Comerica, KBRA & Fitch on delinquencies, inflation & recession

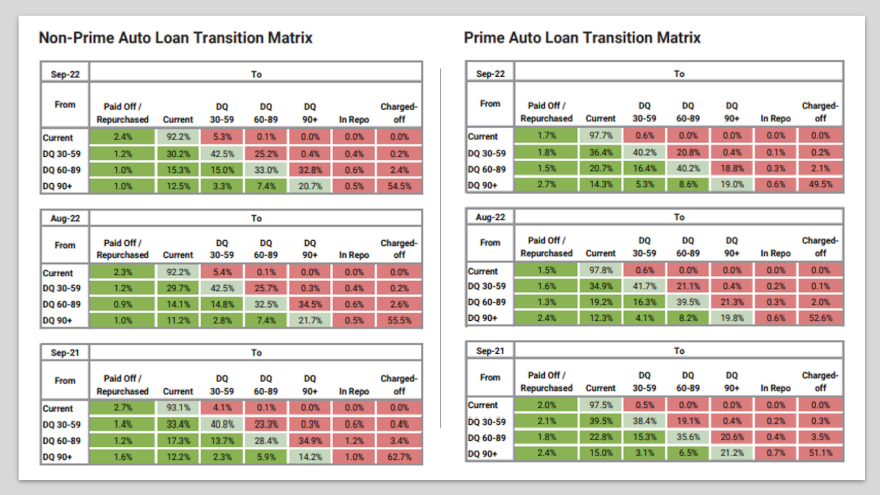

Charts courtesy of Kroll Bond Rating Agency (KBRA).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

If you were looking for upbeat news about auto finance payment performance or the economy in general, Kroll Bond Rating Agency (KBRA), Fitch Ratings and Comerica Bank didn’t have too much to offer last week.

While Fitch shared its expectations for when an official recession might arrive, and Comerica discussed inflation, KBRA indicated that September remittance reports showed mixed credit performance across securitized prime and non-prime auto pools.

Analysts determined delinquency rates edged higher in KBRA’s prime auto index but improved in its non-prime auto index on a month-over-month basis.

Annualized net losses in KBRA’s prime auto index climbed 6 basis points month-over-month and 15 bps year-over-year to 0.3%, while prime delinquency rates — contracts 60 days or more past due — rose 3 basis points month-over-month and 12 basis points year-over-year to 0.4%.

Meanwhile, analysts discovered that annualized net losses in KBRA’s non-prime index increased 46 basis points month-over-month and 314 basis points year-over-year to 6.72%.

Analysts added the percentage of non-prime contract holders who are 60 days or more past due fell to 5.27%, which was 3 basis points lower month-over-month 161 basis higher year-over-year.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

With vehicle demand beginning to slow, KBRA mentioned recovery rates have decreased to 56.97% and 47.71% for the prime and non-prime indices, respectively.

“The recovery rate in our prime index is now at 2018 and 2019 levels, while the non-prime index is expected to reach those levels before year-end. Softening recovery rates should place upward pressure on current loss rates,” KBRA said in its latest report.

Inflation, interest rates and recession

In its latest installment of Comerica Insights, chief economist Bill Adams and senior economist Waran Bhahirethan discussed how much inflation is burdening consumers.

“Despite a cooling economy, inflation surprised to the upside again in September. While gasoline prices fell in the month, prices of food rose, and core CPI hit a new multi-decade high. Inflation will stay very bad for at least a few more months,” Adams and Bhahirethan said. “Gasoline prices edged up again in the first half of October, and home heating costs will be higher this winter as Russia-Ukraine pushes up prices of natural gas, heating oil, and electricity. In 2023, inflation will continue to overshoot the Fed’s 2% target, but by how much is harder to say.”

With inflation above a level deserved by the Federal Reserve, Adams and Bhahirethan also projected what policymakers might do in connection with interest rates.

“Upside risks to inflation will keep the Fed on the warpath for a few more months. They are likely to make a fourth consecutive 0.75% interest rate hike in November, then a 0.50% hike in December and a 0.25% hike at the next decision in early February 2023,” the Comerica Bank experts said in their report.

“Aggressive rate increases will compound headwinds from housing, inflation eroding consumer spending power, and weak foreign economies, making a recession by the end of 2023 a two-in-three chance. If a recession happens, job losses and pullbacks in business and consumer sentiment will probably weaken wage growth and cool inflation by the second half of 2023, allowing the Fed to begin lowering interest rates,” Adams and Bhahirethan went on to say.

However, robust U.S. consumer finances will help cushion the impact of a likely recession starting in second quarter of next year, according to Fitch Ratings.

Fitch explained in a news release that household debt service and leverage continue to be relatively low compared with historical standards. Analysts also said delinquencies across all household liabilities have also remained muted, in contrast to the elevated risks associated with consumer liabilities entering the Great Recession.

Excluding government transfers, real household income is 1% higher year-over-year as of August, according to Fitch, with the growth underpinned by 1% growth in real labor income.

Olu Sonola, head of U.S. regional economics for Fitch, said that the aggregate household balance sheet is resilient despite the recent equity market correction, with real estate wealth offsetting some losses in equity holdings.

“Fitch expects the U.S. economy to enter genuine recession territory — albeit relatively mild by historical standards — in 2Q23. The projected recession is quite similar to that of 1990–1991, which followed similarly rapid Fed tightening in 1989–1990. Nevertheless, downside risks stem from nonfinancial debt-to-GDP ratios, which are much higher now than in the 1990s,” Sonola said in the news release.