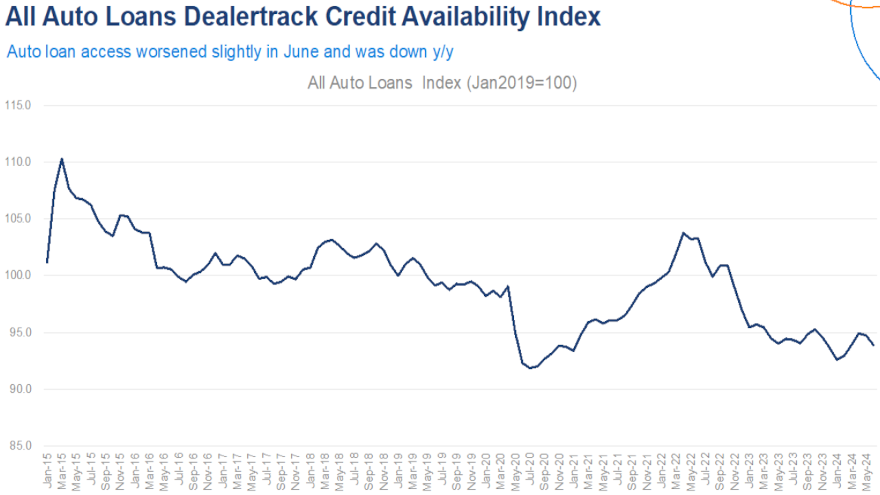

Dealertrack index for June shows more credit tightening

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

First, Edmunds highlighted how much negative equity and lengthening terms surfaced within auto financing booked during the second quarter.

Then, Cox Automotive pointed out how difficult it might have been to get approved for auto financing at all last month.

The newest Dealertrack Credit Availability Index showed access to auto credit declined again in June as credit tightened across all channels and all finance company types. Analysts indicated the index came in at 93.9 in June, which was 0.8% lower than a downwardly revised May reading and 0.5% lower year-over-year.

“Several factors contributed to making credit access more challenging for consumers,” Cox Automotive senior manager of economic and industry insights Jonathan Gregory said in an analysis that accompanied the index update. “Approval rates declined, yield spreads increased, and the share of negative equity decreased.

“However, the proportions of subprime loans and term lengths remained stable month-over-month, having no significant impact on consumer credit access. A slight decrease in down payment shares was the only factor that positively influenced credit access.” Gregory continued. “The subprime share and term lengths remained unchanged, which means that there was no additional impact on consumer credit access from these factors. This is significant as it indicates that despite other tightening measures, these factors did not worsen the credit access situation for consumers.”

Analysts added perspectives about what’s happening at the store level based on Dealertrack activity.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“By channel, used loans through franchised dealers saw the least tightening, while new loans saw the most amount of tightening. On a year-over-year basis, improvement was seen only by used loans from independent dealers, which loosened, while credit availability for certified pre-owned loans tightened the most,” Gregory said.

Cox Automotive then explained how movements in the overall financial system influenced what happened in auto last month.

In June, analysts recapped the average yield spread on auto financing grew by 15 basis points, making the rates consumers received less attractive relative to bond yields.

“This significant increase should raise concerns about the affordability of auto loans for consumers,” Gregory said noting credit access was loosened by finance companies as credit unions tightened most.

Analysts determined the average rate decreased by 3 basis points in June compared to May, while the five-year U.S. Treasury decreased by 18 basis points, resulting in a larger average observed yield spread.

“This means that consumers are now paying a higher premium for auto loans compared to the bond market, which could impact their affordability,” Gregory said.

Elsewhere, analysts noticed the approval rate decreased by 80 basis points in June, softening 3.0 percentage points year-over-year.

Cox Automotive added the subprime share was flat in June and was up 1.8 percentage points year-over-year.

Analysts also mentioned the share of contracts with terms longer than 72 months came in flat in June on a sequential comparison, dipping 1.8 percentage points versus a year ago.

Cox Automotive reiterated that each Dealertrack Auto Credit Index tracks shifts in approval rates, subprime share, yield spreads and contract details, including term length, negative equity, and down payments.

The index is baselined to January 2019 to provide a view of how credit access shifts over time.