Cox Automotive unveils Dealertrack Credit Availability Index

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

ATLANTA –

Cox Automotive recently launched a new industry measurement called the Dealertrack Credit Availability Index that’s geared to track how the auto-finance market is trending.

For the first installment, analysts discovered credit availability continued to improve in November for all types of financing. Cox Automotive indicated the index improved 0.8% in November to 94.8, reflecting that credit was easier to get than the previous month.

However, analysts determined access remains tighter by 5.1% year-over-year, or by 4.4% compared to February.

Looking at trends by provider category, Cox Automotive reported that credit tightened by 0.8% at credit unions, while access loosened at banks, captives and auto-focused finance companies.

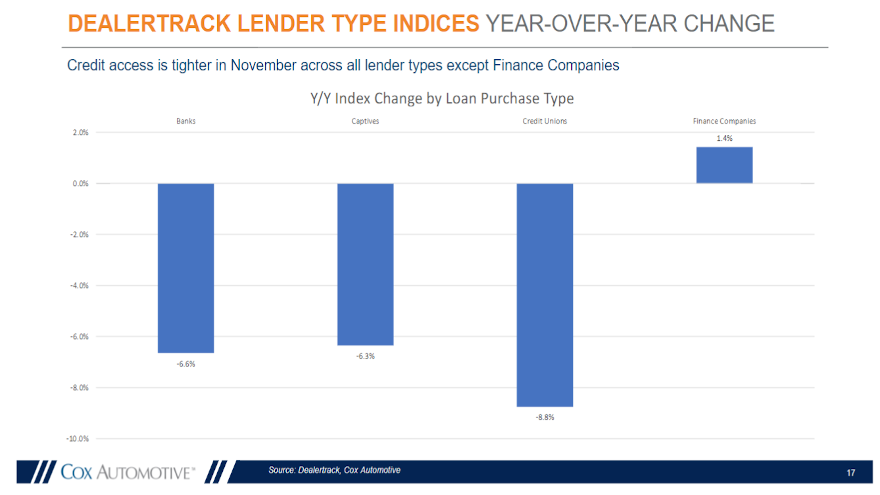

“On a year-over-year basis, auto-focused finance companies have loosened credit access, while all other lender types have tightened,” analysts said in their update.

Cox Automotive explained the overall reading is baselined to January 2019 to provide a view of how credit access shifts over time. Each Dealertrack Credit Availability Index tracks shifts in approval rates, subprime share, yield spreads and contract details including term length, negative equity and down payments.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Across all auto financing in November, approval rates increased from October, subprime share declined and negative equity share increased, while yield spreads declined, and the share of terms longer than 72 months increased,” Cox Automotive said.

“Auto-loan performance deteriorated again modestly in November, but performance remains better than last year or a typical year and much better than a typical recession. Loan delinquencies and defaults have been low because of stimulus support and loan accommodations,” analysts continued.

To back its assertions, Cox Automotive shared data it received from Equifax, which estimated that 3.1% of auto loans were under an accommodation as of Nov. 30. Equifax indicated that figure is down from 3.3% the company reported on Nov. 3 but is 2.4 percentage points higher than February.

Equifax also computed that 2.4% represents more than 1.9 million contracts that likely would have fallen into delinquency and possibly complete default by now.

According to Equifax, “the auto loan severe delinquency rate increased slightly and remains down from February.”