Findings from TransUnion & J.D. Power study on LTVs

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

A newly released TransUnion and J.D. Power study showed just how much risk is likely in your auto-finance portfolio nowadays.

The study, “Impact of Unsettled Vehicle Values on Lenders and Consumers,” found that, as a result of well-established supply and inventory challenges early in and throughout much of the pandemic, vehicle values increased dramatically, in particular in the used-vehicle market.

As a result, study orchestrators found many consumers secured contracts with relatively high monthly payments.

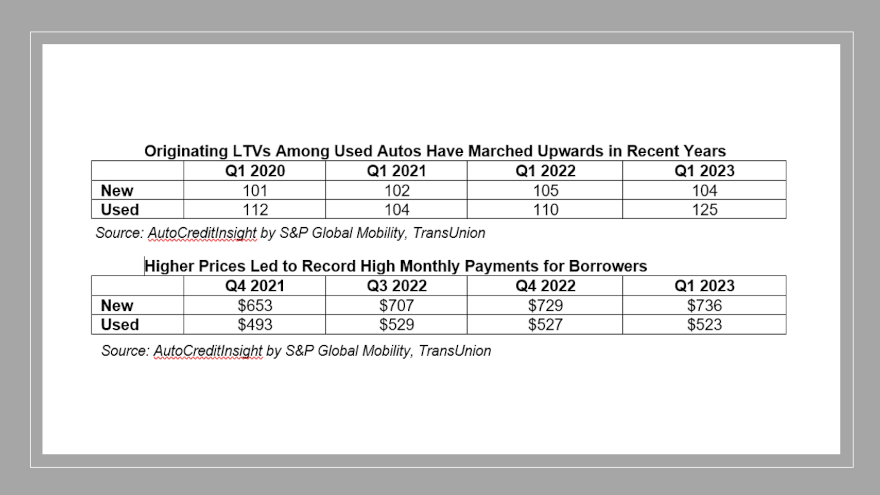

As vehicle values have declined in recent quarters, TransUnion and J.D. Power explained used loan-to-value ratios (LTVs) at origination have trended in the wrong direction for consumers.

Analysts indicated originating LTVs in Q1 2023 averaged 125 up from 110 in Q1 2022, and 104 two years prior. They reiterated LTVs measure the difference between the contract amount and the market value of the vehicles. A lower LTV generally means a consumer has more equity in their auto contract.

Satyan Merchant, senior vice president and auto business lead at TransUnion, pointed out these trends mean that while the majority of consumers will find themselves with positive equity, there are some in more challenging spots.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“To a large extent, used-vehicle values were elevated as a result of the scarcity brought on my pandemic-related supply chain and inventory issues,” Merchant said in a news release. “As those issues have abated, and inventories have begun to return to more of a normal state, the value of those used vehicles have begun to decline.”

LTVs being an arbiter of credit performance

The study also showed that rising LTVs are important to take note of as they may be a future arbiter of higher delinquencies among used-vehicle finance customers.

While higher LTVs at origination were more indicative of a rising delinquency rate, a similar trend appeared to take hold among consumer who saw their equity position worsen and their LTV increase even after origination and during the life of the contract.

For instance, the study examined one cohort of subprime consumer who originated used-vehicle financing in Q1 2020, the vast majority of whom saw a 140 or higher LTV at origination.

The study found that among those in that cohort whose LTVs declined over the next 24 months, the risk of delinquency declined as well.

In fact, among those whose LTVs had dropped to less than 100 by Q4 2022, TransUnion and J.D. Power discovered their risk of a 60 days or more past due delinquency was about one-quarter that of a subprime borrower with an LTV that remained at 140 or higher.

Ultimately, the study found that equity and depreciation are key factors in future performance, as consumers with more vehicle equity appear more likely to protect that equity by making payments.

Merchant pointed out that this situation stands in contrast to those consumers with faster depreciating vehicles, and therefore flat to rising LTVs post origination, who were more likely to go delinquent.

“Vehicle financing continues to evolve as the market emerges from pandemic-related disruptions. While many lenders and consumers have benefited from elevated vehicle values and lower delinquencies during the pandemic, vehicle values are expected to decline,” Merchant said. “Given the possibility that accelerated depreciation will result in negative existing LTVs for longer periods, this will be especially important for lenders to monitor.

“Lenders would be best served to utilize the necessary tools and resources, such as, trended and alternative data at underwriting, to successfully optimize each phase of the vehicle financing lifecycle,” he went on to say.