Advocates point to spike in CFPB complaint database to open National Consumer Protection Week

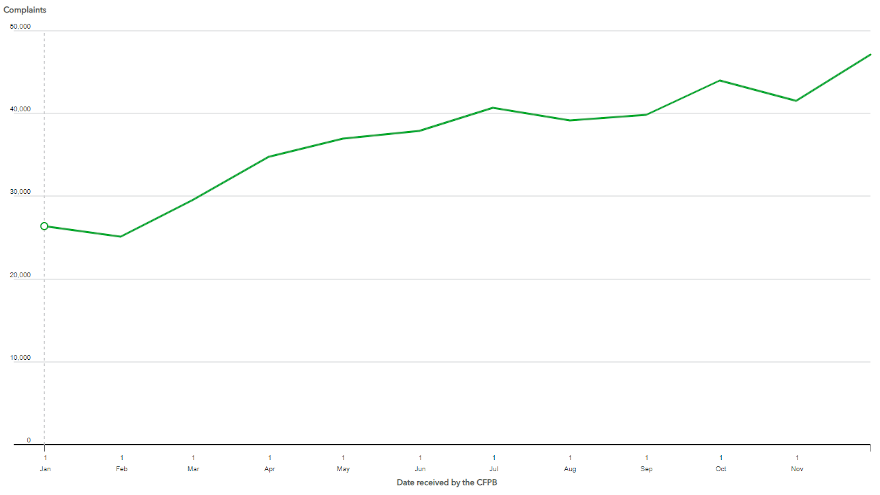

This chart indicates how many complaints were added to the Consumer Financial Protection Bureau database each month last year. Chart courtesy of the CFPB.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

CARY, N.C. –

Consumer advocates and other regulators began National Consumer Protection Week on Monday in part by pointing to the significant jump in cases recorded in the complaint database housed by the Consumer Financial Protection Bureau.

According to the CFPB’s online dashboard, complaints in 2020 came in at 443,143; that’s up from the 206,607 complaints registered in 2019.

All told, the CFPB dashboard indicated there have been 1,987,591 complaints sent to the regulator since the database’s inception in December 2011.

By far, the category where the most complaints landed with the CFPB in 2020 fell within credit reporting. The dashboard said that category contained 282,977, more than double the next four categories combined. Those other four segments included debt collection, credit cards, mortgage and checking/savings accounts.

The U.S. PIRG Education Fund used those metrics as part of a report it released on Monday, stating that the number of complaints about credit reporting doubled in 2020 demonstrating what “a headache this industry causes for Americans.” The report pointed to consumer clashes with Experian, TransUnion and Equifax arriving amid the pandemic.

“Mistakes in credit reports lead to lower credit scores and denial of credit, housing or employment, but under President Trump, the CFPB gave the credit bureaus a free pass from handling consumer disputes in a timely manner,” said Lucy Baker, U.S. PIRG Education Fund’s consumer program associate.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“That hands-off approach couldn’t have happened at a worse time. It exacerbated family finance problems during a pandemic that had already left many consumers teetering on the edge of financial ruin,” Baker continued in a news release.

The report included several recommendations to Congress and the CFPB, including three steps that the consumer advocate organization said should be taken immediately. The suggestions included mitigating the financial harms posed by the COVID-19 pandemic; rescinding the actions the Trump administration took “to weaken CFPB rules against predatory payday lending,” and rolling back Trump-era rules that allow debt collectors “to harass debtors and other consumers.”

Frontier Group analyst and report co-author Gideon Weissman added, “The surge in complaints is a signal of the strain the pandemic put on consumers, and of the minefield of tricks and traps they face in the financial marketplace. Americans who share their stories are telling us exactly what kinds of help they need, and the CFPB would do well to start listening and responding.”

On Tuesday, the Senate is set to hold a hearing to question President Biden’s nominee, Rohit Chopra, to lead the CFPB. Should Chopra be confirmed, he would replace acting director Dave Uejio, who has taken an active stance since coming into the position in an interim capacity.

“Dave Uejio has acted swiftly to get the CFPB back on track to protecting consumers,” said Mike Litt, U.S. PIRG Education Fund’s consumer campaign director.

“The next step is Senate confirmation of Rohit Chopra to direct the bureau. Chopra helped build the CFPB from the start and he is the right person Americans need in the driver’s seat.”

Meanwhile, one of the most active state attorneys general also made an announcement on Monday in connection National Consumer Protection Week

New York attorney general Letitia James listed the top 10 categories of consumer complaints sent to her office last year. What James’ office classified as internet related led the way at 9,832 cases. Coming in No. 5 was automotive, including sales, financing and repairs, with 2,561.

“The havoc unleashed by the COVID-19 pandemic, in addition to the numerous other ways consumers were defrauded in 2020, sadly resulted in my office receiving a record number of consumer fraud complaints in 2020,” James said in a news release.

“Consumers who have helped identify and report issues to our office have been invaluable partners in our efforts to stop deceptive scams and will continue to be vital partners going forward,” she went on to say.