Experian Q2 data could illuminate ongoing movements involving affordability & risk

Chart courtesy of Experian.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Is vehicle affordability improving for consumers? Or are finance companies not taking on as much risk?

To help you decide, consider these metrics from Experian’s State of the Automotive Finance Market Report: Q2 2024 released on Thursday.

Experian determined the average amount financed for a used vehicle delivered in the second quarter declined $1,068 year-over-year to $26,248. Experian noted the average interest rate on that used-car paper rose from 11.47% to 12.01% year-over-year.

However, analysts noticed the average monthly payment for those used vehicles dropped from $536 to $525 over the same period.

In the new-car market, the average amount financed in Q2 rose to $40,927 from $40,743 while the APR ticked up from 6.78% to 6.84% year-over-year.

But the average monthly payment for a new vehicle saw just a modest $1 increase — reaching $734 in the second quarter.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Perhaps here’s the metric that might help you decide.

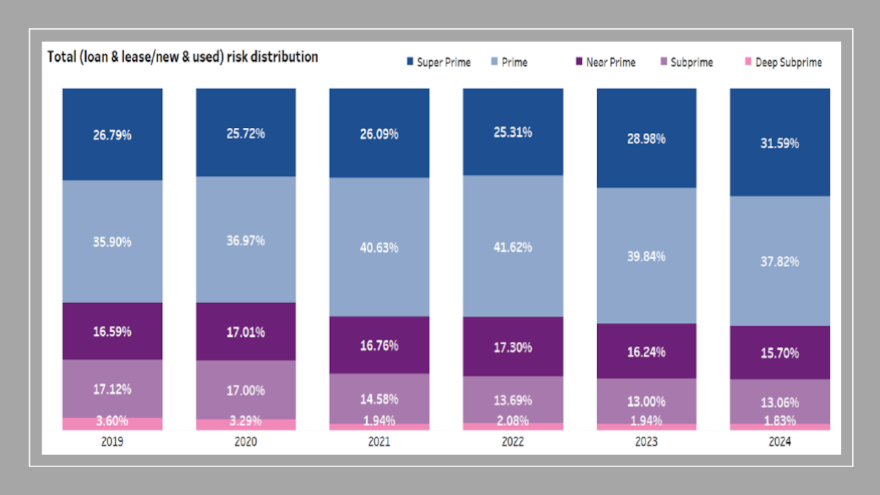

Experian reported prime and super-prime consumers comprised nearly 70% of the total finance market in Q2.

Whether the customer has a credit score above 800 or a reading only about half of that figure, Experian saw a clear provider segment holding the most market share.

In Q2, analysts determined captives gathered 30.88% of the total automotive finance market, up from 28.46% last year.

Meanwhile, Experian said banks declined from 24.67% to 24.41% and credit unions came in at 20.16%, down from 23.29% in Q2 2023.

Analysts pointed out captives also captured more than half of the new-vehicle finance market share, coming in at 60.56% in Q2, up from 57.30% a year ago.

Banks dropped from 22.41% to 21.26% and credit unions went from 14.43% to 10.30% in the same time frame, according to Experian tracking.

For the used-vehicle finance market share, Experian mentioned credit unions represented 27.63% in Q2, down from 29.46% a year earlier.

Banks were not far behind in the used department at 26.83% in Q2, up from 26.21% last year and captives slightly grew from 8.39% to 8.45%.

“With captives continuing to offer incentives, it’s expected to see their share grow across the spectrum,” Experian head of automotive financial insights Melinda Zabritski said in a news release.

“Monitoring the shift in consumer preferences and how it affects the overall market share is important for professionals as they make informed decisions when assisting their respective shoppers,” Zabritski continued.

A trio of other notable findings for Q2 2024 included:

—New-vehicle financing increased to 80.11% this quarter, from 79.91% last year and used-vehicle financing declined from 38.98% to 35.84% year-over-year.

—Average contract terms for new vehicles grew from 68.29 months in Q2 2023 to 68.48 months in Q2 2024 and used-vehicle contract terms went from 67.38 months to 67.41 months in the same time frame.

—60-day delinquencies saw a slight uptick from 0.83% last year to 0.85% this quarter.

Experian elaborated about its findings through a free webinar that’s available here.