Insolvency Exception Could Help Form 1099-C Recipients

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

HOUSTON and RALEIGH, N.C. –

Working with customer disputes isn’t an unfamiliar situation to most buy-here, pay-here operators. Dealers have become accustomed to smoothing out situations about repairs, payments and a host of other issues.

Another customer concern happening more often stems from individuals who had their vehicle repossessed and the loan balance forgiven (or discharged under state law). That process forces operators by federal law to file with the IRS and send to the borrower Form 1099-C showing that the discharged balance is considered income potentially subject to tax. These customers are notified by the Form 1099-C that they may have a significant tax liability when they file their individual return, despite losing ownership of their car.

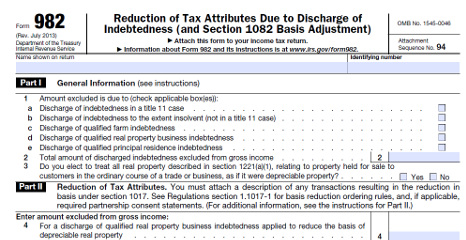

However, there is an IRS form that may brighten the day for both the upset customer and the BHPH operator — Form 982 titled, “Reduction of Tax Attributes Due to Discharge of Indebtedness.” If the customer is insolvent immediately before the debt is cancelled and the car is repossessed, the amount reported on the Form 1099-C is not taxable. For this purpose, a customer is insolvent if all of his/her liabilities were more than the value of all assets (including the repossessed car) immediately before the debt was cancelled.

Ken Shilson, founder of the National Alliance of Buy-Here, Pay-Here Dealers who spent decades as a practicing certified public accountant, recently mentioned Form 982 to some veteran operators who were unaware of the potential impact of customers utilizing this process.

“When they hear about it, they say, ‘That’s genius.’” Shilson said.

Potential of Form 982

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

McGladrey’s Scott Ruby explained to BHPH Report what Form 982 is in a nutshell.

“The income tax law has an insolvency exclusion that says that if your liabilities exceed your assets, you are probably excused from paying tax on cancelled debt,” Ruby said.

Especially in deep subprime where many BHPH customers reside, insolvency might be extremely common. Ruby shared information from the Taxpayer Advocate Service, which is an independent organization within the IRS aimed at making sure that every taxpayer is treated fairly. Each year the Taxpayer Advocate makes a report for Congress that lists changes that the IRS should consider.The 2010 Annual Report to Congress indicates that many taxpayers overlook the

benefit of the insolvency exclusion.

“Based on a study done by the Taxpayer Advocate Service, 47 percent of the taxpayers that received a Form 1099-C would likely qualify for the insolvency exception,” Ruby said. “Our expectation, because this is deep subprime, is that we’re probably talking about an insolvency figure much higher than 47 percent. I expect in deep subprime the level may be as high as 90 percent.”

The bottom line, customers who receive a Form 1099-C probably do not have to pay additional income taxes.

Shilson agreed with Ruby’s estimation.

“When I mentioned the exception to a couple of dealers, they responded by saying nearly everyone in deep subprime is insolvent,” Shilson said.

However, an accounting professional as experienced as Ruby cautioned about the potential pitfalls of Form 982.

“I think that the form is unbelievably confusing” Ruby said. “Customers probably want to talk to their tax accountant to help them compute the amount of their insolvency. If they are insolvent, some or all of the income may be excluded from taxable income. Their tax savings are probably going to far outweigh the cost of the tax preparation.”

Ruby suggested that operators can include Form 982 (and its instructions and worksheets) to customers along with the Form 1099-C, or instruct customers on how they Can obtain it from the IRS.

“You can have a simple handout at the dealership saying, ‘We can’t provide tax advice, but ask your tax advisor and if the Form 1099-C amount can be excluded from income under the insolvency rules.’ Tax preparers are generally pretty busy this time of year and it can be easy to overlook this exception. Sharing this simple phrase ‘please check the insolvency rules’ will be a helpful clue your tax advisor.” Ruby said.

Helping Customers in Financial Trouble

As explained in previous installments in this BHPH Report series, operators who have a related finance company are required by federal tax law to send Form 1099-C when an uncollectable balance has been discharged.Shilson described how BHPH operators can Point to Form 982 to potentially help a customer who experienced an extreme financial hardship such as divorce or mounting medical expenses, causing the repossession and eventual charge-of .

“That’s the customer you want to have this exception,” Shilson said.

And at the same time, Shilson pointed out that operators also can use the power of Form 1099-C. For example, it might be beneficial when some customers default on their installment contract and skip with the vehicle or if a competing dealer sells them a different vehicle and encourages them to abandon the old obligation.

Shilson said these “abandonment” situations have happened more frequently in the current highly competitive environment where deep subprime buyers are being offered newer vehicles by competitors.

“They deserve to get a Form 1099-C.That’s the customer you want to have a tax liability,” Shilson said.