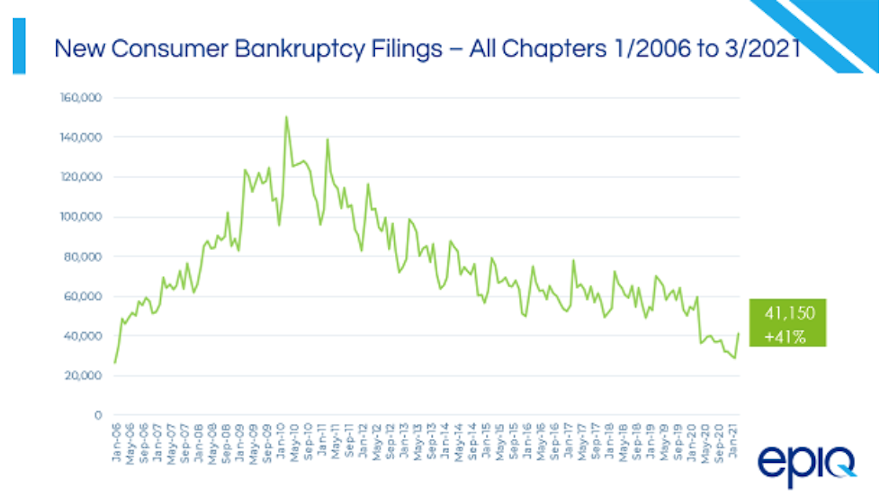

Q1 closes with biggest surge in consumer bankruptcies since COVID-19 arrived

Chart courtesy of Epiq.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

ALEXANDRIA, Va., and NEW YORK –

The first quarter closed with the largest amount of consumer bankruptcy filings registered during a single month since the pandemic began.

According to filing statistics from Epiq’s AACER bankruptcy information services business, there were 41,150 new non-commercial consumer filings in March, representing a 41% month-over-month increase and the largest single month of new filing activity since COVID-19 was declared a pandemic last March.

All told, Epiq reported that March new filings spiked to 43,425 cases, also driven by commercial filings across all chapters that increased over February’s historic low with a total of 2,275 new filings. That figure marked a 16% increase month-over-month.

“Bankruptcy filings in March saw large increases over February,” said Chris Kruse, senior vice president of Epiq AACER.

“The vaccination roll-out and corresponding economic recovery is gaining momentum that will accelerate the return to pre-pandemic new bankruptcy filings levels,” Kruse continued in a news release. “We approach the second quarter of 2021 cautiously anticipating the bankruptcy backlog that emerged during the pandemic may be peaking.”

Epiq indicated there were 106,958 total new bankruptcy filings across all chapters during the first quarter, down from 177,245 in the same period in 2020.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The firm said the two largest increases in March were in non-commercial consumer filings with 30,802 new Chapter 7 cases and 10,265 new Chapter 13 cases, increases of 9,939 and 1,945 over February, respectively.

Analysts added commercial Chapter 11 filings were down 9% over February with 384 new filings in March.

“While the government has extended economic stabilization measures and lenders remain flexible to meet the economic hardships of the COVID-19 pandemic, bankruptcy provides a proven shield to families and businesses with mounting debt loads and financial uncertainty,” American Bankruptcy Institute executive director Amy Quackenboss said in a separate news release.

“Recent action by Congress and the administration will ensure that households and small businesses continue to have greater access to the financial fresh start of bankruptcy,” Quackenboss continued.

President Joe Biden on March 27 signed the “COVID-19 Bankruptcy Relief Extension Act” into law to extend provisions providing financially distressed consumers and small businesses greater access to bankruptcy relief.

ABI explained the legislation will extend personal and small business bankruptcy-relief provisions that were part of last year's CARES Act through March 2022.

Some of the key provisions of last year’s relief packages were the increased debt limit to $7.5 million for small business debtors electing to file under subchapter V and allowing individuals to seek COVID-19–related hardship modifications, among other changes. More information is available on this website.

“The decline in commercial chapter 11 filings is a direct reflection of both lenders and owners working with companies to protect their investments outside of a bankruptcy process,” said Deirdre O’Connor, senior managing director of corporate restructuring at Epiq.

ABI looked deeper into Epiq’s latest information to mention that the average nationwide per capita bankruptcy filing rate for the first three months of this year increased to 1.38 (total filings per 1,000 per population) from the 1.23 filing rate of the first two months of 2021.

States with the highest per capita filing rates (total filings per 1,000 population) for Q1 included:

1. Alabama (3.29)

2. Delaware (2.98)

3. Nevada (2.85)

4. Tennessee (2.56)

5. Georgia (2.27)

ABI has partnered with Epiq in order to provide the most current bankruptcy filing data for analysts, researchers and members of the news media.