Auto credit availability tightens in May

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

It appears May was a tipping point in the auto financing space.

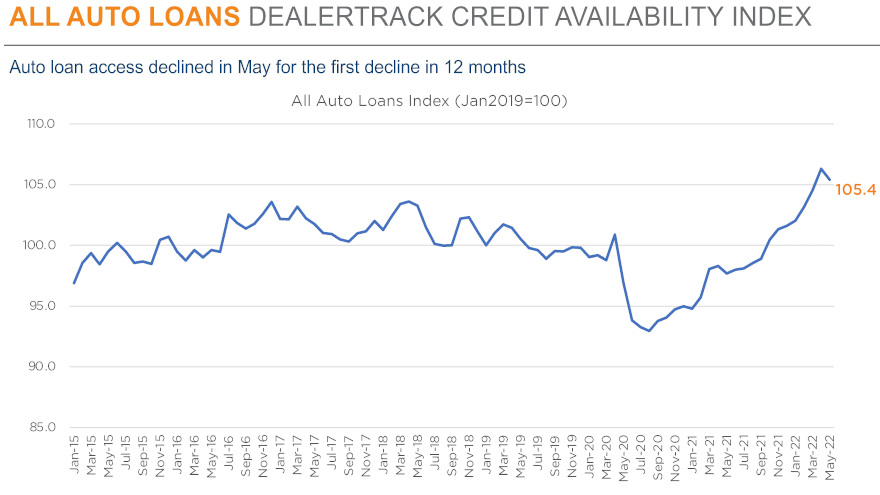

After loosening for 11 months in a row, access to auto credit tightened in May, according to the Dealertrack Credit Availability Index for all types of auto financing.

Cox Automotive shared in a Data Point that the index declined 0.8% to 105.4 in May, reflecting that auto credit was harder to get in the month compared to April.

Analysts said access was looser by 7.9% year-over-year, and compared to February 2020, access was looser by 6.3%.

Following that runup, Cox Automotive pointed out that the index in May was the second-highest recorded in the data series going back to January 2015.

Analysts explained in the report that two key credit availability factors moved substantially against consumers in May.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“The average yield spread on auto loans widened slightly, so rates consumers saw on auto loans in May moved more than bond yields,” said Cox Automotive, which noted that the average auto rate increased by 13 basis points in May compared to April, while the five-year U.S. Treasury increased by 9 basis points, resulting in wider observed yield spreads.

Cox Automotive determined that captives tightened their underwriting most in May, while finance companies that oftentimes specialize in non-prime paper kept availability flowing the most.

Each Dealertrack Credit Availability Index tracks shifts in approval rates, subprime share, yield spreads and contract details, including term length, negative equity, and down payments. The index is baselined to January 2019 to show how credit access shifts over time.

“Across all auto lending in May, the approval rate increased slightly, terms lengthened, negative equity grew slightly, and the down payment percentage declined slightly. The moves in those factors made credit more accessible,” analysts said.

“However, yield spreads widened, and the subprime share declined, so those factors moved against accessibility,” they added.

Cox Automotive closed this Data Point by reiterating some of the trends mentioned in this previous feature from SubPrime Auto Finance News about consumer confidence.

Analysts noted that according to the Conference Board, consumer confidence declined 2.0% in May. The drop left confidence down 11.3% year-over-year.

“The underlying measures of both the present situation and future expectations declined,” Cox Automotive said. “Plans to purchase a vehicle in the next six months declined but were slightly higher than a year ago. Plans to purchase a home also declined and were higher year-over-year.”

Analysts mentioned the sentiment index from the University of Michigan declined 10.4% in May as both current conditions and expectations declined.

“The Michigan reading was down slightly from midmonth and was at the lowest full-month reading since August 2011,” Cox Automotive said. “Buying conditions for vehicles declined and were only slightly better than the all-time low recorded in February.

Finally, analysts said the Morning Consult daily index also declined in May, down 4.4% for the month.

“The daily index from Morning Consult was at its lowest level so far for the pandemic on May 30, as inflation, declining equity markets, and increasing cases of COVID driven by omicron variants weighed on consumer attitudes,” Cox Automotive said.