Agora Data reveals 5 members of new financial institutions group

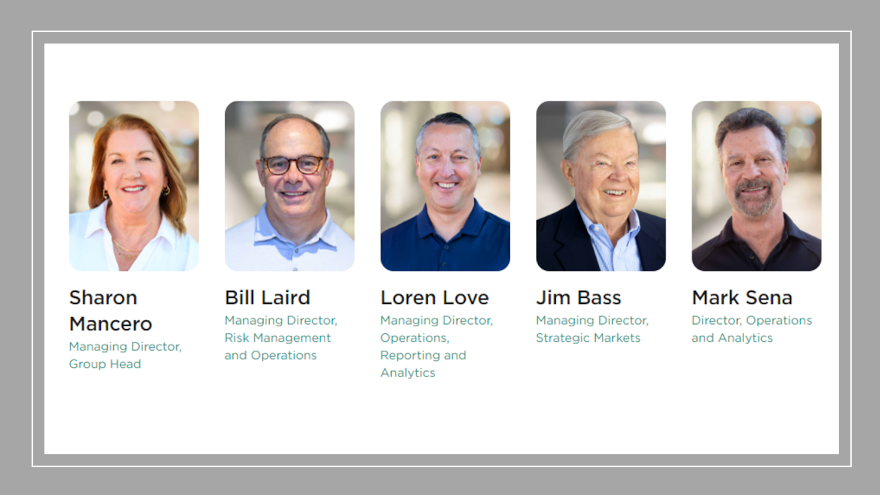

Agora Data's new financial institutions group. Images courtesy of the company.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Agora Data on Tuesday announced the formation of its new financial institutions group, which is tailored to serve finance companies that specialize in addressing the needs of the subprime to non-prime market.

Agora Data said the division supports independent consumer finance companies, banks, credit unions, investment firms, insurance companies and other entities by offering these institutions the capital necessary for portfolio growth, enhanced efficiencies and increased profitability.

By integrating traditional refinancing structures with ongoing forward flow arrangements, Agora said its new group can deliver seamless liquidity, enabling companies to scale their operations without having to raise additional equity or operate under restrictive financial covenants.

Led by managing director Sharon Mancero — who is among the executives set to appear on stage during Used Car Week beginning on Nov. 18 in Scottsdale, Ariz. — the group includes:

—Bill Laird, managing director, risk management and operations

—Loren Love, managing director, operations, reporting and analytics

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

—Jim Bass, managing director, strategic markets

—Mark Sena, director, operations and analytics

“Agora Data has recognized the need to level the playing field for consumer finance companies by providing them with the technology and capital to regain their competitive edge. We facilitate this by delivering innovative financing solutions with advanced artificial intelligence (AI) and machine learning (ML) underwriting and servicing tools to better serve credit-challenged consumers,” Mancero said in a news release.

“By helping financial institutions operate more efficiently and profitably, we’re aligning good business practices with meaningful community impact. With enhanced technology, expanded capital options, and increased funding capacity, our targeted customer base can better compete,” Mancero continued.

Agora Data offers financial institutions access to capital while maintaining the full benefit of the valuable assets they originate.

By offering off-balance sheet, non-recourse credit facilities without the restrictive covenants historically required, Agora can facilitate businesses’ access to capital markets enabling growth and long-term financial stability.

CEO Steve Burke is excited about potential work this group can do toward enhancing those offerings.

“Agora Data has assembled a powerhouse team of structured finance experts drawn from leading national banks with over three decades of experience, creating an entrepreneurial environment that challenges the status quo and drives innovation across the industry,” Burke said.

“We take pride in delivering strategies that fuel mutual growth and success. By expanding services, sharing resources, and opening new market opportunities, we are transforming the industry. Our collaborative approach ensures that we continue to break new ground and redefine what’s possible in consumer finance,” Burke went on to say.