Cox Automotive: Auto credit tightens for fourth straight month

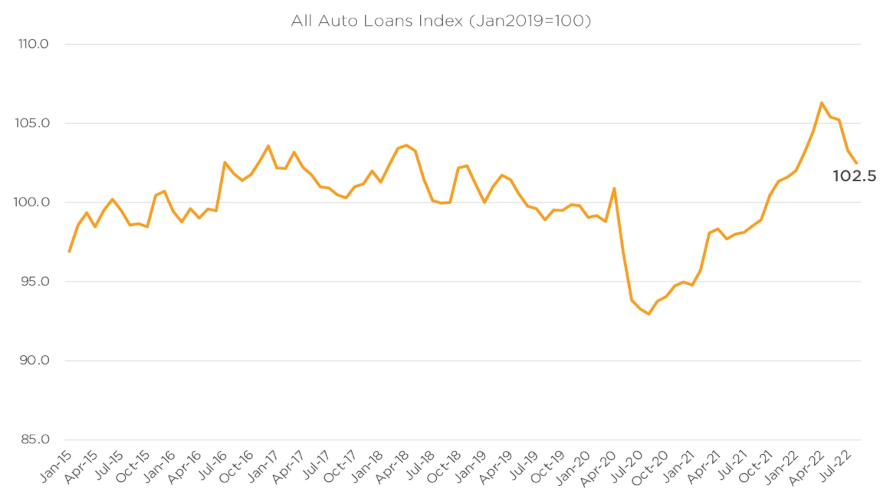

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Cox Automotive spotted a potential reason if your store is having more trouble getting deals bought through your network of finance companies.

Access to auto credit declined for the fourth straight month in August, according to the Dealertrack Credit Availability Index.

Analysts determined the index dipped 0.8% to 102.5 in August, reflecting that auto credit was harder to get in the month compared to July.

Cox Automotive explained through a Data Point that the decline in access in recent months reflects conditions that were last tighter in January.

Still with the decline in August, analysts indicated access was looser by 4.0% year-over-year. And compared to February 2020, they said access was looser by 3.4%.

Cox Automotive recapped the index in April rose to the highest recorded in the data series going back to January 2015.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“The credit availability factors in August mostly moved against consumers,” analysts said in the Data Point. “The average yield spread on auto loans widened, so rates consumers saw on auto loans were less attractive in August relative to bond yields. The average auto loan rate increased by 23 basis points in August compared to July, while the five-year U.S. Treasury declined by 7 basis points, resulting in a wider average observed yield spread.

“The approval rate fell, the subprime share declined, and the down payment share increased, which worked against consumer access to credit in August, as well,” Cox Automotive continued. “The only factors to move in support of consumers in August were an increase in loan terms and an increase in the share of loans with negative equity.”

Each Dealertrack Auto Credit Index tracks shifts in approval rates, subprime share, yield spreads and contract details, including term length, negative equity and down payments.

The index is baselined to January 2019 to show how credit access shifts over time.

“Across all auto lending in August, yield spreads widened, the approval rate declined, and the subprime share declined, so those factors moved against accessibility. Terms lengthened and the share of loans with negative equity increased, and those moves helped mitigate some of the tightening,” analysts reiterated.