Auto default rate ticks up just 1 basis point in September

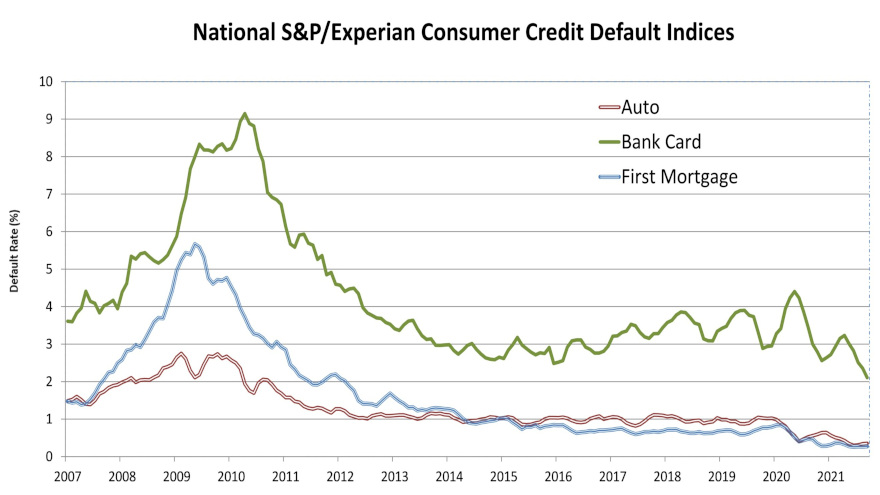

Chart courtesy of S&P Dow Jones Indices and Experian.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

NEW YORK –

If the auto default rate ticks up only at the pace analysts have seen during the past couple of months, it could take a year — maybe longer — for the metric to return to what it was at the end of 2019.

This week, S&P Dow Jones Indices and Experian released its data through September for the S&P/Experian Consumer Credit Default Indices. The auto default rate edged up just 1 basis point higher month-over-month to land at 0.35%.

By the way, the auto default rate in December 2019 was 1.02%.

Analysts found that the composite rate — which represents a comprehensive measure of changes in consumer credit defaults — remained unchanged in September at 0.39%.

Also staying steady was the first mortgage default rate at 0.27%, while S&P Dow Jones Indices and Experian indicated that bank card default rate fell 24 basis points to 2.11%.

Looking at the five major metropolitan areas analysts track for the monthly update, three of them posted lower default rates in September compared to the previous month.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Miami generated the largest decline, dropping 8 basis points to 0.80%. New York dipped 4 basis points to 0.40%, while Los Angeles ticked down by 3 basis points to 0.31%.

S&P Dow Jones Indices and Experian went on to mention that Chicago remained unchanged at 0.43%, and Dallas edged 2 basis points higher to 0.43%.

Jointly developed by S&P Indices and Experian, analysts noted the S&P/Experian Consumer Credit Default Indices are published monthly with the intent to accurately track the default experience of consumer balances in four key loan categories: auto, bankcard, first mortgage lien and second mortgage lien.

The indices are calculated based on data extracted from Experian’s consumer credit database. This database is populated with individual consumer loan and payment data submitted by lenders to Experian every month.

Experian’s base of data contributors includes leading banks and mortgage companies and covers approximately $11 trillion in outstanding loans sourced from 11,500 lenders.