Comerica Bank & Salary Finance spot more evidence of tightening household budgets

Graphic courtesy of Salary Finance.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Recent analysis from Comerica Bank and Salary Finance point to a similar assertion. There’s a reasonable chance many of the contract holders currently in your auto finance portfolio are having their monthly budget squeezed by several factors.

With Comerica Bank chief economist Bill Adams saying that high inflation sunk the personal saving rate to its lowest level since 2013, more American workers are dealing with financial stress, according to a survey by Salary Finance, a global provider of socially responsible financial products in the workplace

Salary Finance explained the elimination of COVID programs, such as student loan forgiveness and the enhanced child tax credit, the high cost of property and a record-high inflation worsened by the escalating war in Ukraine, are likely the root causes for the highest percentage of financial stress in the four years the company has conducted the survey.

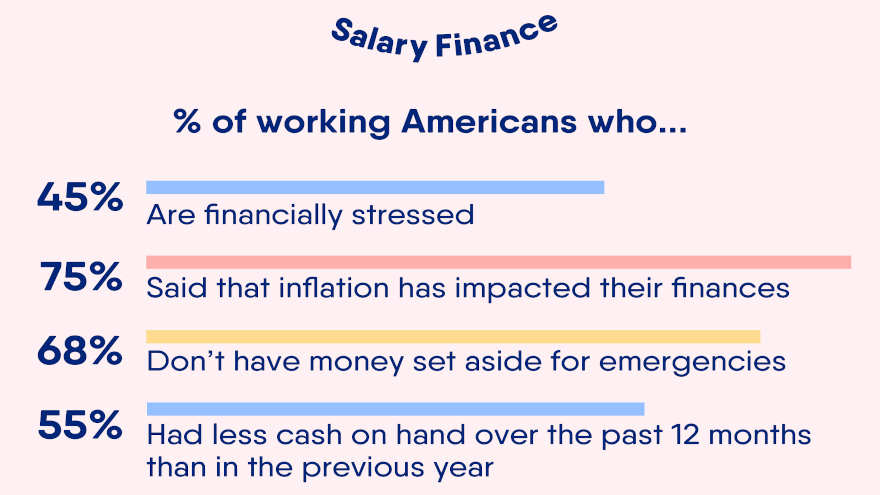

According to Inside the Wallets of Working Americans, the Fourth Annual Salary Finance Report, 45% of working Americans experience financial stress, an increase from 42% the previous two years.

Salary Finance indicated workers are running out of money faster, as one out of five American workers runs out of money between paychecks. Of those experiencing financial stress, nearly 60% are living paycheck-to-paycheck.

Other highlights of the latest Salary Finance survey included:

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

—Three-quarters said that inflation has impacted their finances

—More than two-thirds don’t have money set aside for emergencies

—More than half have less cash on hand over the past year than in the previous

—One out of two don’t have emergency savings and are anxious about it

—Four out of 10 are unhappy with their current level of savings

“American workers are at a crossroads,” Salary Finance chief executive officer Dan Macklin said in a news release that included the report’s online availability.

“Just as there is some optimism about the decline in COVID cases, we’re watching the casualties of a war in Europe and crippling inflation that is impacting all of us globally,” Macklin continued. “There’s evidence that employers are showing greater empathy toward workers, but we need more of it.

“Employers need to put programs in place that put a premium on work/life balance and put a greater emphasis on financial programs that get employees out of debt and into savings,” he went on to say.

Similar to what Salary Finance discovered, Comerica Bank said in a separate analysis that household finances are under increasing pressure from inflation, the end of stimulus programs, and rising interest rates.

While personal income rose 0.5% in February, matching consensus expectations, Adams noted that personal expenditures rose 0.2% in February after a 2.7% increase in January that revised up from 2.1%.

“March’s surge in gas prices means the strain on household budgets has worsened further,” Adams said. “Higher income and wealth consumers will dip into crisis-era savings and home equity to absorb the pinch of higher prices. Lower- and middle-income consumers have less resources to manage surging consumer prices, especially renters, who have seen rents jump and don’t see their wealth rise with house prices.

“Workers who exited the labor force during the pandemic will likely re-enter in larger numbers in the next few months to supplement incomes, and should find work quickly since job openings are near a record high,” he continued. “This will likely show up in labor market data as continued rapid growth of employment, concentrated in lower wage industries and occupations.”