Experts see positives of Trump & Congress on auto, plus less Fed impact

Chart courtesy of Experian.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

President-elect Donald Trump is set to return to the White House, and a Republican-controlled Congress is about to be in place, too.

Those developments and what lawmakers could do going forward, plus potential future decisions by the Federal Reserve, are combining to create a somewhat stable forecast for auto financing and retailing, according to a variety of sources that shared perspectives since policymakers cut interest rates again just before Christmas, Hannukah and Kwanzaa.

“In 2025, when it comes to news that impacts the auto business, we’re expecting more influence to come from the halls of Congress and the Oval Office and less from what is decided in the Board Room of the Federal Reserve. We, for one, are glad to see the Fed move off center stage,” Cox Automotive chief economist Jonathan Smoke wrote in his blog on Dec. 18 , when the Fed cut the federal funds rate another quarter percent as widely expected during its last decision opportunity of 2024.

The target range for the federal funds rate now sits at 4.25% to 4.5% after policymakers took each of their last three opportunities to trim it to finish the year. Like Smoke, Comerica Bank chief economist Bill Adams and senior economist Waran Bhahirethan do not expect the Fed to maintain that aggressive downward approach in 2025.

Adams and Bhahirethan wrote on the day of Federal Open Market Committee’s last decision of 2024 that “one change to the Fed’s statement does signal that rate cuts will likely proceed at a slower pace in 2025 than between September and December, when the Fed cut their target rate a cumulative percentage point.

“Where the prior statement said that committee will pay attention to ‘incoming data, the evolving outlook, and the balance of risks’ in ‘considering additional adjustments’ to rates, the current statement commits the Fed to evaluating those information ‘in considering the extent and timing of additional adjustments.’ (Our emphasis added),” Adams and Bhahirethan continued.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

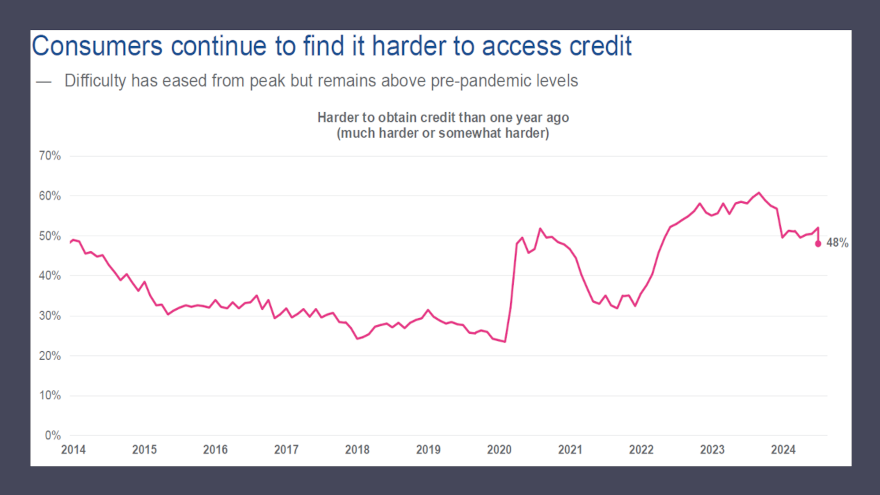

So how do banks, in particular, see the current credit environment? Experian chief economist Joseph Mayans and economic analyst Josee Farmer tackled that question in their latest installment of their Lending Conditions Chartbook released a day after the Fed’s decision.

Mayans and Farmer explained that growth in non-revolving (non-mortgage) consumer credit — including auto finance — is running “well below” its pre-pandemic level but may have bottomed out.

Mayans and Farmer also pointed out that overall levels of delinquency continue to trend higher but there are signs the industry may be near the peak of the cycle, especially for consumer products

“Credit growth remains constrained by higher interest rates and tighter lending standards, but there are tentative signs that the slowdown has stabilized. Lower rates could be a catalyst for more lending activity if the economy is able to avoid a pronounced slowdown, though lenders and consumers may take a ‘wait-and-see’ approach in the near term,” Mayans and Farmer wrote in the report.

“Banks continue to tighten lending standards, but the pace of tightening has slowed off the peak. Standards are generally on the tighter end of range of what has been seen in the market since 2005,” they continued.

“Across the board, consumers are reporting more difficulty obtaining credit and are reporting less likelihood to apply for credit over the next 12 months,” Mayans and Farmer added.

“Consumers’ view of their financial situation — while still more challenging than in 2019 — has generally improved since the peak of inflation in mid-2022 and has remained flat throughout 2024. Consumers across the board still see a higher likelihood of missing a debt payment than prior to the pandemic,” they went on to say.

Should missing debt payments not be widespread, Smoke described what could happen as a result as potential buyers collaborate with dealerships and finance companies.

“Lender confidence in the economy and in future used vehicle value trends, along with lower auto loan delinquencies, could see more aggressiveness by lenders that would reduce yield spreads, which is the premium charged by lenders to compensate them for risk. Many lenders have room to cut yield spreads by 50-to-100 basis points just to get back to average,” Smoke wrote.

“We expect that consumers may see even lower rates by spring, which would create the most normal and favorable buying environment since 2019,” he added.

By spring, Trump and the new Congress likely will be established in Washington, D.C. Edmunds analysts note that some consumers might feel more optimistic about their economic prospects during the new administration, and therefore could be more open to making a vehicle purchase.

“Consumers are still feeling the pinch, but the market has become a slightly friendlier place for car shoppers than it was at the start of the year,” Edmunds’ head of insights Jessica Caldwell said in December.

“Consumers feeling energized about the incoming administration may be motivated to make a purchase, while those uncertain about the new leadership’s stance on policies might choose to hold off,” Caldwell added.