October bankruptcies rise but remain below pre-pandemic readings

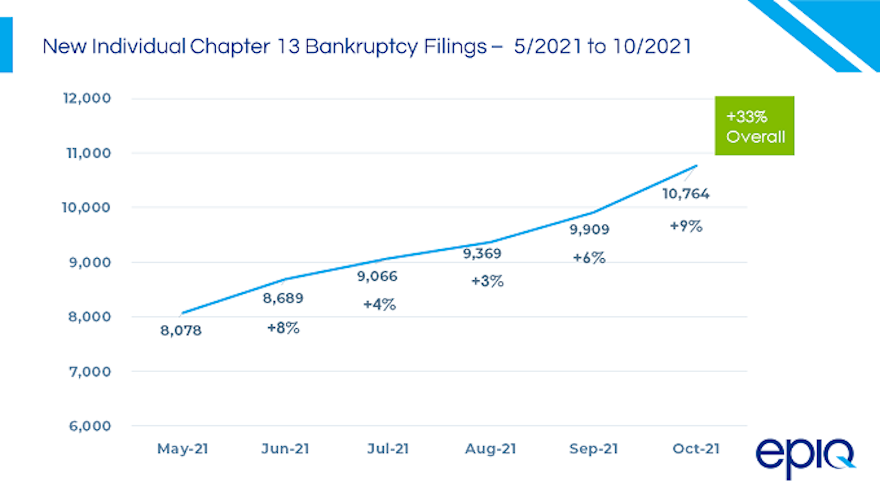

Chart courtesy of Epiq.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

ALEXANDRIA, Va., and NEW YORK –

While still not recovered to the activity level seen before the pandemic, bankruptcy filings are trending higher.

Epiq recently released its October bankruptcy filing statistics from its AACER bankruptcy information services business. The firm said October new filings for all chapters increased 1.8% to 31,471, up from 30,920 in September.

Epiq indicated total individual Chapter 13 filings rose 8.6% compared to September, with 10,764 new filings versus 9,909 filings in September 2021.

Experts said total individual Chapter 7 filings softened 1.9% over September, with 18,874 new filings compared to 19,942 in the prior month.

“Although October had one less business day than September, October 2021 filings were up 1.8% month-over-month. However, new filings remain significantly lower than the comparable pre-COVID number of 67,878 for all chapter new filings in October 2019,” said Chris Kruse, senior vice president of Epiq AACER, in a news release.

Epiq pointed out that Chapter 13 individual filings increased for the fifth consecutive month, growing 33% since May when 8,079 new cases were filed. However, experts said these filing rates remain 55% below the comparable 23,688 pre-COVID new filings in October 2019.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The five states leading the October individual Chapter 13 new filings included Georgia, Alabama, Florida, Tennessee, and Illinois.

Epiq went on to mention total commercial Chapter 11 filings in October increased by 21.1% with a total of 293, compared to 242 new filings in September 2021.

As a subset of the total new Chapter 11 commercial filings, Epiq added Chapter 11 Subchapter V filings were up 16.7% with 84 new filings, compared to 72 new filings in September 2021.

The American Bankruptcy Institute (ABI) combed through the Epiq data and offered this reaction in a separate news release.

“With the expiration of government relief programs, supply shortages and inflationary price increases, families and businesses are contending with a number of economic challenges,” ABI executive director Amy Quackenboss said. “Bankruptcy provides struggling companies and consumers with a reliable lifeline when faced with an uncertain financial future.”

Delving deeper into the Epiq information, ABI noted that the average nationwide per capita bankruptcy filing rate in October was 1.33 (total filings per 1,000 per population), a slight decrease from the filing rate of 1.34 during the first nine months of 2021.

ABI added that average total filings per day in October were 1,574, a decrease of 18% from the 1,915 total daily filings in October 2020.

Furthermore, states with the highest per capita filing rates (total filings per 1,000 population) in October included:

1. Alabama (3.14)

2. Nevada (2.69)

3. Tennessee (2.45)

4. Indiana (2.24)

5. Georgia (2.14)