KBRA & DBRS Morningstar offer latest views of auto ABS performance

Charts courtesy of Kroll Bond Rating Agency (KBRA).

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

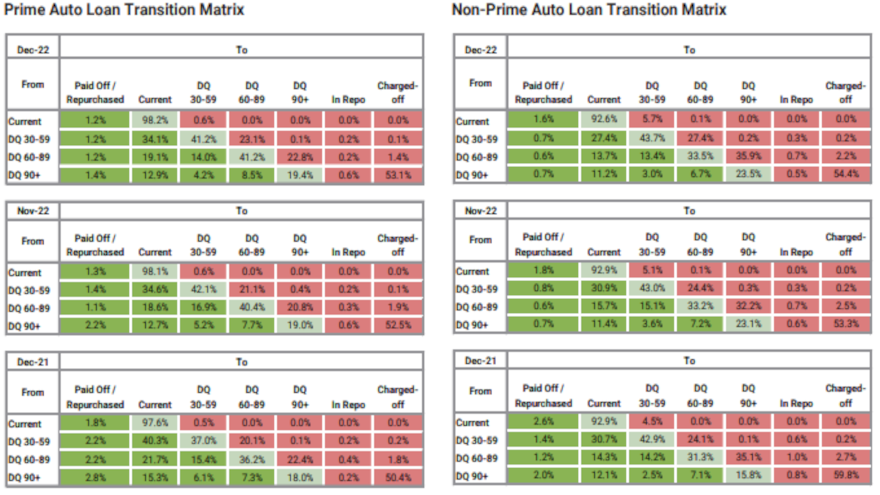

During the same week as S&P/Experian Consumer Credit Default Indices highlighted the rising December auto reading, the newest analysis Kroll Bond Rating Agency (KBRA) revealed more performance softening based on data from the securitization market.

KBRA said December remittance reports showed mixed credit performance across securitized prime and non-prime auto pools during the November collection period.

Analysts indicated annualized net losses in their prime index improved 7 basis points month-over-month but rose 12 basis points year-over-year to 0.35%. KBRA’s non-prime index annualized net losses moved up 19 basis points month-over-month and 349 basis points year-over-year, landing at 8.02%.

Meanwhile, KBRA found that 60-day delinquency rates ticked up for the second straight month in both indices, rising 6 basis points month-over-month and 9 basis points year-over-year to 0.44% in its prime index. The delinquency rates climbed 33 basis points month-over-month and 114 basis points year-over-year to 5.62% in its non-prime index.

Analysts went on to mention recovery rates in KBRA’s prime index improved 4.7 percentage points month-over-month but declined 4.1 percentage points year-over-year, coming in at 53.29%. In the non-prime area, those recovery rates dropped 2.3 percentage points month-over-month and 13.1 percentage points year-over-year to 40.99%.

“Differences in absolute recovery rates and recovery rate trends are attributed to a variety of factors, including loan-to-value ratios, vehicle age, and vehicle type, among others,” KBRA said in its newest report.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

In a separate news release, DBRS Morningstar commented about the entire market, explaining that it has a stable credit rating outlook across U.S. asset-backed securities (ABS) despite economic headwinds.

“We enter 2023 amid a challenging and uncertain economic backdrop,” DBRS Morningstar said in the release. “Thanks in large part to aggressive federal stimulus measures during the Coronavirus Disease (COVID-19) pandemic, the U.S. economy had been humming along over the 18 months leading up to the spring of 2022 when the first quarterly decline in real GDP was reported following six consecutive quarters of growth. The Federal Reserve reversed course and pulled back from its accommodative monetary policy measures, with the first of seven successive interest rate increases occurring in March 2022.

“DBRS Morningstar expects to see some deterioration in underlying consumer ABS collateral performance amid this inflationary environment with rising costs of goods, particularly across subprime auto and consumer loans, but we believe structural mechanisms such as deleveraging and credit enhancement will help mitigate this expected decline in collateral performance,” analysts went on to say.