Auto credit availability improves to best level since March

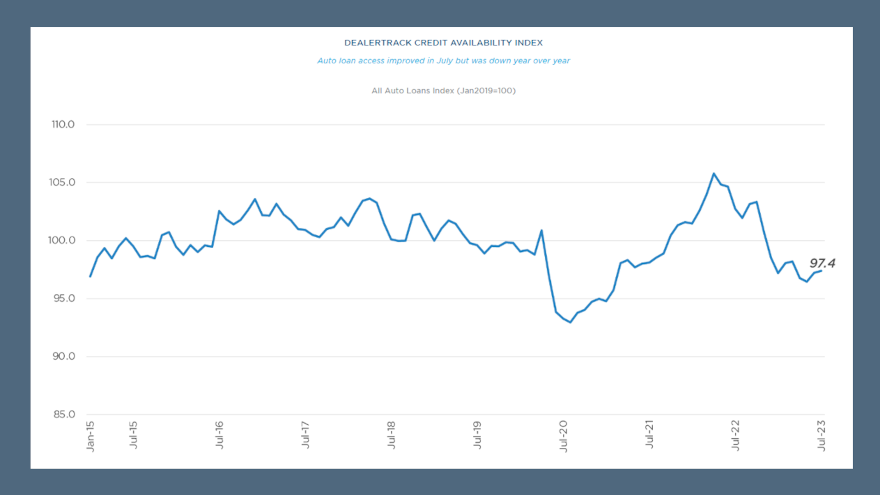

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Cox Automotive noticed that July was the best conditions to get your paper bought since March, but the subprime share still softened.

The July reading of Dealertrack Credit Availability Index came in at 97.4, marking the second straight month of upticks. The 0.2% increase in July pushed the index to its highest reading since March and reflected that auto credit was easier to get than in April, May and June.

But experts said credit access remained tighter than a year ago as well as before the pandemic.

Despite the improvement, Cox Automotive determined July credit access was tighter by 5.2% year-over-year and 1.8% tighter compared to February 2020.

“Movement in credit availability factors was mixed in July,” Cox Automotive senior manager of economic and industry insights Jonathan Gregory said in a Data Point that contained the latest index reading. “While yield spreads narrowed, approval rates increased, improving consumer credit access.

“However, average terms lengthened, the subprime share declined, down payments declined, and the negative equity share declined, and those moves hurt credit access for consumers,” Gregory continued.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Cox Automotive explained the average yield spread on auto financing originated in July narrowed by 6 basis points, so interest rates consumers secured were more attractive in July relative to bond yields.

Experts noticed the average auto finance rate increased by 13 basis point in July compared to June, while the five-year U.S. Treasury increased by 19 basis points, resulting in a narrower average observed yield spread.

In other trends, Cox Automotive highlighted the approval rate increased by 74 basis in July but ticked 1 percentage point lower year-over- year.

Experts added the subprime share declined to 10.4% from 10.5% in July and slid 1.1 percentage points year-over-year.

Cox Automotive went on to note that the share of contracts with terms at 72 months or longer decreased 0.4 percentage points month-over-month 1.3 percentage points year-over-year.

“Credit availability was mixed in July across all lender types. Captives tightened, while auto-focused finance companies loosened the most. On a year-over-year basis, credit access was mixed across lender types, with auto-focused finance companies loosening and credit unions tightening the most,” Gregory said.

Experts reiterated each Dealertrack Auto Credit Index tracks shifts in approval rates, subprime share, yield spreads and contract details, including term length, negative equity and down payments.

The index is baselined to January 2019 to show how credit access shifts over time.

Cox Automotive closed its update with some positive findings about consumer confidence from the Conference Board and the University of Michigan

“Consumers’ views of buying conditions for vehicles rose again in July to the best level since February,” Gregory said. “The daily index of consumer sentiment from Morning Consult also measured improving sentiment in July, as the index posted a 2.8% gain over June. Expectations of the future improved the most in June and July and are now at the highest level since August 2021.”