5 findings from Open Lending’s vehicle accessibility survey

Chart courtesy of Open Lending.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Open Lending Corp. recently offered a in-depth reminder for when a finance company decides to buy that installment contract, especially for an applicant in need of reliable transportation.

The provider of analytics, risk-based pricing, risk modeling and default insurance to auto finance companies throughout the United States highlighted five findings from its survey on vehicle accessibility in the U.S.

With responses from 1,347 full- and part-time employees, including 597 vehicle owners and 750 non-car owners, the survey examined barriers to ownership, misperceptions around the financing process, and opportunities for finance companies to expand their customer base by reaching those who believe they can’t afford a vehicle.

Between rising vehicle costs, the return to physical workplaces and a growing move away from urban hubs with public transportation, Open Lending pointed out the question of vehicle access has come into sharp focus.

Open Lending’s report shows how significantly vehicle access impacts job performance, earning potential and daily life. It also explores why lenders should look to dispel negative perceptions of the financing process and adopt solutions to engage non-vehicle owners — especially those in near- and non-prime credit segments.

The five key themes that emerged from the survey included:

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

1. Access misconceptions

Open Lending acknowledged that it comes as no shock that affordability issues stop people from purchasing vehicles.

What’s more surprising is that vehicle affordability is a widely cited issue across income levels: 52% of Gen Zers and 50% of millennials say they can’t afford a vehicle, regardless of annual earnings.

2. Car-buying complexity

For many non-car owners, the process of getting approved for auto financing lacks clarity, with just 11% saying they perceived the vehicle-buying process as “extremely transparent.”

By contrast, over one-third of non-owners (35%) said they viewed the process as either “mostly” or “extremely opaque.”

At the same time, 83% said they would return to lenders for other purposes if they had a positive auto loan experience.

3. The professional toll

A majority of non-car owners said owning a vehicle would improve their job performance, with 64% saying they felt their earning potential would increase with access to a vehicle.

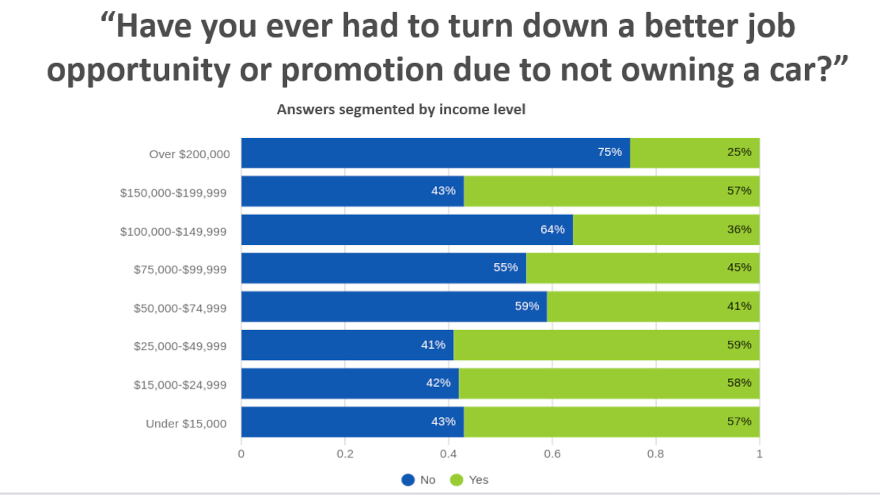

Open Lending said it’s more than a gut feeling as 55% of non-car owners have had to turn down a better job or promotion due to not owning a vehicle.

4. The ownership impacts

When asked to explain in their own words how vehicle ownership would most change their lives, Open Lending found that respondents widely cited flexibility, financial gains and independence as life-changing benefits of vehicle ownership.

5. A discrepancy in equitable opportunities

Open Lending determined that non-car owners reported a slew of personal and professional inconveniences and hardships.

The survey showed 60% of non-car owners said essential tasks and errands are more challenging without a car, while 48% said not having a car makes it difficult to spend time with family and friends.

“For lenders, these findings illustrate the transformative power of more accessible auto loans. There’s virtually no aspect of daily life that isn’t impacted by lack of vehicle access,” Open Lending chief revenue officer Matt Roe said in a news release. “By taking steps to put auto loans within reach for more Americans, lenders can improve quality of life and livelihoods across underserved populations, while also enhancing the loan experience for these underserved populations.

“And it’s good for business too: With industry-leading risk management solutions that include default insurance coverage, lenders can expand their portfolios to near- and non-prime buyers while controlling for risk — leading to higher yields and loyal repeat consumers,” Roe went on to say.

For more insights from Open Lending’s survey, go to this website.