Cox Automotive dissects latest in credit tightening

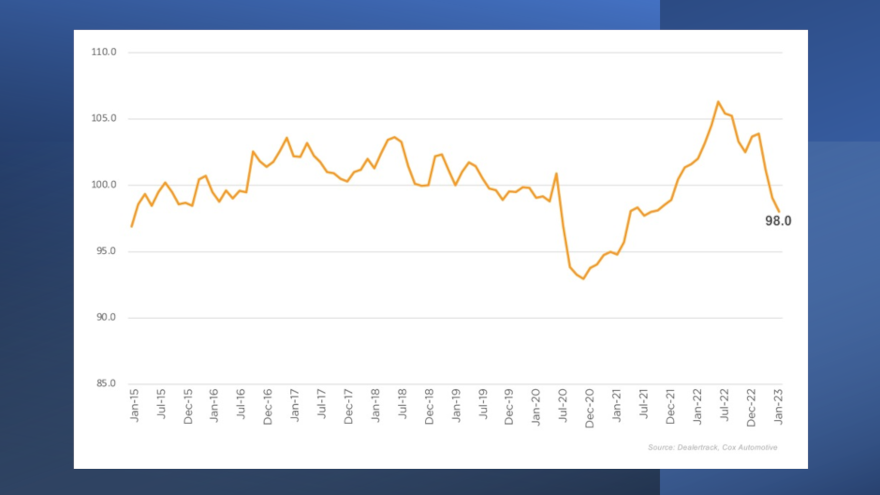

The Dealertrack Credit Availability Index dipped 1% in January. Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

You likely weren’t overreacting if it seemed like it was more difficult to get your dealership’s contracts bought last month.

Cox Automotive reported access to auto credit tightened again in January, according to the Dealertrack Credit Availability Index for all types of auto financing.

The index declined 1% to 98.0 in January, reflecting that auto credit was harder to get in the month compared to December.

Analysts said the decline in access reflected conditions that were tightest since June 2021.

With the downward move in January, Cox Automotive indicated access was tighter by 3.9% year-over-year. And compared to February 2020, access was tighter by 1.2%.

Dissecting the data further, analysts pointed out that the subprime share declined to 10.3% in January from 11.0% in December, sliding 1.5 percentage points year-over-year.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Cox Automotive added the approval rate actually ticked up by 0.2 percentage points month-over-month but dipped 1.9 percentage points year-over-year.

The index report also mentioned the average down payment percentage was up 1.8 percentage points year-over-year.

“Movement in credit availability factors was mixed in January. Yield spreads widened, the subprime share declined, and the share of loans with negative equity declined, and these moves limited credit access for consumers,” Cox Automotive said in a Data Point that highlighted the latest index.

“However, consumers were helped by a lengthening in terms and a slightly higher approval rate. Down payments were unchanged but remained at a record high,” analysts continued.

“The average yield spread on auto loans widened, so the rates consumers saw on auto loans were less attractive in January relative to bond yields,” Cox Automotive went on to say. “The average auto loan rate increased by 2 basis points in January compared to December, while the 5-year U.S. Treasury declined by 11 basis points, resulting in a wider average observed yield spread.

“In addition to rate changes, the most significant year-over-year changes were subprime share, approval rate and average down payment percentage,” analysts added.

Along with the index reading, Cox Automotive touched on a couple of other trends that might illuminate how auto financing might trend later.

Analysts recapped that the Conference Board Consumer Confidence Index declined 1.7% in January, as views of the present situation improved, but future expectations fell by 6.7%.

Plans to purchase a vehicle in the next six months were unchanged from December and were down slightly year-over-year, according to that confidence index.

Perhaps what might influence consumer decisions is what is happening at underwriting departments.

“Credit access tightened across most lender types in January, with only auto-focused finance companies loosening and banks tightening the most,” Cox Automotive said. “On a year-over-year basis, credit access was tighter across most lender types except auto-focused finance companies. Over the last year, credit unions have tightened the most.”

Each Dealertrack Auto Credit Availability Index tracks shifts in approval rates, subprime share, yield spreads and contract details, including term length, negative equity and down payments.

The index is baselined to January 2019 to show how credit access shifts over time.