2 new studies show rebounding incomes & optimism

Charts courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

CHICAGO and FORT LAUDERDALE, Fla –

This month marks one year since U.S. lockdowns began and the subsequent financial fallout that ensued from the COVID-19 pandemic.

However, data and survey information from Consolidated Credit and TransUnion arriving this week showed rebounding household incomes and consumer sentiments — perhaps two trends that could help auto-finance companies originate contracts and continue to collect on seasoned paper.

Consolidated Credit asked more than 1,000 Americans about their financial outlook. The survey found that most Americans are optimistic and have proactive plans for their finances and the next stimulus check.

According to a news release, 40% of those surveyed told Consolidated Credit they need the next stimulus to “pay off credit card debt,” while 27% of respondents said need the next stimulus for past-due bills. Another 29% said they need it to replenish savings.

“After facing the financial uncertainty of the pandemic, Americans are becoming more hopeful,” Consolidated Credit president Gary Herman said in the news release. “If all goes well, this optimism will translate into more cash spending, boosting the economy post-pandemic.”

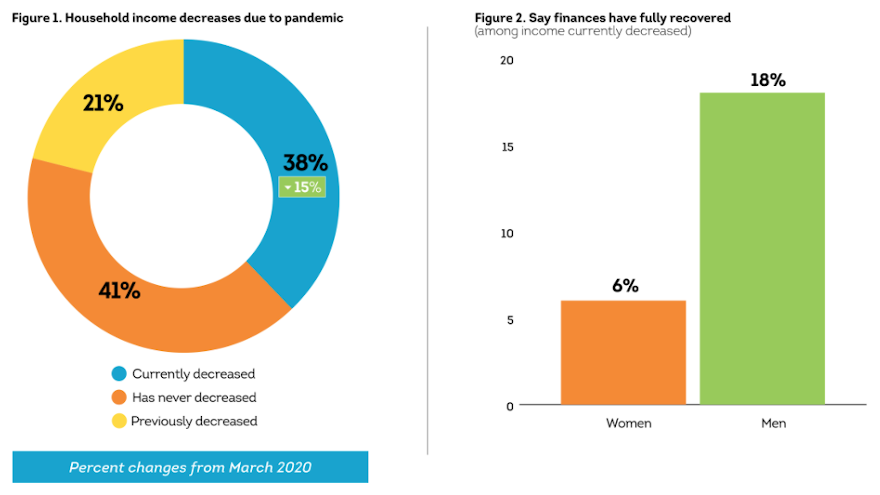

TransUnion’s newest Consumer Pulse study reinforced that outlook as analysts reported that the percentage of consumers who said their household income remains negatively impacted by the pandemic now stands at 38%. That’s significantly lower than one year ago when TransUnion said that reading was 53%.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Formerly named the TransUnion Financial Hardship study, the Consumer Pulse study includes a survey of 2,995 U.S. consumers conducted between Feb. 26 and March 1. As the impact on household income lessens, TransUnion highlighted that early indicators point to the COVID-19 vaccine having a positive effect on consumers’ outlook.

Of those persons who said they had been fully vaccinated, 77% stated they are optimistic about the future compared to just 59% of those who had not been vaccinated.

“Over the last 12 months, TransUnion has maintained a monthly study of the economic hardship experienced by millions of consumers impacted by COVID-19 around the world,” TransUnion chief executive officer Chris Cartwright said in another news release. “The insights from this rich data set provide an invaluable global barometer of the pandemic’s financial impact.”

One year since the pandemic arrived, the Consumer Pulse study determined that three primary U.S. consumer types have formed as a result of COVID-19:

• Stable (35% of the population): Those consumers whose income has not decreased and finances are as planned

• Hopeful (27% of the population): Consumers with income that has decreased, but believe their finances will recover

• In limbo (22% of the population): People with income that has decreased, but say they are unsure or slightly doubtful their finances will recover.

TransUnion explained the remaining U.S. consumer types include those persons who are resilient, thriving, devastated or financially hit.

Analysts said resilient consumers, who make up 8% of the population, saw their income decrease, but say their finances have fully recovered.

They noted that thriving consumers (5% of the population) had no income drop and better than planned finances.

The credit bureau said devastated consumers (2%) had decreased income and don’t think they’ll ever recover.

TransUnion added that financially hit people (1%) include those whose household income has not been impacted, but say finances are worse than planned.

The study focused on the in-limbo group since its participation in the financial recovery may play an outsized role.

Comparing them to the total population, analysts pointed out that 62% of in-limbo individuals cut back on discretionary spending versus 45% overall, and 38% canceled subscriptions/memberships versus 24% overall.

TransUnion discovered the uncertain future of those in limbo is leading them to curb future spending as 54% expect to decrease discretionary spending versus 37% overall.

Though the in-limbo group may be struggling, the report highlighted that many consumers may soon release pent-up demand for spending that was curbed during the pandemic.

The report showed more than half (53%) of resilient consumers and nearly one-third of thriving (27%) and hopeful (29%) consumers expect to increase discretionary spending.

“Whether you are in limbo, hopeful, or stable, the expectation is that many consumers will soon be flexing their spending muscle,” said Charlie Wise, head of global research and consulting at TransUnion.

“In addition to more people receiving vaccinations, consumers have been or soon will be buoyed by an improved employment picture, stimulus checks, income tax returns and more access to credit,” Wise went on to say.

Despite the positives observed in the report, TransUnion acknowledged some consumers continue to struggle.

Concern about the ability to pay bills, installment contracts and other loans among consumers who state their income is currently down (38% of the population) has remained consistently high (73% in March 2020 and 74% presently).

Analysts added that government assistance continues to be important to impacted consumers as 39% of middle- and low-income consumers plan to use stimulus checks to pay their current bills or other monthly payments.

TransUnion also mentioned more consumers whose income is currently down are turning to borrowing cash (25% versus 17% in April 2020), taking out personal loans (16% versus 9% in April 2020) or opening new credit cards (15% versus 8% in April 2020) to cover their daily expenses.

“A benefit to consumers is that lenders are incorporating alternative data into their lending strategies,” Wise said.

“Leveraging such information can result in more trustworthy relationships between consumers and lenders, which is especially important when uncertainty has reigned over the credit landscape during much of the last year,” Wise went on to say.

The complete Consumer Pulse study can be downloaded from this website.