Experian spots notable jumps in Q4 data

Chart courtesy of Experian.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

To use the industry vernacular, Experian’s newest State of the Automotive Finance Market report reinforced how much more money is on the street nowadays.

According to Experian’s fourth-quarter report released on Thursday, the average amount financed and monthly payments both jumped significantly year-over-year for both used- and new-vehicle financing.

Stemming in part from impacts of the chip shortage, analysts determined the average amount financed for a new vehicle increased 12% year-over-year, from $35,421 in Q4 2020 to $39,721 in Q4 2021.

Experian noticed that used-vehicle trends made a more notable increase, with the average amount jumping 20% year-over-year from $22,630 to $27,291.

Furthermore, analysts found that the average term for used-vehicle financing saw a sharp increase year-over-year, too, growing from 65.66 months in Q4 2020 to 67.36 months in Q4 2021.

Meanwhile, these increases are being reflected in the average monthly payments, as well.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

In Q4 2021, Experian said the average monthly payment for new vehicles reached $644, while the average used-vehicle monthly payment jumped to $488, up from $579 and $417 a year ago, respectively.

In addition to the chip shortage, Experian explained another driving factor of these increases is consumers continuing to select larger vehicles, such as SUVs, which are more expensive.

In Q4 2021, analysts tabulated that 59.43% of all new-vehicle financing was for SUVs and wagons. Experian pointed out that the shift to larger vehicles over the past few years has a trickle-down effect, as many of these larger vehicles are now reentering the market as used vehicles.

While the money on the street is on the rise, Experian spotted a lift in delinquency. But thankfully for finance companies, the uptick likely won’t trigger panics in the collections department.

Experian noticed delinquency rates saw a slight uptick in Q4 2021, as 30-day delinquencies increased from 1.81% to 1.86% from Q4 2020 to Q4 2021, while 60-day delinquencies increased from 0.64% to 0.66% in the same time frame.

For fuller context of how the market is performing, Experian data indicated that these rates are still lower than those of Q4 2019, when 30- and 60-day delinquencies were 2.42% and 0.83%, respectively.

“The increases we see in delinquencies are slight, so it’s important to consider that this is another sign that the market is continuing to return to pre-pandemic trends. However, the rates are still significantly under those of 2019, which is a positive sign, overall,” said Melinda Zabritski, Experian’s senior director of automotive financial solutions.

“Especially with the increases in average vehicle loan amounts and monthly payments we’ve seen over the last few quarters, this will be an important metric to monitor in the quarters to come,” Zabritski added in a news release.

Experian highlighted additional notable findings for Q4 2021 included:

• Used-vehicle financing made up a larger segment of vehicle financing as a whole, at 58.66% of financing in Q4 2021, up from 55.2% in Q4 2020.

• Banks increased share of financing year-over-year, making up 31.84% of all vehicle financing in Q4 2021, up from 29.73% in Q4 2020

• The Honda Civic was the top leased vehicle in Q4 2021 at 2.85%, followed by the Honda CRV (2.37%), and the Mazda CX-5 (1.92%)

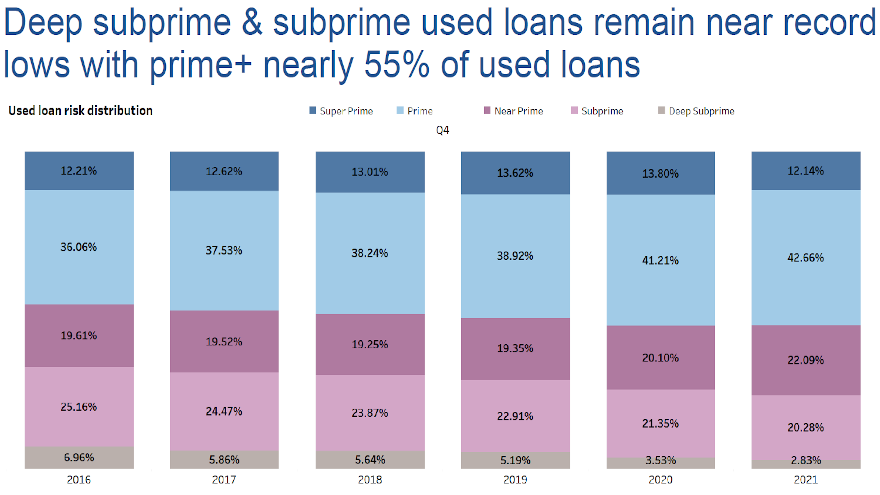

• Prime and super prime consumers are beginning to shift back to purchasing used vehicles, with 63.39% of prime and 46.76% of super prime consumers selecting used, up from 60.46% and 44.02%, respectively, in Q4 2020.