Cox Automotive: Looser credit hasn’t translated into additional applications

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

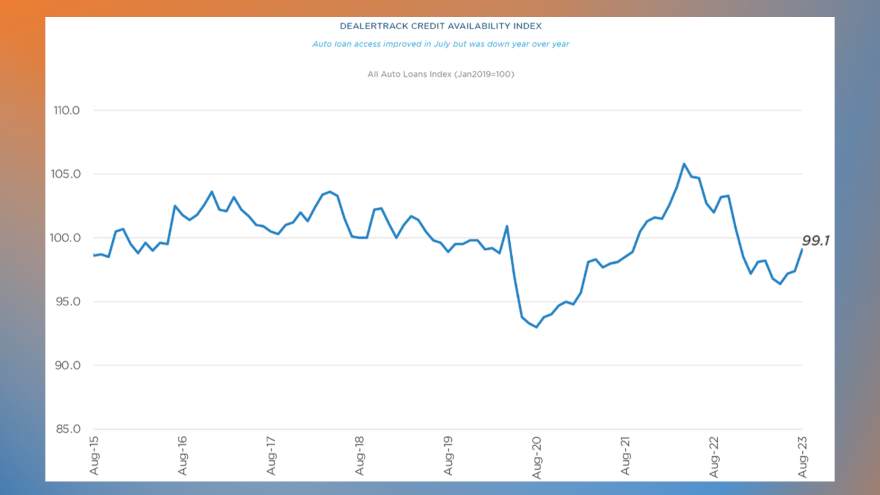

Auto finance providers reportedly loosened underwriting again in August, according to the Dealertrack Credit Availability Index. They opened to a point that experts said auto credit was easier to get in August than any time so far this year.

But finance companies apparently aren’t seeing a flood of additional applications, at least not in the opening segment of September.

Cox Automotive chief economist Jonathan Smoke said on Tuesday that credit applications on Dealertrack last week dropped 17% year-over-year, adding that “unique applications on a same-store basis saw a declining trend impacted by the holiday.”

That application volume figure surfaced after Cox Automotive indicated access to auto credit improved again in August, as the Dealertrack Credit Availability Index increased 1.8% to 99.1 in August, the highest reading since November.

“However, credit access remains tighter than a year ago and, for many channels, tighter than before the pandemic,” Cox Automotive said in its analysis that accompanied the index update, which noted that credit was tighter by 2.8% year-over-year and flat compared to February 2020.

Cox Automotive explained the average yield spread on auto financing in August narrowed by 49 basis points, so interest rates consumers gained were more attractive in August relative to bond yields.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The average interest rate on auto financing booked in August increased by 32 basis points compared to July, while the five-year U.S. Treasury increased by 81 basis points, resulting in a narrower average observed yield spread, according to analysts.

Cox Automotive added that the approval rate decreased by 46 basis points in August and 1.1 percentage points year-over-year. Analysts also mentioned the subprime share increased to 11.0% from 10.4% in August but dipped 0.3 percentage points year-over-year.

The share of contracts booked in August with terms longer than 72 months decreased by 0.8 percentage points versus July and 2.3 percentage points year-over-year, according to Cox Automotive.

“Movement in credit availability factors was mixed in August. Yield spreads narrowed, subprime share increased, and negative equity share increased, and those moves improved credit access for consumers,” analysts said. “However, average terms lengthened, down payments declined, and approval rates fell, and those moves hurt credit access for consumers.”

Despite some headwinds, Smoke said dealerships are moving metal.

But then he went on to say in a video commentary posted on Tuesday, “September has started with continued momentum in the vehicle market, but will it last with the pending UAW strike potentially altering new-vehicle availability, pricing and even consumer sentiment? Sentiment is up slightly to start September, but barely. The downside to vehicle sales momentum to start the month is tightening supply, which won’t be helped by the UAW strike.”

Each Dealertrack Auto Credit Index tracks shifts in approval rates, subprime share, yield spreads and contract details, including term length, negative equity, and down payments. The index is baselined to January 2019 to provide a view of how credit access shifts over time.