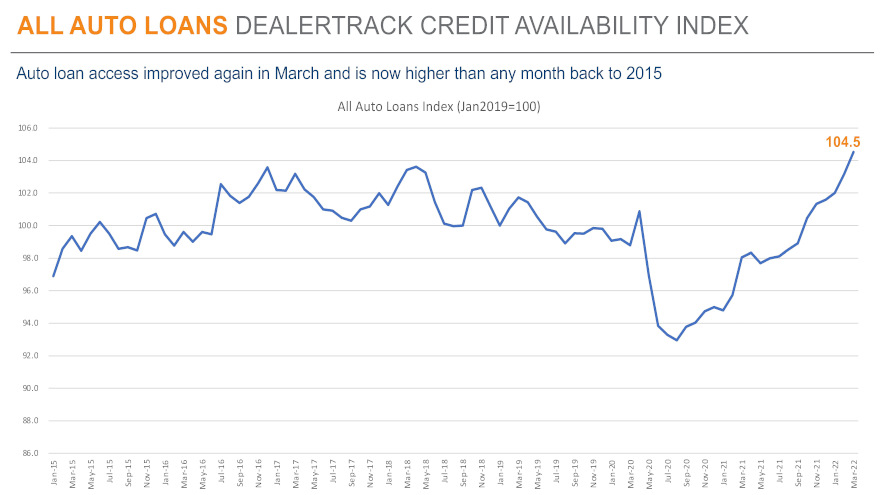

Auto credit availability remains at record readings

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

There might not be a robust amount of used and new vehicles available to retail, but access to credit to fuel originations and deliveries appears to be quite plentiful.

For the second month in a row, the Dealertrack Credit Availability Index rose to a reading that was the highest recorded in the data series going back to January 2015.

Cox Automotive indicated in a Data Point that the access to auto credit expanded again in March for many types of financing, as the index increased 1.3% to 104.5 in March, reflecting that auto credit was easier to get compared to February.

Analysts said access was looser by 6.6% year-over-year, and compared to February 2020, access was looser by 5.4%.

While the average yield spread on auto financing widened in March, Cox Automotive pointed out that other factors improved to more than compensate.

Analysts computed that the average installment contract increased by 53 basis points in March compared to February, while the five-year U.S. Treasury increased by 28 basis points, resulting in wider observed yield spreads.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Credit access also improved across most lender types in March with credit unions having loosened the most. On a year-over-year basis, all lenders had looser standards with auto-focused financed companies having loosened the most,” Cox Automotive said in the Data Point.

Analysts recapped that each Dealertrack Credit Availability Index tracks shifts in approval rates, subprime share, yield spreads and contract details, including term length, negative equity and down payments. The index is baselined to January 2019 to provide a view of how credit access shifts over time.

“Across all auto lending in March, the approval rate increased, the subprime share grew and negative equity grew, and the moves in those factors made credit more accessible,” Cox Automotive said. “However, yield spreads widened, terms shortened and down payments grew, so those factors moved against accessibility.”

More consumer trends

Cox Automotive mentioned in the Data Point that multiple measures of consumer sentiment ended up mixed in March.

Analysts said consumer confidence increased 1.4% in March, according to the Conference Board, when experts expected a decline.

“But the February index was revised down, so the March index came in very close to expectations,” Cox Automotive said. “The underlying measures of present situation and future expectations moved in opposite directions as present situation improved, but future expectations declined.”

“Plans to purchase a vehicle in the next six months declined and remained down year-over-year,” Cox added.

Analysts also mentioned the sentiment index from the University of Michigan declined 5.4% in March as both current conditions and expectations declined, with inflation accelerating.

Cox Automotive went on to note that the Morning Consult daily index declined 1.4% in March, but it was down 6% at mid-month at the peak of gas prices and recovered much of the early March decline as gas prices stopped increasing and moderated slightly.

Meanwhile, through its news release, Numerator, a data and tech company serving the market research space, released its monthly inflation insights update to provide a view of rising prices through March, with added context by consumer demographic segments.

Numerator shared three findings that might be relevant to potential vehicle buyers based on its ongoing survey of more than 10,000 consumers that is designed to provide additional detail around financial health, outlook and spending. Those findings included:

• Hispanic / Latino consumers reported an improvement in their financial situations over the past month, with 49.5% of consumers reporting a “good” or “very good” outlook in March versus 47.7% of consumers in February.

• Gen Z was the only group to show a decline in financial security, as more of these consumers reported a “poor” or “very poor” financial outlook in March than in February (17% versus 14.4%).

• Fewer consumers say they have spare cash, most notably Asian consumers. More than one in five consumers (22.8%) say they do not have extra funds available, a trend even more pronounced among Asian consumers (28.6%).

New-vehicle affordability discussion

Another Data Point highlighted the newest Cox Automotive/Moody’s Analytics Vehicle Affordability Index.

Analysts shared that the new-vehicle affordability remained stable in March but remains near the low in affordability set in December as rate increases in 2022 offset income gains and modest price declines.

“The inputs to the index again moved in differing directions in the month,” analysts said while noting that the number of median weeks of income needed to purchase the average new vehicle in March remained 42.9 weeks, as was the case in February.

Supporting affordability, Cox Automotive and Moody’s Analytics said the price paid moved 0.3% lower following a larger decline in February. The peak in pricing arrived in December at $47,064.

While median income also grew, analysts acknowledged the rest of the factors worked against affordability.

“Incentives declined slightly. The average interest rate increased another 32 basis points,” Cox Automotive and Moody’s Analytics said. “As a result of these moves, the estimated typical monthly payment increased 0.3% to $691, which was a new record high.

“New-vehicle affordability in March was much worse than a year ago when prices were lower and incentives were higher. The estimated number of weeks of median income needed to purchase the average new vehicle in March was up 18% from last year,” Cox Automotive and Moody’s Analytics went on to say in the report.