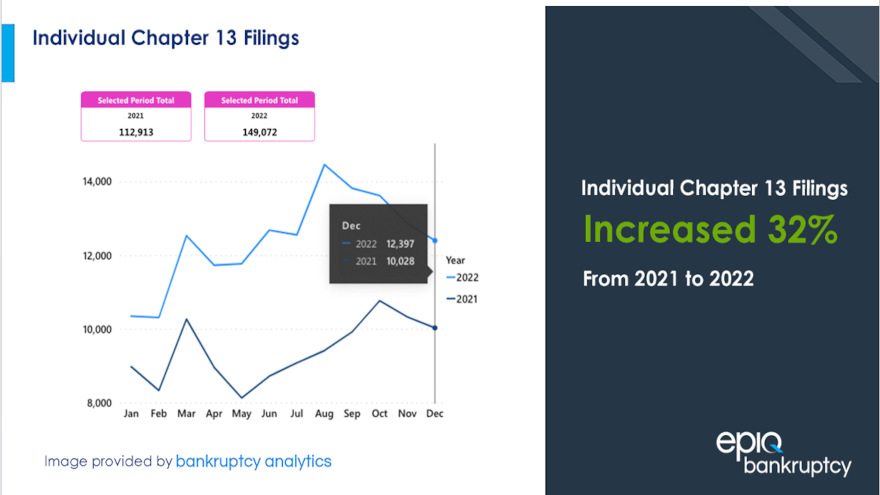

According to data provided by Epiq Bankruptcy, individual Chapter 13 bankruptcy filings in 2022 increased 32% to 149,072 from the 2021 total of 112,913.

While representing a “substantial” year-over-year increase, Epiq pointed out that individual Chapter 13 filings remain lower than the pre-pandemic total of 272,451 recorded in 2019.

Epiq reported overall individual filing totals for 2022 declined 6% to 356,930 from the 378,918 individual filings the previous year. Experts said individual filings are at their lowest levels since the 341,233 filings registered in 1985.

Experts also reported the 378,326 total bankruptcy filings in 2022 represented a 6% decrease from the 401,479 filings in 2021.

Epiq recapped that annual bankruptcy filings last registered a similar total in 1984, with 348,521 total filings.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Experts went on to mention commercial filings also declined, as 21,396 filings in 2022 represented a 5% drop from the 22,561 filings recorded in 2021.

“The underlying data tells different year-over-year economic stories. The Chapter 7 story is encouraging with new filings down 21.6 percent. The Chapter 11/11V story is business as usual with new filings slightly up 1.2 percent, and the Chapter 13 story looks bleak as new filings were up 32 percent,” said Gregg Morin, vice president of business development and revenue for Epiq Bankruptcy.

“But if you are in the bankruptcy servicing business there is still another story as all three chapters had more cases close in 2022 than new cases filed,” Morin continued in a news release. Chapter 7 filings had 29,799 more cases closed than opened, Chapters 11/11V had 265 more closed, and Chapter 13s had 44,361 more closed. Every month in 2022, all chapter totals had more cases close than open totaling 74,678 for the year, continuing the annual trend since 2011,” Morin added.

Looking at just December data, Epiq reported that all filing categories increased during the last month of 2022 compared to the previous year.

Total bankruptcy filings in December increased 6% to 29,631 over the 27,997 total filings in December 2021. The 27,919 individual filings also represented a 6% rise over the 26,306 filings in December of last year.

Total commercial filings for December came in at 1,712, an increase of 1% over the 1,691 total commercial filings in December 2021.

“Steep bankruptcy filing declines abated over the past year as pandemic assistance programs and lender forbearance receded while interest rates, inflationary pressures and debt loads grew,” American Bankruptcy Institute executive director Amy Quackenboss said in the same news release. “As struggling families and companies face mounting economic pressures at the start of 2023, bankruptcy provides a proven shield toward a financial fresh start.”

ABI has partnered with Epiq Bankruptcy, a leading provider of data, technology, and services for companies operating in the business of bankruptcy. to provide the most current bankruptcy filing data for analysts, researchers and members of the news media.