KBRA carefully explains softening credit performance

Chart courtesy of Kroll Bond Rating Agency (KBRA).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

NEW YORK –

The word choices Kroll Bond Rating Agency (KBRA) used to describe its latest auto-finance indexes might be reassuring to executive and managers, even if their collections are deteriorating.

KBRA reported on Monday that August remittance reports showed softening credit performance across securitized auto loan pools during the July collection period.

However, analysts said in the latest index update that the movement is “likely driven more by seasonality than a change in fundamentals.”

The indicated that early-stage delinquencies — 30 to 59 days past due — in KBRA’s Prime Auto Loan Index increased 5 basis points month-over-month to 0.82%, while late-stage delinquencies — 60 days or more past due — rose 1 bp to 0.27%.

Meanwhile, analysts determined early- and late-stage delinquencies in KBRA’s Non-Prime Auto Loan Index jumped 9 basis points and 10 basis points month-over-month, respectively, to leave the readings at 6.77% and 3.53%.

KBRA went on to mention annualized net losses also trended higher in both indices versus the previous month but remained below year-ago levels. Analysts point out that “this year’s sharp rise in used vehicle values has helped boost loan recoveries.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Here’s more of those word choices KBRA made in its latest report that might give some solace to finance companies as they navigate through a potential return to pre-pandemic business conditions.

“Credit performance has been stellar so far this year, as 2021 delinquencies and losses on a month-over-month basis have trended well below historical norms,” analysts said.

“We expect credit performance to soften through the remainder of the year, keeping in line with seasonal trends as summer travel and holiday spending weigh on borrower finances,” they continued.

“Moreover, the termination of extended federal unemployment benefits earlier this month, coupled with a slowing economic recovery as the delta variant spreads, may place further pressure on consumer credit fundamentals,” analysts went on to say.

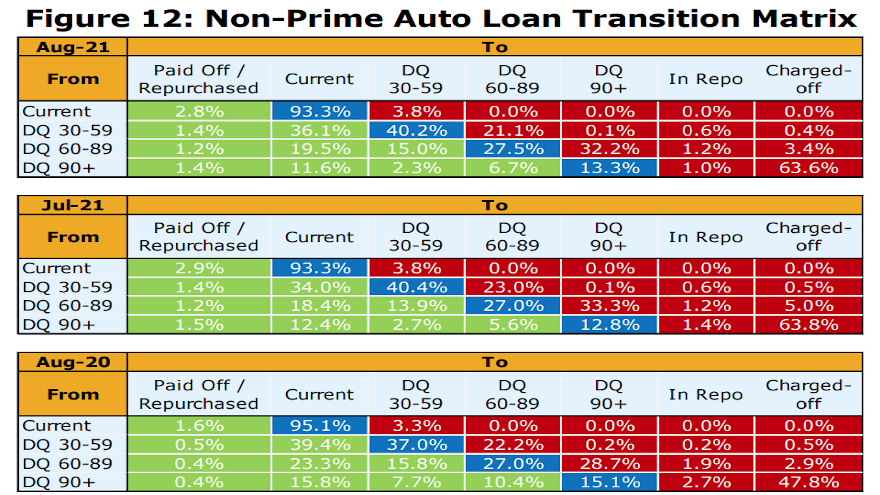

KBRA closed its latest update by examining contract holders who fell behind as well as the paper that landed into the charge-off category.

The firm indicated the percentage of prime and non-prime consumers who transitioned from current to 30-day delinquent in August totaled 0.5% and 3.8%, respectively. The moves marked an uptick of 4 basis in prime pools and 7 basis points in non-prime pools compared to the previous month.

Furthermore, the percentage of prime contract holders who rolled from 60 days or more past due to a charge-off came in at 12.1%, representing a decline of 199 basis points month-over-month. And KBRA said the non-prime roll rate into charge-off decreased 107 basis points to 19%.