Consumer Stress Legal Index at highest point since November 2020

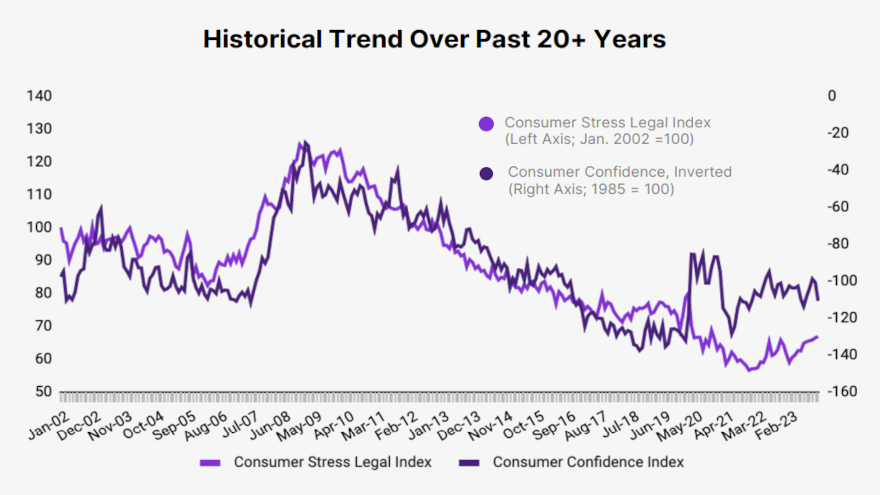

Chart courtesy of LegalShield.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

LegalShield experts contend consumers’ financial status and optimism might not be so rosy.

LegalShield recently released new data suggesting rising financial instability for consumers nationwide. The company’s December Consumer Stress Legal Index (CSLI) increased for the 10th straight month to 66.7, reaching its highest level since November 2020 and pointing to a decline in consumer confidence in the coming months.

According to LegalShield, one of the world’s largest platforms for legal, identity, and reputation management services protecting individuals and businesses across North America, these findings are in contrast to a string of recent positive economic indicators including robust GDP growth, easing of inflation and a strong jobs report, as well as record consumer spending during the 2023 holiday season.

The Mastercard Spending Pulse indicates a 3.1% year-over-year jump in holiday spending from Nov. 1 to Dec. 26.

LegalShield’s CSLI (formerly the Economic Stress Index) was launched in 2018 and is based on a dataset of more than 35 million consumer requests for legal assistance since 2002. The index examines findings from approximately 150,000 calls received monthly from consumers seeking legal help in more than 90 areas of law, including key consumer issues.

LegalShield senior vice president of consumer analytics Matt Layton said through a news release the latest data reflects growing concerns among everyday Americans facing financial strains.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“People don’t call attorneys unless they are genuinely worried about something,” Layton said. “The strength of our data lies in the source — unprompted calls from LegalShield members seeking help from an attorney. They already identified the value of affordable legal assistance to help them solve challenges.

“This is not a survey with leading questions or prompts about the economy; these are real concerns from real people who sought out affordable legal advice to take action,” Layton continued.

Since its inception, LegalShield said its CSLI has been a leading indicator of the Conference Board’s Consumer Confidence Index. Its rise in 2023 follows the Federal Reserve interest rate hikes that started in March 2022.

Key drivers of the index’s rise are requests for legal help with foreclosures and bankruptcies, according to LegalShield.

LegalShield data also indicated Millennials and Gen Xers are significant contributors to the climbing index. Layton explained these generations face acute budget pressures seen in rising calls about payday loans, in addition to a sharp spike in auto repossessions, billing disputes and other money issues.

“Our Consumer Stress Legal Index has historically preceded financial challenges by 60-90 days,” Layton said. “The CSLI data is showing that consumers are stretched financially thin — from holiday shopping to making a car payment. The rise in consumer stress in contrast to increased spending may point to an even sharper rise in household debt in the coming months.”

In the latest federal report, U.S. household debt rose 1.3% in the third quarter of 2023 to a record $17.29 trillion, led by mortgage, credit card and student loans as well as auto financing, according to the Federal Reserve Bank of New York.

“Despite rosy macroeconomic signs, our data reveals a concerning rise in consumer debt struggles — from bankruptcies to car repossessions,” LegalShield CEO Warren Schlichting said.

“With rising inquiries about foreclosures and missed bill payments, we’re monitoring this retail-level financial stress,” Schlichting continued. “People may not be able to cover costs despite positive jobs reports and interest rates.”