Experian: Affordability continues to be major factor in Q3 financing

Chart courtesy of Experian.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Affordability evidently isn’t just a consideration within the subprime market.

Experian highlighted on Thursday that affordability also is pushing some prime and super prime consumers to return to used vehicles.

That’s just one of the findings included in Experian’s State of the Automotive Finance Market Report: Q3 2024.

While the new-vehicle finance market continued to stabilize in Q3, analysts said their data showed prime and super prime consumers may be returning to the used-vehicle market.

According to the report, nearly 66% of prime consumers chose to finance a used vehicle in Q3 2024, up from 65.47% the previous year, while 48.92% of super prime consumers followed a similar path, up from 47.96% over the same period.

Experian also determined the average amount financed for a used vehicle in Q3 was $26,091, down $1,195 from the previous year. Similarly, the average monthly payment for a used vehicle dropped $18 to reach $520 over the same period.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“We’ve seen the effects of the reintroduction of new vehicle inventory over the past several quarters, and it’s brought some stability to the market,” said Melinda Zabritski, Experian’s head of automotive financial insights.

“With the re-emergence of leasing and more availability of late-model vehicles, it’ll be important to keep a close eye on how consumer preferences evolve over the coming years. It will likely shape our market for the near future,” Zabritski continued in a news release.

One other note on the affordability front: Experian said 30-day delinquencies increased from 2.91% last year to 3.09% this past quarter, while 60-day delinquencies increased from 0.92% to 0.96% over the same period.

And speaking of new models, Experian reported captives (58.67%) continued to capture an overwhelming share of the new vehicle finance market in Q3, largely driven by the availability of new-vehicle inventory and incentives. Experian’s tracking showed banks (22.65%), credit unions (10.07%) and finance companies (6.52%) followed on the new-car financing chart.

In addition to market share, analysts noticed that the effects of increased inventory and incentives were felt across other aspects of the industry.

For example, Experian indicated although the average amount financed for a new vehicle ($41,068) experienced a slight uptick, rising $736 compared to the previous year, while the average monthly payment for a new vehicle only increased $5 over the same period, reaching $737.

Meanwhile, the average interest rate for a new vehicle contract decreased from 7.09% in Q3 of last year to 6.61% in Q3 of this year.

A few other additional findings for Q3 included:

—Leasing accounted for 24.03% of new vehicle financing in Q3, up from 20.35% the previous year.

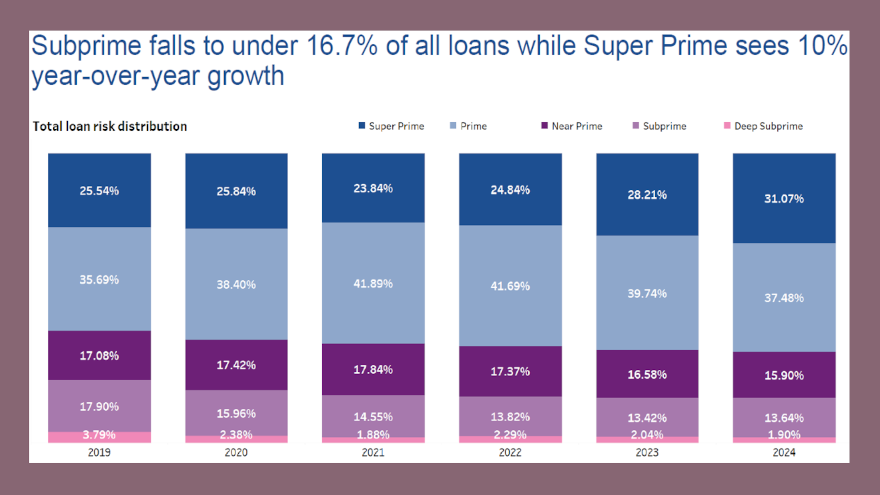

—Prime and super prime consumers comprised nearly 71% of the total vehicle finance market in Q3 2024.

—Outstanding automotive balances increased 1.10% year-over-year, reaching $1.49 trillion.

To learn more, watch the entire State of the Automotive Finance Market Report: Q3 2024 presentation on demand.