Auto credit access expands in January, with depth of projected March rate rise ‘a coin toss’

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

CARY, N.C. –

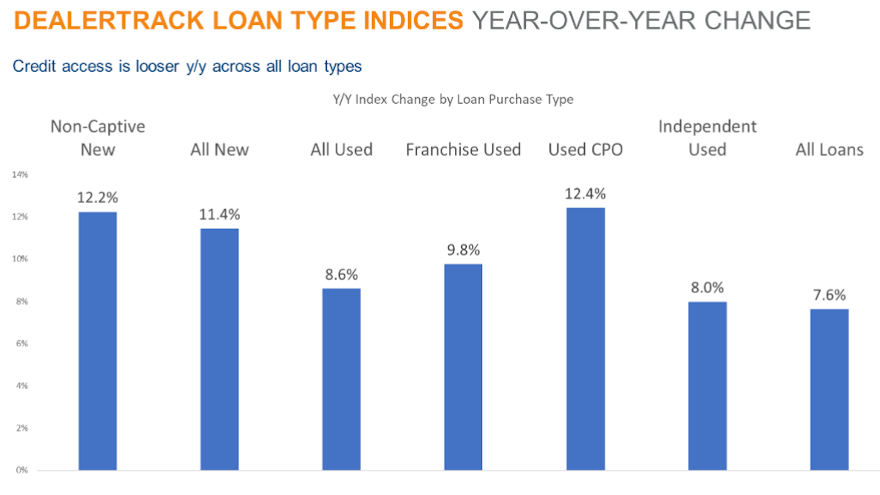

Access for all types of auto financing expanded in January, according to the newest Dealertrack Credit Availability Index.

But change might be coming with the likelihood of interest rates rising, with one economist calling it a “coin toss” as to how much the increase will be when the Federal Reserve announces its decision next month.

Cox Automotive reported that the Dealertrack Credit Availability Index increased 0.4% to 102.0 in January, reflecting that auto credit was easier to get in the month compared to December.

Analysts said access was looser by 7.6% year-over-year. And compared to February 2020, Cox said availability was looser by 2.9%.

Furthermore, analysts said the last time the time Dealertrack Credit Availability Index was this high was November 2018.

“A key reason for the improvement in credit availability in January was that the average yield spread on auto loans narrowed to the lowest level since January 2018,” Cox Automotive said in its index report.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Even though the average auto loan saw a higher rate in January compared to December, bond yields increased by a larger amount, resulting in the lower observed yield spreads,” analysts continued.

“Credit access also improved across lender type in January with auto-focused finance companies having loosened the most,” Cox added. “On a year-over-year basis, all lenders had looser standards with auto-focused finance companies having loosened the most.”

Each Dealertrack Credit Availability Index tracks shifts in approval rates, subprime share, yield spreads and loan details including term length, negative equity and down payments.

The index is baselined to January 2019 to provide a view of how credit access shifts over time.

“Across all auto lending in January, yield spreads narrowed, and terms lengthened, and the moves in those factors made credit more accessible,” Cox Automotive said. “However, down payments increased, the approval rate declined, and the negative equity share declined, and the moves in those factors made credit less accessible.

“The subprime share was unchanged in January from December,” analysts added.

Cox Automotive mentioned some other trends that can play a factor in auto financing, noting first that consumer sentiment fell in January.

Analysts recapped that consumer confidence declined 1.2% in January, according to the Conference Board, erasing some of December’s 2.9% gain. The movement left confidence down 14.2% compared to February 2020.

“The underlying measures of present situation and future expectations moved in opposite directions as present situation declined but future expectations improved,” Cox Automotive said. “Plans to purchase a vehicle in the next six months increased to the highest level in six months and was higher than a year ago. Plans to purchase a home also improved to a record level.”

Analysts also pointed out that the sentiment index from the University of Michigan declined 4.8% in January as both current conditions and expectations declined.

The Michigan reading was the lowest since November 2011, according to Cox.

Analysts went on to mention that the Morning Consult daily index of consumer sentiment declined 2.1% in January, leaving it down 3.3% year-over-year and down 24.1% from the end of February 2020.

Meanwhile, Comerica bank chief economist Bill Adams also chimed in with a discussion about interest rates and what the Federal Reserve might do.

“With economic activity looking resilient to Omicron in early 2022, inflation gaining momentum, and energy prices rising, the Fed is pivoting rapidly to withdraw stimulus from the U.S. economy,” Adams said in an analysis released on Thursday.

Adams recounted that the minutes of the Federal Open Market Committee’s meeting on Jan. 25-26 lay out a potential FOMC course for the Fed to start shrinking their balance sheet later this year.

Adams also explained that the meeting minutes reaffirm that asset purchases (known as quantitative easing or QE) will end in March. He recapped that the FOMC said, “participants generally noted that current economic and financial conditions would likely warrant a faster pace of balance sheet runoff than during the period of balance sheet reduction from 2017 to 2019 and a number of participants commented that conditions would likely warrant beginning to reduce the size of the balance sheet sometime later this year.”

The Comerica Bank expert closed by stating the FOMC minutes confirm that a federal funds rate hike is very likely at the FOMC’s next meeting on March 15 and 16, but “shed no light on whether members are considering a 0.50% hike (as opposed to a ‘normal’ 0.25% hike).

“By extension, FOMC members’ recent discussion of a 0.50% hike in public statements could be part of a deliberate strategy to guide the public’s expectations toward a half percentage point hike. Comerica Economics sees the March rate decision as a coin toss between a 0.25% hike and a 0.50% hike,” Adams went on to say.