Auto defaults make largest monthly rise in more than a year

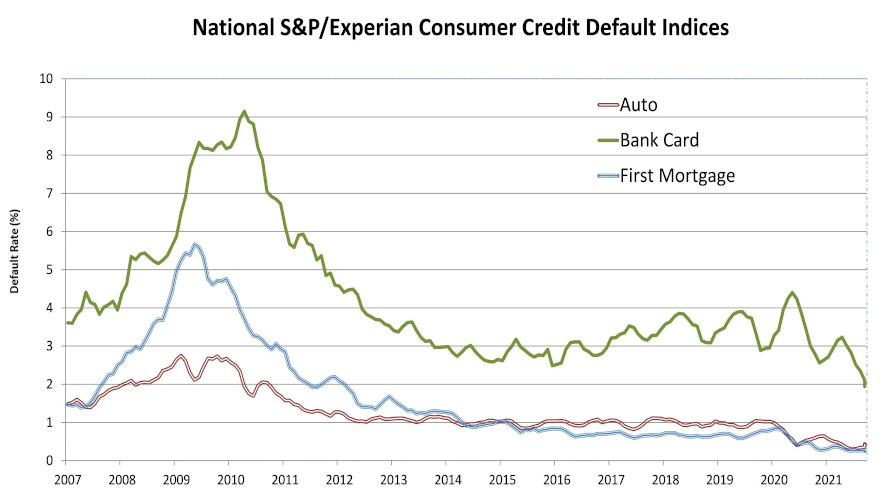

Chart courtesy of S&P Dow Jones Indices and Experian.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

NEW YORK –

Experts from Kroll Bond Rating Agency (KBRA), S&P Dow Jones Indices and Experian all noticed some deterioration in auto finance performance before 2021 finished.

Released four days before Christmas, data through November for the S&P/Experian Consumer Credit Default Indices showed the auto reading made the largest month-over-month rise in more than a year. S&P Dow Jones Indices and Experian indicated that the auto default rate increased 6 basis points to 0.44%.

That’s the most auto defaults have increased since July to August 2020, and that movement came off of what was the all-time low at that juncture (0.40%).

But then a year later, defaults dropped even lower to 0.30%. However, defaults now have ticked up five months in a row since that reading.

Meanwhile, KBRA offered evidence of what’s fueled that streak and why it might continue.

In its latest report distributed on the same day as the update from S&P Dow Jones Indices and Experian, KBRA said November auto ABS remittance reports displayed the “typical seasonal credit deterioration common across most consumer loan types, as holiday expenditures weigh on consumer finances and the influx of cash from tax refunds is still a few months away.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Experts indicated that early-stage delinquencies (30 to 59 days past due) in KBRA’s Prime Auto Loan Index increased 10 basis points month-over-month to 0.95%, while late-stage delinquencies (60 days or more past due) rose 4 basis points to 0.32%.

Meanwhile, early- and late-stage delinquencies in KBRA’s Non-Prime Auto Loan Index jumped 9 basis points and 15 basis points month-over-month, respectively, at 7.29% and 4.09%.

KBRA mentioned that net losses trended higher as well, influenced by the “dual effect” of rising charge-off rates and the recent stabilization of recovery rates, “as used-vehicle prices have started to plateau.”

Annualized net losses in KBRA’s prime index rose 12 basis points month-over-month to 0.37%, while non-prime annualized net losses climbed 47 basis points to 4.67%.

“We expect securitized auto loan credit performance to continue to soften through the early months of 2022, until borrowers begin to receive their tax refunds in early spring,” KBRA said in its latest report.

“However, the typical boost to credit performance that tax refund season usually provides will likely be partly offset by the continued phasing out of other COVID-related stimulus programs,” the firm added.

What KBRA referenced could influence future updates from S&P Dow Jones Indices and Experian, too.

Experts there mentioned that their November composite rate — which represents a comprehensive measure of changes in consumer credit defaults — edged 1 basis point lower to 0.37%.

S&P Dow Jones Indices and Experian reported that the bank card default rate dropped 7 basis points to 1.94%, while the first mortgage default rate was unchanged in November at 0.26%.

Looking at defaults by geography, experts pointed out that two of the five major metropolitan areas generated lower default rates in November compared to the previous month.

New York posted the largest decline, dropping 6 basis points to 0.30%, while Dallas edged 1 basis point lower to 0.49%.

Experts said Miami and Chicago remained unchanged at 0.73% and 0.45% respectively. They added that Los Angeles was the only large city that increased, moving 4 basis points higher to 0.34%.