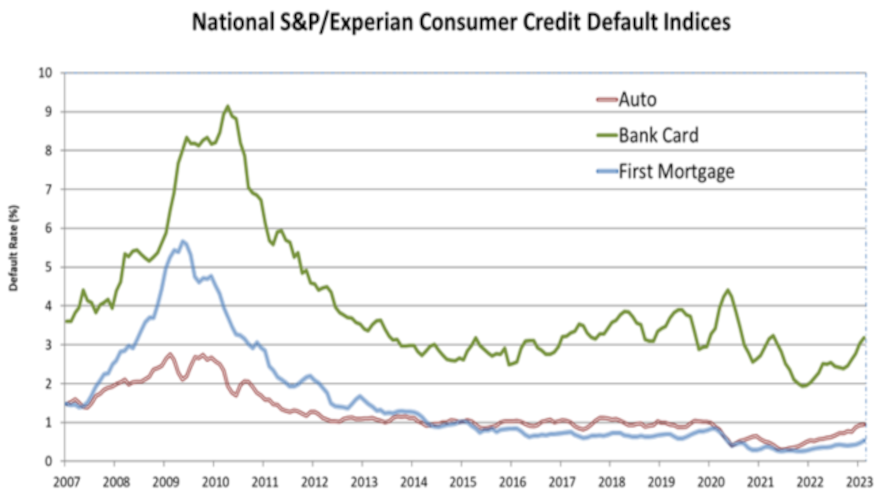

Auto defaults approach 1% reading in February

Chart courtesy of S&P Dow Jones Indices and Experian.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Perhaps normalcy with auto defaults is near since the latest rate reading is just 5 basis points away from being at or above 1%. The rate hasn’t been at that level since the end of 2019.

According to data through February for the S&P/Experian Consumer Credit Default Indices, S&P Dow Jones Indices and Experian reported on Tuesday that the auto default rate ticked up 1 basis point to 0.95%.

Back in November and December 2019, the rate stood at 1.02%, according to the database built by S&P Dow Jones Indices and Experian. Auto defaults dropped to a record low of 0.30% in June 2021 and have climbed in 18 of the 21 months since that point.

Meanwhile, analysts discovered the composite rate — which represents a comprehensive measure of changes in consumer credit defaults — rose 6 basis points higher at 0.75%.

The other two major credit categories S&P Dow Jones Indices and Experian track also moved higher as the bank card default jumped 14 basis points to 3.18% while the first mortgage default increased 5 basis points to 0.53%.

Furthermore, S&P Dow Jones Indices and Experian indicated four of the five major metropolitan statistical areas generated higher default rates in February compared to previous month.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Los Angeles posted the largest increase, rising 14 basis points to 0.54%, while Miami rose 10 basis points to 0.96%.

Dallas’ rate increased 7 basis points to 0.80%, and New York’s reading increased 2 basis points to 0.63%.

Only Chicago moved lower month-over-month, dipping 3 basis points to 0.86%.

Jointly developed by S&P Indices and Experian, analysts noted the S&P/Experian Consumer Credit Default Indices are published monthly with the intent to accurately track the default experience of consumer balances in four key loan categories: auto, bankcard, first mortgage lien and second mortgage lien.

The indices are calculated based on data extracted from Experian’s consumer credit database. This database is populated with individual consumer loan and payment data submitted by lenders to Experian every month.

Experian’s base of data contributors includes leading banks and mortgage companies and covers approximately $11 trillion in outstanding loans sourced from 11,500 lenders.