Bottom line from Open Lending’s new benchmark report about near- and non-prime consumers

Graphic courtesy of Open Lending.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Along with three other major findings, the second annual Lending Enablement Benchmark Report from Open Lending Corp. gave this bottom line.

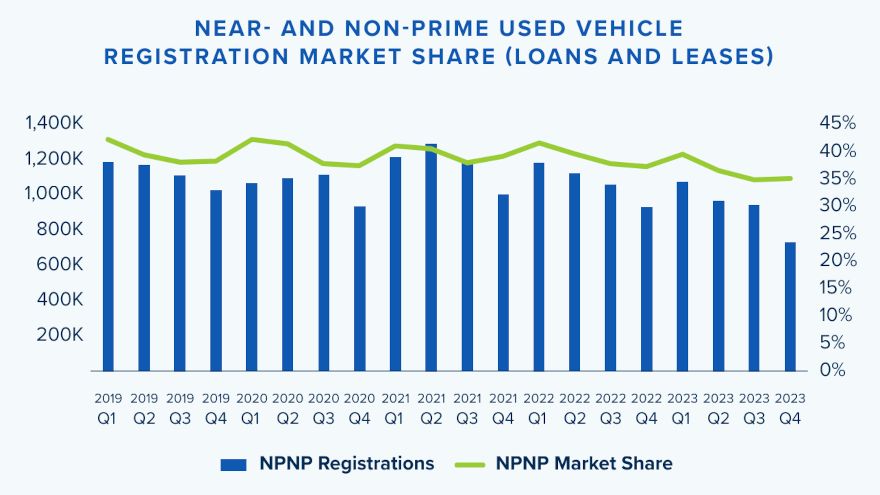

The near- and non-prime market share has reached a five-year low.

Open Lending highlighted that in 2019, near- and non-prime consumers represented 20% of new, newly registered vehicles. By the end of 2023, researchers found those consumers represented 14%.

For used vehicles, Open Lending said near- and non-prime consumers represented 42% of the market in 2019 but decreased to 35% in 2023.

“Despite some easing of new-car and used-car interest rates in late Q4, we have yet to witness any increase in volumes or market share in this credit tier,” Open Lending said in the report.

Open Lending surveyed senior leaders across banks, credit unions, insurance companies, and more to understand how macroeconomic factors shape automotive financing challenges and identify opportunities for success through lending enablement solutions (LES).

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Despite more financial institutions using LES, Open Lending learned that many finance companies still rely primarily on traditional credit scores to measure creditworthiness.

“This report reveals why quick, comprehensive loan decisions are necessary to build a resilient portfolio and increase yield on existing assets,” Open Lending said in a news release.

Researchers said traditional methods of assessing applicants’ creditworthiness are exposing automotive finance companies to risk and volatility as delinquencies rise.

Three other key findings from the study included:

Three in five finance companies are seeing rising delinquencies, with prime consumers driving them.

When asked about the credit tiers’ impact on driving delinquencies, Open Lending reported an 8-percentage-point increase in the “mostly prime/+” category and a 12-percentage-point decrease in the “mostly near- and non-prime” category year-over-year.

“This shift illustrates the need for alternative data to give a more clear and accurate picture of borrower risk beyond traditional credit scores alone,” researchers said.

There is a positive trend in the adoption of alternative credit data, but there is still room to grow.

“Low credit score” is financial institutions’ top reason for denying credit applications, according to the Open Lending study, with only 40% using alternative credit data for underwriting decisioning.

While this figure is up from 34% in 2023, “it still shows a concerning oversight given heightened delinquency rates,” Open Lending said.

Slow contract decisions are costing businesses crucial opportunities.

Open Lending determined only half of finance companies provide credit decisions with rates within minutes after application submission.

“The lenders who don’t may find that their prospective borrowers will seek and obtain loans from institutions that provide faster decisions,” Open Lending said.

Open Lending senior vice president of marketing Kevin Filan summarized the entire report this way.

“Cautious automotive lenders are focusing their lending strategies on prime borrowers, but this approach is not protecting their portfolios in the way they’re hoping,” Filan said. “This is because credit scores fail to capture the full picture of a borrower’s ability to pay. By reserving approvals for prime applicants, lenders may be filtering out perfectly worthy near- and non-prime borrowers while giving riskier prime borrowers a pass. This phenomenon may explain the uptick in delinquencies over the past year.

“Delivering quick, comprehensive decisions is table stakes for automotive lenders who want to remain competitive,” Filan continued. “Our research found that many lenders still take hours or even days to return loan offers and counteroffers. That’s plenty of time for a worthy applicant to accept a deal from a speedier competitor. Meanwhile, those slower lenders may find themselves stuck with less desirable applicants and rate-shoppers — borrowers who are likely contributing to heightened delinquency rates among lenders who can’t return decisions quickly.”