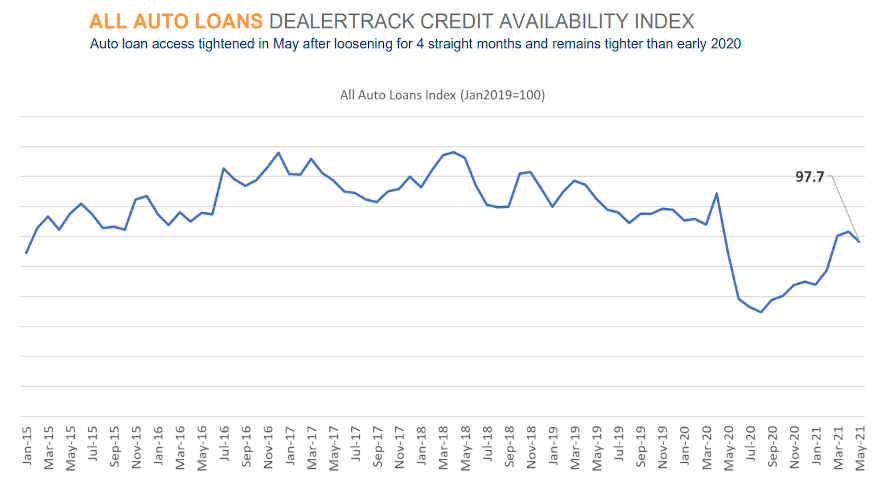

Dealertrack Auto Credit Availability Index dips in May

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

ATLANTA –

You might have noticed it’s been a little more difficult to get your potential buyer’s deal bought by your network of finance companies.

The newest Dealertrack Auto Credit Availability Index showed just how much of a pinch in paper funding is happening.

Cox Automotive analysts said access to auto credit declined in May after loosening for three straight months, as the index dipped 0.7% to 97.7 in May, reflecting that credit was harder to get in the month compared to April.

Analysts also noted that access was looser by 0.7% year-over-year, but compared to February of last year, access was tighter by 1.5%.

“Most loan types tightened in May with only new loans from non-captives loosening slightly. Used CPO loans tightened the most. On a year-over-year basis, all loan types were easier to get with non-captive new loans having loosened the most,” analysts said in the report that accompanied the index update.

“Credit standards tightened in May across lender types except for auto-focused finance companies,” they continued. “Credit tightened the most at banks. On a year-over-year basis, only captives were tighter, but that comparison was against a time of more aggressive lending by the captives last spring.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Auto-focused finance companies have loosened credit access the most year-over-year. Compared to February 2020, only auto-focused finance companies were looser in May, and banks had tightened the most,” analysts added.

Cox Automotive reiterated that each Dealertrack Auto Credit Index tracks shifts in approval rates, subprime share, yield spreads and contract details including term length, negative equity and down payments. The index is baselined to January 2019 to provide a view of how credit access shifts over time.

Across all auto financing in May, Cox Automotive determined that approval rates increased, yield spreads narrowed, the share of terms longer than 72 months increased and the down payment size declined, which all made credit more accessible.

However, analysts also indicated the subprime share fell substantially to the lowest level in four months, and the negative equity share declined, and those factors moved against credit expansion.

Cox Automotive highlighted other trends that have a tangential relationship with auto financing; ones that gauge how consumers are approaching the market.

Analysts pointed out that COVID-19 cases continued to fall, but consumer confidence declined.

Cox Automotive said 135 million Americans were fully vaccinated by May. But, analysts pointed out that consumer confidence according to the Conference Board declined 0.3% in May and left confidence down 11.6% compared to February 2020.

“Plans to purchase a vehicle in the next six months slid to a 13-month low. Plans to purchase a home also declined in May to a more than nine-year low,” Cox Automotive said.

“Of particular concern in the Conference Board data was a substantial erosion in future expectations while the view of the present situation continues to improve,” analysts added.