Experian: Credit unions now pace all auto financing

Chart courtesy of Experian.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Experian made the official declaration on Thursday.

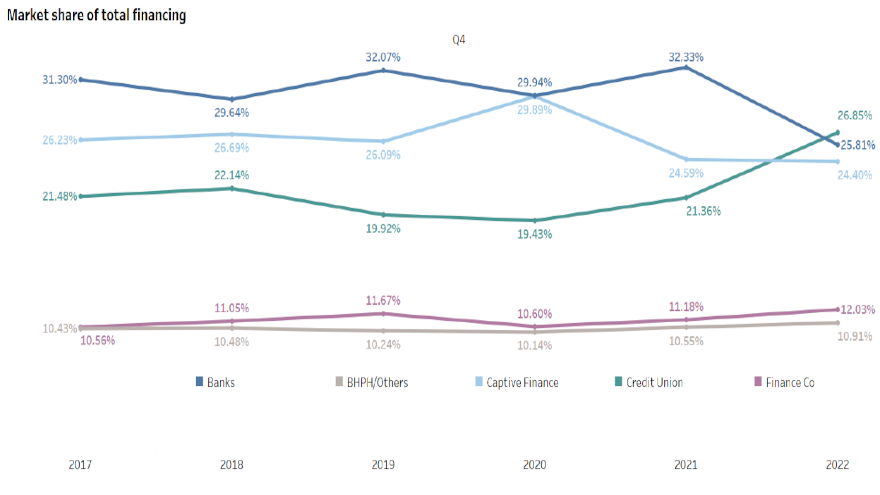

In the fourth quarter of 2022, credit unions held the largest percentage of the vehicle finance market for the first time.

According to Experian’s State of the Automotive Finance Market Report: Q4 2022, credit unions accounted for 26.85% of all vehicle financing during the quarter, comprising the largest share of vehicle financing across the marketplace.

Taking leasing out of the equation, analysts said credit unions make up nearly 30% of all vehicle installment contracts at 29.12%. This figure was followed by banks (27.35%), captives (19.53%), and finance companies (12.67%).

Experian classifies finance companies as providers that offer credit for vehicles but do not hold consumers’ cash deposits.

“The biggest driver of credit union growth was lower interest rates, for both new and used vehicle financing. Even as rates overall have increased, credit unions have managed to be a full percentage point lower than other lenders,” Experian senior director of automotive financing Melinda Zabritski said in a news release.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“In addition to lower rates, we continue to see fewer incentives from captive lenders, giving credit unions the opportunity to grow market share in the competitive rate environment. Having a broader understanding of data like interest rates can help lenders and dealers make strategic decisions and serve consumers effectively,” Zabritski continued.

In Q4, Experian indicated the average interest rate offered by credit unions for new vehicles was 5.49%, with captives slightly lower at 5.45%. Banks clocked in at an average interest rate of 7% for new-vehicle financing, while what Experian categorized as buy-here, pay-here was 6.06% and finance companies came in at 9.38%.

On the used side of financing, Experian said credit unions offered the lowest rate on average at 7.03%, followed by captives at 9.25%, banks at 9.34%, buy-here, pay-here at 11.2% and finance companies at 19.17%.

Zooming out to look at the market overall, Experian noticed increases in average amounts financed began to taper off in Q4.

The average amount finance for a new vehicle increased 4.04% year-over-year to $41,445. That’s a much smaller year-over-year increase than Q4 2021, when it was 12.46%.

Analysts said the difference was even more notable for used vehicles, with a year-over-year increase of only 1.38% for the average amount financed, which reached $27,768. That’s compared to a 20.96% increase in Q4 2021.

Experian went on to mention average terms also leveled out in the fourth quarter, with the average new-vehicle contract term decreasing from 69.64 months in Q4 2021 to 69.44 months in Q4 2022.

Used-vehicle contract saw a slight uptick in length, clocking in at 68.01 months in Q4 2022, up from 67.35 months in Q4 2021.

“Seeing attributes like loan amount growth and average terms beginning to normalize is a positive sign the industry is moving in the right direction,” Zabritski said. “It’s important to pay attention to all attributes to have a holistic picture of the industry.”

Additional findings from Q4 included:

—Overall outstanding balances continued to grow, rising from $1.3 trillion in Q4 2021 to $1.4 trillion in Q4 2022

—Leasing saw a year-over-year decrease, sliding to 17.21% in Q4 2022 from 23.95% Q4 2021

—Prime and super prime comprised 66.5% of all vehicle financing in the fourth quarter of 2022, up from 64.98% in Q4 2021, while subprime saw a decline, from 16.38% to 15.57% year-over-year.

—The share of financing made up by sedans grew from 17.69% in Q4 2021 to 18.26% in Q4 2022.

—Honda remained the top leased OEM at 12.07%, followed by Chevrolet at 9.17% and Toyota at 8.85%.