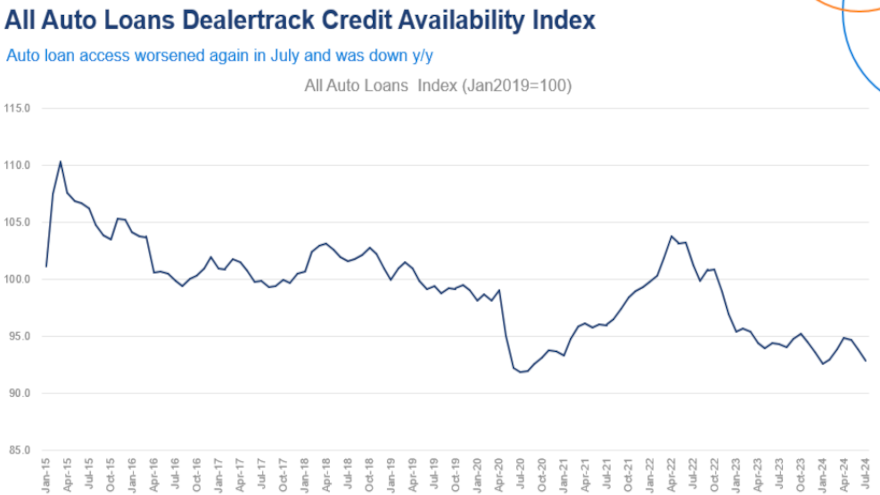

Auto-credit availability dips for fourth consecutive month

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The flow of credit from the auto-finance spigot is steadily decreasing.

The Dealertrack Credit Availability Index now has declined for four months in a row, as Cox Automotive reported the July reading at 92.9.

That index level represented a 1.0% drop from a downwardly revised June reading and a 1.5% decline year-over-year.

Jonathan Gregory, a senior manager on Cox Automotive’s economic and industry insights team, looked to give some context in an analysis that accompanied the latest index reading.

“The decrease in the index is the result of falling approval rates, reduced subprime share, and increased yield spreads, which make auto credit access more challenging for consumers,” Gregory said. “The percentage of down payments and term lengths remained unchanged month-over-month. However, the number of loans with negative equity saw a slight increase and was the only element that positively impacted consumer credit access.”

Looking closer at the trends, Cox Automotive discovered banks tightened their underwriting for the fifth consecutive month, the most significant tightening amongst all finance companies since June.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Meanwhile, Cox Automotive said finance companies whose only business line is providing credit for vehicle deliveries tightened the least and have widened compared to pre-pandemic levels.

“On a year-over-year basis, the same is true: Auto-focused finance companies tightened the least, while banks saw the most tightening,” Gregory said.

Cox Automotive calculated the average yield spread on auto financing increased by 9 basis points in July, making rates less attractive to consumers compared to bond yields.

Gregory explained the average auto finance rate decreased by 7 basis points in July compared to June, while the five-year U.S. Treasury note decreased by 16 basis points, resulting in a larger average observed yield spread.

“It is worth noting that we have seen average auto loan rates decrease by 80 basis points since February,” Gregory said.

Cox Automotive pointed out approval rates decreased by 39 basis points in July, sliding 4 percentage points year-over-year.

For applicants who were approved, Cox Automotive indicated the share of contracts with terms exceeding 72 months remained steady for the fourth month in a row.

But as Gregory mentioned, Cox Automotive watched the number of deals that included negative equity increase by 20 basis points in July, a month after they decreased.

While gradually decreasing since the beginning of the year, Cox Automotive mentioned the down payment percentage is 30 basis points higher compared to a year ago.

Each Dealertrack Auto Credit Index tracks shifts in approval rates, subprime share, yield spreads and contract details, including term length, negative equity and down payments.

The index is baselined to January 2019 to provide a view of how credit access shifts over time.

Gregory wrapped up his analysis with a recap of consumer confidence.

“The Conference Board Consumer Confidence Index increased 2.6% in July, as views of the future improved, but views of the present declined,” Gregory said. “Consumer confidence was down 12.0% year-over-year for its worst year-over-year performance since July 2022. “Plans to purchase a vehicle in the next six months declined compared to June and was lower than in July last year and represented the lowest share of people planning to buy in nine months.

“According to the sentiment index from the University of Michigan, consumer sentiment declined 2.6% in July compared to June and was down 7.1% year-over-year,” he continued. “The median consumer expectation for inflation in a year declined to 2.9%, which was the lowest level in four months and matches the lowest level since 2020.

“The expectation for inflation in five years was steady at 3.0%,” Gregory added. “The consumer’s view of buying conditions for vehicles declined to the lowest level since December 2022 as the view of interest rates and prices remains very negative.”