Auto defaults make largest rise so far in 2022

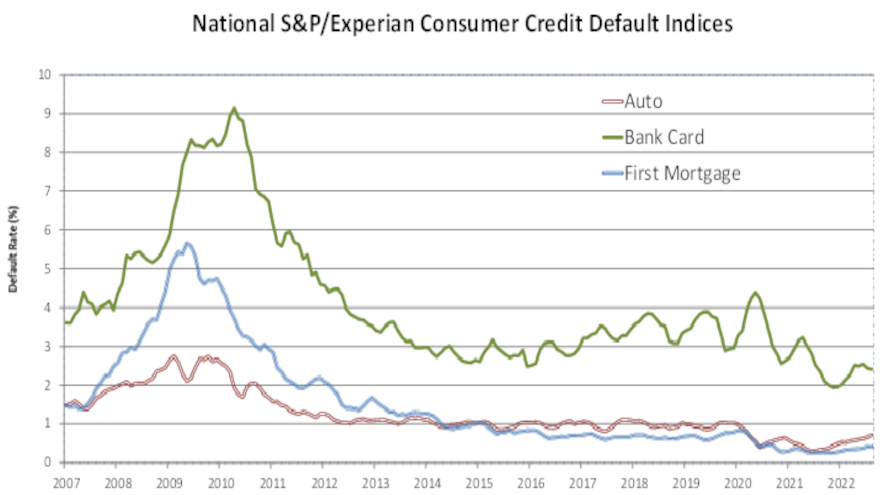

Chart courtesy of S&P Dow Jones Indices and Experian.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Here’s another piece of auto finance industry data to consider as you close the books on another month and quarter.

While perhaps still relatively modest, auto defaults made their largest month-over-month rise so far this year. According to data from S&P Dow Jones Indices and Experian, the August auto default rate came in at 0.72%, which is 6 basis points higher than July.

Based on the database for the S&P/Experian Consumer Credit Default Indices, the August rise isn’t quite the largest one to happen since the pandemic arrived. That occurred in July 2020 when the rate rose 7 basis points from the previous month.

For reference, that database also shows that the latest reading is still well below where analysts had it at the end of 2019. Data from S&P Dow Jones Indices and Experian put the auto default rate at 1.02% in December of that year.

Turning back at the newest data, analysts determined the composite rate — which represents a comprehensive measure of changes in consumer credit defaults — remained unchanged at 0.57% in August.

Elsewhere in the credit market, data from S&P Dow Jones Indices and Experian showed the bank card default rate fell 3 basis points to 2.41%, while the first mortgage default rate also was unchanged at 0.42%.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Next checking in on the five major metropolitan areas analysts track each month, they found three of them posted higher default rates in August compared to the previous month.

Data from S&P Dow Jones Indices and Experian indicated Dallas had the largest increase, rising 7 basis points to 0.69%. Miami and Chicago each moved 3 basis points higher to 1.16% and 0.70%, respectively.

Analysts noticed the default rates in New York and Los Angeles each dropped 7 basis points to 0.58% and 0.45% respectively.

Jointly developed by S&P Indices and Experian, analysts noted the S&P/Experian Consumer Credit Default Indices are published monthly with the intent to accurately track the default experience of consumer balances in four key loan categories: auto, bankcard, first mortgage lien and second mortgage lien.

The indices are calculated based on data extracted from Experian’s consumer credit database. This database is populated with individual consumer loan and payment data submitted by lenders to Experian every month.

Experian’s base of data contributors includes leading banks and mortgage companies and covers approximately $11 trillion in outstanding loans sourced from 11,500 lenders.