Fed reiterates push to keep credit flowing during pandemic

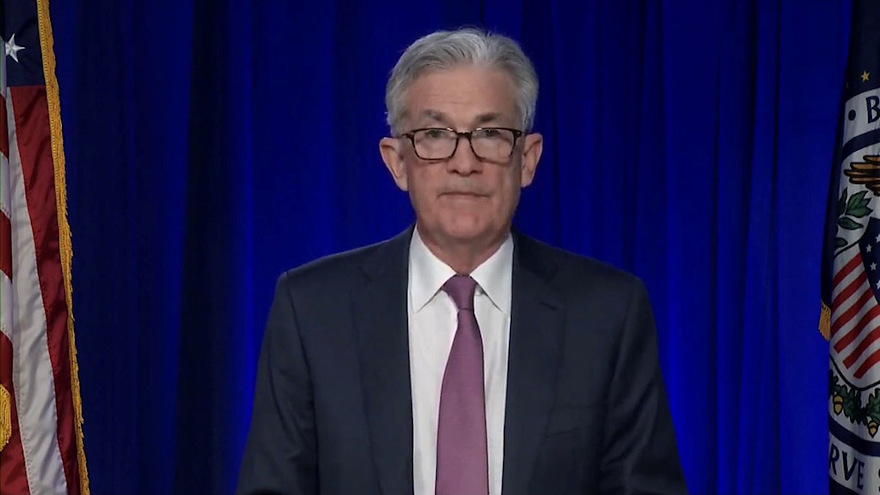

Chair Jerome Powell participates in the virtual Federal Open Market Committee (FOMC) press conference on Wednesday. Image courtesy of the Federal Reserve.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

CARY, N.C. –

Finance companies likely remember what happened during the Great Recession 12 years ago when the credit market seized up as bad a car engine without oil.

The Federal Reserve reiterated the significant steps it’s taking to ensure finance companies have the raw material to keep their portfolios growing. But the pace providers might be buying paper still looks a bit uncertain.

Fed chair Jerome Powell made public comments on Wednesday following the Federal Open Market Committee voting unanimously to leave interest rates unchanged.

“The Federal Reserve has also been taking broad and forceful actions to more directly support the flow of credit in the economy for households, for businesses large and small and for state and local governments. Preserving the flow of credit is essential for mitigating damage to the economy and promoting a robust recovery,” Powell said during his opening statement of Wednesday’s press conference.

“Many of our programs rely on emergency lending powers that require the support of the Treasury Department and are available only in very unusual circumstances, such as those we find ourselves in today. These programs serve as a backstop to key credit markets and have helped to restore the flow of credit from private lenders through normal channels,” Powell continued. “We have deployed these lending powers to an unprecedented extent, enabled in large part by financial backing and support from Congress and the Treasury.

“Although funds from the CARES Act will not be available to support new loans or new purchases of assets after Dec. 31, the Treasury could authorize support for emerging lending facilities, if needed, through the Exchange Stabilization Fund. When the time comes, after the crisis has passed, we will put these emergency tools back in the box,” he went on to say.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Cox Automotive chief economist Jonathan Smoke offered his latest assessment later on Wednesday through a blog post titled, “The Fed Will Keep Rates Low, But That Alone Won’t Sell Cars.”

Smoke pointed out that the 10-year U.S. Treasury yield ticked up this week, approaching the highest level he’s seen during the pandemic. He also mentioned that mortgages and auto financing rates have not followed Treasury’s path, meaning that providers are keeping their rates lower despite the underlying yields being higher.

“Yet despite these better conditions, we are not seeing auto demand respond,” Smoke said. “November saw a notable softening in sales, especially in the back half of the month as the third wave of COVID-19 grew. Consumer sentiment has also declined since October as conditions worsened.

“The Fed’s actions may not influence much in the near term as attention focuses more on stimulus, the initial distribution of vaccines and when we see signs that this third wave of the pandemic has passed its peak. The Fed is keeping rates low and credit broadly available, but this alone will not keep Americans buying,” Smoke added.

Meanwhile, Powell acknowledged the points Smoke made as well as the conundrum finance companies face when trying to form strategy for 2021.

“As we have emphasized throughout the pandemic, the outlook for the economy is extraordinarily uncertain and will depend in large part on the course of the virus. Recent news on vaccines has been very positive. However, significant challenges and uncertainties remain with regard to the timing, production, and distribution of vaccines, as well as their efficacy across different groups. It remains difficult to assess the timing and scope of the economic implications of these developments,” Powell said.

“The ongoing surge in new COVID-19 cases, both here in the United States and abroad, is particularly concerning, and the next few months are likely to be very challenging,” he added. “All of us have a role to play in our nation’s response to the pandemic. Following the advice of public health professionals to keep appropriate social distances and to wear masks in public will help get the economy back to full strength. A full economic recovery is unlikely until people are confident that it is safe to reengage in a broad range of activities.”

And among those activities could be acquiring a new or used vehicle with some kind of financing attached.

Looking ahead to 2021, Edmunds analysts also noted that there are still uncertainties ahead, but they remain confident that industry sales will continue at a steady pace without a dramatic decline like the one seen at the outset of the pandemic.

“Even if we face another wave of retail shutdowns, the good news is that dealers are far better prepared now for selling virtually than ever before,” Edmunds executive director of insights Jessica Caldwell said in a news release distributed on Thursday. “And vaccines on the way should only help keep consumer confidence high.”