Experian & Oliver Wyman see path to score 96% of credit applicants

Chart courtesy of Experian and Oliver Wyman.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

COSTA MESA, Calif. –

It’s a challenge non-prime and subprime auto finance companies face regularly inside their underwriting departments. An application lands from a consumer with a thin credit file or one who isn’t scored at all.

Experian and Oliver Wyman recently found expanded data and advanced analytics can improve access to credit for nearly 50 million credit invisible and unscoreable Americans

The companies said their new research outlined the challenges consumers face when trying to access credit, how the financial services industry can increase financial inclusion and score 96% of applicants

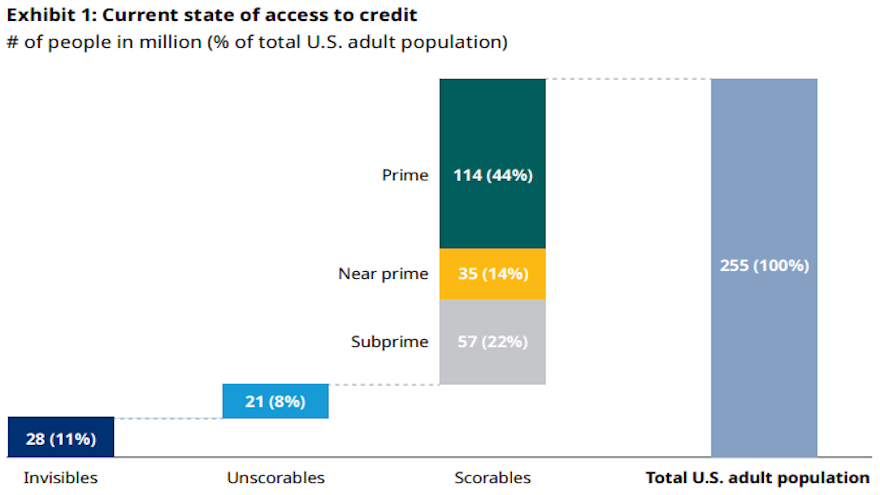

Nearly 106 million U.S. consumers are unable to secure credit at mainstream rates either because they are credit invisible, unscoreable by conventional credit scores, or have a subprime or below credit score, according to new research recently released by Experian and Oliver Wyman.

The research showed that by using expanded data sets such as rental payments, trended data, utility information and more and advanced analytics in their decisioning, finance companies can improve access to credit for nearly 50 million credit invisible and unscoreable consumers, as well as millions of consumers currently considered subprime.

“We are committed to providing lenders with the right tools and insights to drive financial inclusion and have seen significant progress in recent years with many leading lenders leveraging expanded Fair Credit Reporting Act regulated data and advanced analytics,” said Greg Wright, chief product officer and executive vice president at Experian Consumer Information Services. “Yet, as an industry, we can and must do better to ensure more consumers can access financial services at affordable rates.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“While the findings show we are moving in the right direction, financial access depends on complete industry adoption of new data and insights as well as business practices that proactively address the historical gap that’s existed in serving more consumers,” Wright continued in a news release.

Experts acknowledged that access to fair and affordable credit can help consumers get a college degree, buy a vehicle or home, start or expand a business and ultimately help establish careers, build wealth and achieve greater financial success. Yet, in financial inclusion and access to credit, Experian and Oliver Wyman found just 42% of the adult population lacks a conventional credit score in the range that would typically enable access to credit at mainstream rates.

Additional key findings Experian and Oliver Wyman research include:

— 19% of American adults do not have a conventional credit score. This figure includes 28 million adult Americans who are credit invisible and 21 million who are unscoreable. An additional 57 million have subprime or below credit scores

— Credit invisibility more frequently impacts underserved communities with 26% of Hispanic consumers and 28% of Black consumers unscoreable or invisible compared to 16% of White and Asian consumers

— Credit invisibility often impacts younger consumers, with 40% of credit invisibles in the United States being below the age of 25

— Immigrants and consumers from low-income neighborhoods are more likely to face barriers in accessing mainstream financial services

The report explained that finance companies can expand access to credit for currently underserved consumers by increasing the number of consumers they can assess and by improving their ability to identify the true credit quality of borrowers. Leveraging expanded data, or nontraditional credit data, and advanced analytics can help lenders achieve both.

According to Experian’s research, when advanced analytics and machine learning are combined with expanded data sets as they are with Experian’s Lift Premium score, 96% of applicants can be scored, including an estimated 65% of the credit invisible population and the entire conventionally unscoreable population.

Wright added this level is significantly greater than the 81% of consumers that can be scored by conventional scores.

In addition, 6 million consumers whose conventional scores are subprime could be upgraded to near-prime or above based on the expanded data used in the score, according to Experian.

“Now is the time to begin leveraging sophisticated tools like Experian Lift Premium to ensure all consumers can get the credit they deserve,” Wright said.

The report also pointed out increased opportunities to further drive financial inclusion with expanded data sets, including utility payments, rental payments, consumer permissioned data and bank account data. One example noted is Experian Boost.

Since launching in 2019, nearly 9 million consumers have enrolled in Experian Boost to improve their credit scores by adding their on-time cell phone, utility and video streaming service payments directly to their Experian credit file.

Experian and Oliver Wyman noted that finance companies increasingly can utilize not only their own relationship banking data, but consumer-permissioned data from other financial accounts to improve their credit decisions.

They said the use of consumer-permissioned data in underwriting — once the exclusive province of fintech disruptors — is expanding among mainstream finance companies.

“Responsibly expanding access to credit is both an untapped business opportunity, and a chance to have positive social impact in our communities and with historically disadvantaged groups,” Oliver Wyman partner Mike Hepinstall said in the news release.

“Better identifying and serving creditworthy customers is an opportunity to grow while doing good.”

To download the complete report, go to this website.