Double-digit jump in 2022 tax refunds helps February payments

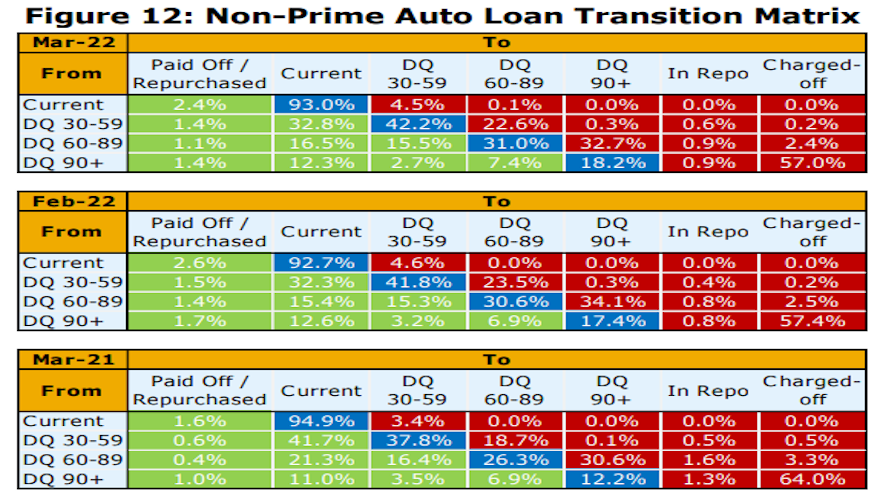

Chart courtesy of Kroll Bond Rating Agency (KBRA).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

According to the April 15 update from the Internal Revenue Service, the IRS had issued $242.62 billion in federal income tax refunds so far this season, representing at 15.2% lift year-over-year.

Kroll Bond Rating Agency (KBRA) noticed that consumers appear to be using at least a portion of those funds to get your portfolio into better shape.

KBRA said March remittance reports showed improved auto credit performance across both prime and non-prime pools during the February collection period.

Analysts determined annualized net losses in KBRA’s prime auto loan index fell 11 basis points month-over-month to 0.21%, while the percentage of prime borrowers that were 60 days or more past due declined a modest 2 basis points to 0.35%.

Meanwhile, analysts discovered annualized net losses and 60-day delinquency rates in KBRA’s non-prime index improved at a much faster pace, falling 108 basis points month-over-over to 5.21% and 52 basis points month-over-month to 4.63%, respectively.

The IRS reported that as of April 15, the average consumer federal income tax refund came in at $3,103, marking an 8.0% improvement compared to the 2021 tax season.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Through its latest report, KBRA explained how its auto finance indices might benefited from those added funds.

“The month-over-month improvements in both indices is consistent with typical seasonal trends as borrowers receive tax refunds, providing an additional source of cash to catch up on past due loan payments,” analysts said. “While we wouldn’t be surprised to see stable or improving credit metrics next month, we broadly expect credit performance to weaken in both indices throughout 2022 as inflationary pressures and the lack of further stimulus weigh on consumer balance sheets.

“Meanwhile, recovery rates in KBRA’s prime and non-prime auto loan indices rose sharply month-over-month and remain elevated versus pre-pandemic levels,” KBRA continued. “Despite this one-month increase, we expect recovery rates to trend toward pre-pandemic levels as the strong used vehicle market enters its 22nd month and defaults occurring now are associated with loans originated after used vehicle values rose sharply in early 2021.

“Furthermore, it is probable that auto loan recovery rates will eventually come under increasing pressure as used vehicle values begin to normalize, but this may not occur until 2023,” analysts went on to say.