4 potential reasons why younger consumers are delinquent

Chart courtesy of the Federal Reserve Bank of New York.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

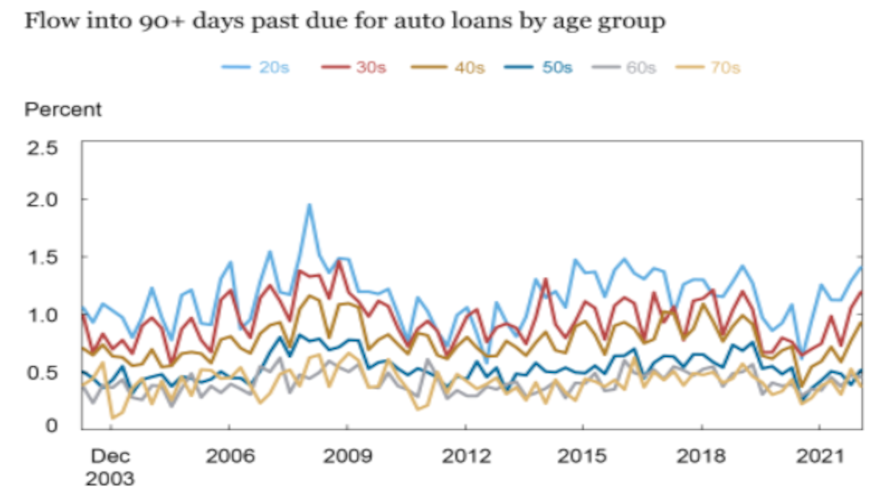

An analysis by five experts at the Federal Reserve Bank of New York showed consumers in their 20s and 30s represent the age groups with the most auto finance contracts 90 days or more past due.

Those fourth-quarter findings are based on anonymized credit reports from Equifax.

The five officials from the New York Fed articulated four potential reasons why those individuals below the age of 40 are struggling more to maintain their auto-finance commitments compared to their older contemporaries.

Their commentary began with noting rising interest rates. But the New York Fed acknowledged that individuals who took vehicle delivery with financing attached during the past 18 months or so likely have not been impacted by this factor as much.

Next, the New York Fed experts mentioned loosening underwriting standards.

“Perhaps it has been easier for those with lower credit scores to borrow, and this is starting to show up in the debt performance. However, a look into our data suggests this is unlikely,” they said.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Auto loan underwriting standards appear to have been relatively steady during the pandemic, with the median score of newly originated loans staying roughly constant — and relatively high — during the past few years,” they continued.

Then, the New York Fed touched on another top-of-mind topic — inflation — which the experts acknowledged to have sped up sharply through 2021 and 2022, reaching a 40-year high last summer. They pointed out how the price increase for vehicles contributed notably to that inflation reading.

“It is possible that increasing prices — and correspondingly, debt service payments — are cutting into borrowers’ balance sheets and making it more difficult for them to make ends meet, particularly as real disposable income fell in 2022,” the New York Fed said.

Furthermore, the experts said delinquencies likely are bound to rise since many pandemic-connect accommodations have expired.

The New York Fed then arrived at what it called a “critical” question. Will these delinquency rates continue to rise, or will they flatten out now?

“Surpassing the pre-pandemic delinquency rates isn’t worrisome per se, because the pandemic recession ended what had been a historically long economic expansion. But the fact that more borrowers are missing their payments, particularly when economic conditions appear strong overall, is somewhat of a puzzle,” the five experts said.

“This is particularly concerning for younger borrowers who are disproportionately likely to hold federal student loans that are still in administrative forbearance. Some of these borrowers are struggling to pay their credit card and auto loans even though payments on their student loans are not currently required,” they continued.

“Once payments on those loans resume later this year under current plans, millions of younger borrowers will add another monthly payment to their debt obligations, potentially driving these delinquency rates even higher,” they went on to say.

The New York Fed closed with a thought that might be offer some reassurance to auto finance companies.

“While person-level delinquencies are high, we do not anticipate widespread stress for lender portfolios as balance weighted delinquencies remain at or below pre-pandemic levels. But, on a person-level, this financial distress is real, and the delinquent marks will impact their access to credit for years to come,” experts said.

The analysis was compiled by:

—Andrew Haughwout, director of Household and Public Policy Research in the Federal Reserve Bank of New York’s Research and Statistics Group.

—Donghoon Lee, an economic research advisor in Consumer Behavior Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

—Daniel Mangrum, a research economist in Equitable Growth Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

—Joelle Scally, a senior data strategist in the Federal Reserve Bank of New York’s Research and Statistics Group.

—Wilbert van der Klaauw, the economic research advisor for Household and Public Policy Research in the Federal Reserve Bank of New York’s Research and Statistics Group.